Bitcoin Holds at $117K Today (July 22) — Are the Whales Gearing Up for the Next Big Move?

Jakarta, Pintu News – Bitcoin (BTC) wallets of various groups are now showing strong accumulation activity again, with whales holding more than 10,000 BTC participating-a participation rate not seen since December 2024.

This trend is happening across wallet sizes, reflecting investors’ great confidence in the ongoing rally.

Notably, Bitcoin is currently trading slightly below $120,000, having experienced a steady rise since early June. The synchronization between small and large holders shows that there is widespread confidence in the direction of BTC’s movement.

Therefore, this simultaneous accumulation phase could be the underlying force that drives the next price surge, if the positive sentiment and market momentum persists.

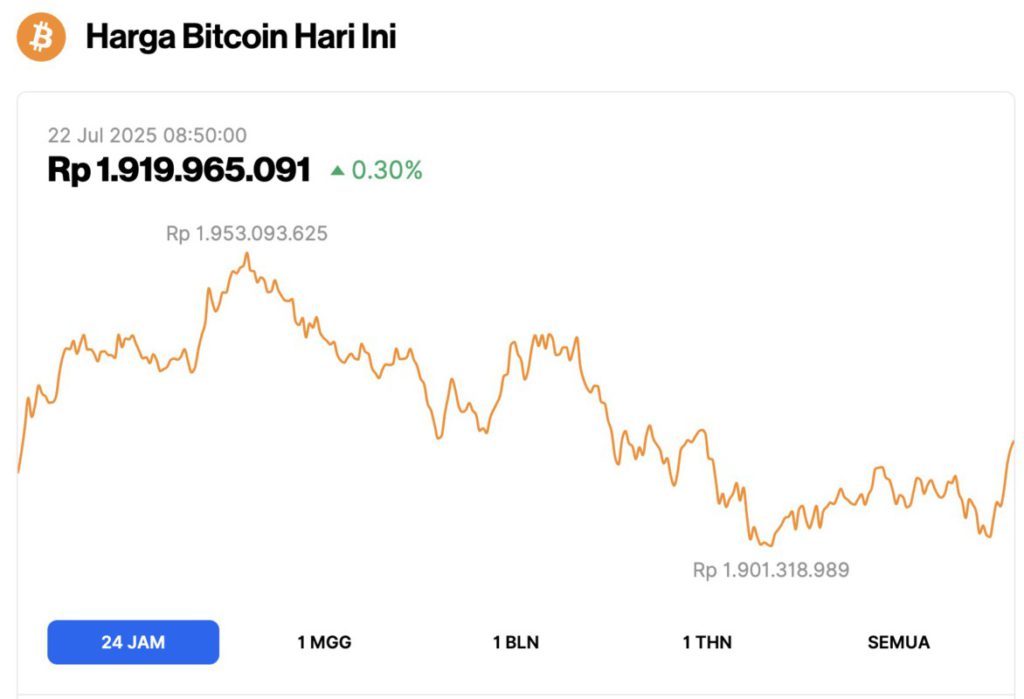

Bitcoin Price Up 0.30% in 24 Hours

As of July 22, 2025, Bitcoin was trading at $117,725, or approximately IDR 1,919,965,091—marking a modest 0.30% increase over the past 24 hours. Throughout this period, BTC dipped to a low of IDR 1,901,318,989 and reached a high of IDR 1,953,093,625.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.34 trillion, with trading volume in the last 24 hours rising 21% to $71.25 billion.

Read also: Ethereum Holds Strong at $3,700 — Is a Massive Breakout to $4,000+ Just Around the Corner?

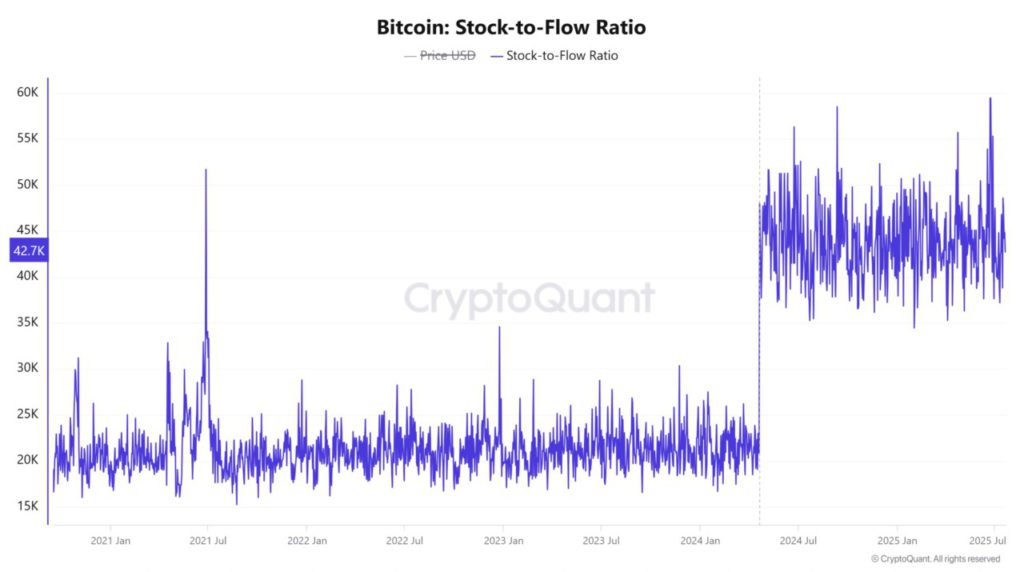

Can Increased Scarcity Drive Bitcoin Price?

According to AMB Crypto, Bitcoin’s stock-to-flow (S2F) ratio jumped 37.5% to 795,800, indicating a higher level of scarcity.

This metric measures the relationship between circulating supply and new coins mined, where an increasing value reflects tighter issuance.

Historically, high S2F readings often precede bullish phases, as Bitcoin’s perceived value increases. This is in line with the accumulation signals that are emerging, reinforcing the narrative that investors prefer to save in the long term rather than speculate in the short term.

As such, this spike in scarcity could be an additional catalyst for bullish momentum-especially if demand remains high while supply remains limited.

Caution Emerges Among Traders

As of July 21, Bitcoin recorded a net inflow of $9.51 million to spot exchanges, reversing the previous trend dominated by outflows. This reversal indicates increasing short-term selling pressure, as asset holders begin to move coins onto trading platforms.

While not yet a dominant trend, this signal brings an element of caution in a previously bullish market structure.

Traders can interpret this as a sign of profit-taking in the short-term, especially when the price of BTC is approaching a major resistance level.

Therefore, monitoring net flows into the bourse in the next few days will be crucial to anticipate changes in market sentiment.

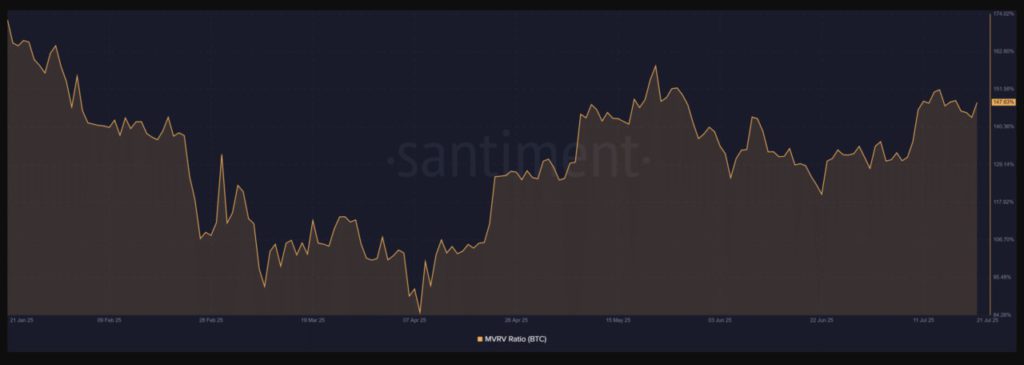

Next Round of Profit Realization?

Meanwhile, Bitcoin’s MVRV (Market Value to Realized Value) ratio has reached 147.63%, indicating that the average BTC holder is still in a profit position.

Read also: Crypto to Watch This Week: Kaito, Avalanche, and Pi Network Ready to Explode?

Historically, high MVRV levels often signal a high probability of profit realization, as investors tend to start selling some of their assets.

However, despite the current favorable positioning, investor confidence appears to remain strong-supported by continued accumulation and a spike in the S2F ratio. Still, if the price continues to approach $120,000 without consolidation, short-term holders may start realizing profits.

As such, this metric suggests a delicate balance between market confidence and the temptation to realize profits.

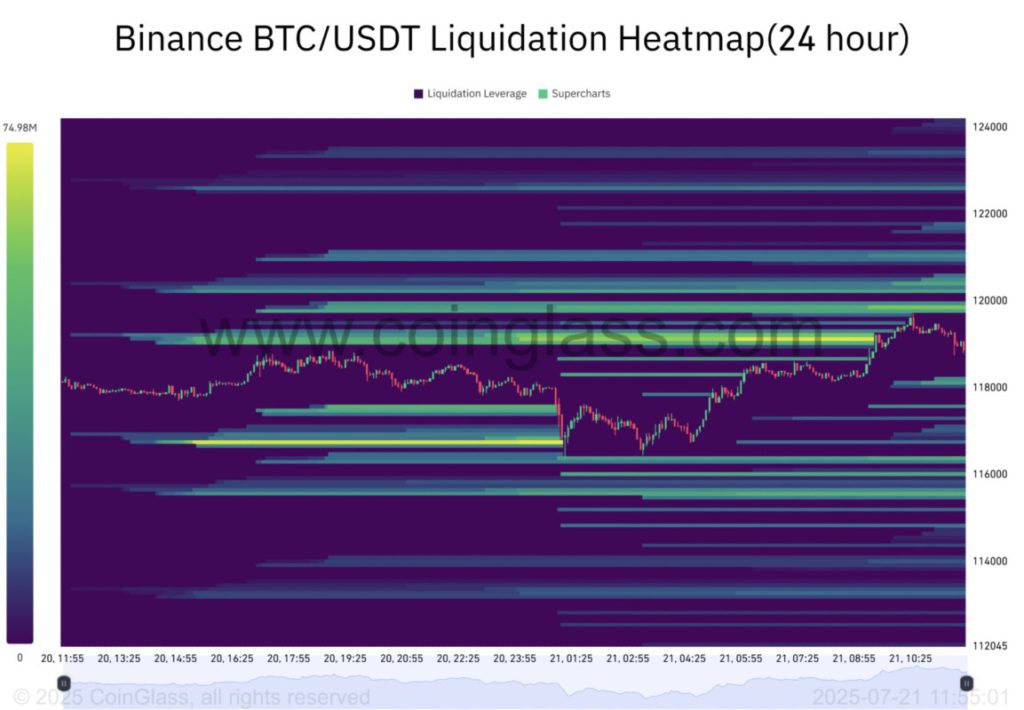

$120.000: The Next Battleground

The Bitcoin liquidation heatmap shows a large concentration of leveraged positions accumulated just below the $120,000 level. These areas are hotspots, where rapid price movements could trigger a series of mass liquidations.

As the price approaches this zone, volatility could increase sharply. If the price manages to break strongly above $120K, a potential short squeeze could occur. Conversely, a rejection at this level could trigger a sharp correction.

As such, $120,000 has become a psychological and structural battleground that could determine Bitcoin’s short-term direction.

Will Confidence Overcome Prudence?

Overall, Bitcoin’s current bullish structure is reinforced by solid accumulation, increasing scarcity, as well as favorable holder positions. However, short-term caution is warranted due to increasing inflows to exchanges and heavily leveraged accumulation near $120K.

This critical zone can trigger a strong breakout or a sharp correction-depending on the trader’s behavior.

Therefore, the next direction of the market is largely determined by whether long-term conviction is able to overpower short-term selling pressure and the risk of increased liquidation.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin whale accumulation returns: Can traders survive the $120K shakeout? Accessed on July 22, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.