BONK records $33 million buyout, but there are threats lurking!

Jakarta, Pintu News – The cryptocurrency market has been abuzz again with a significant rise in the Bonk (BONK) token, where investors have raised more than $33 million worth of tokens. Despite the significant increase, there are several factors that could hinder this positive run.

Investors Aggressively Accumulate

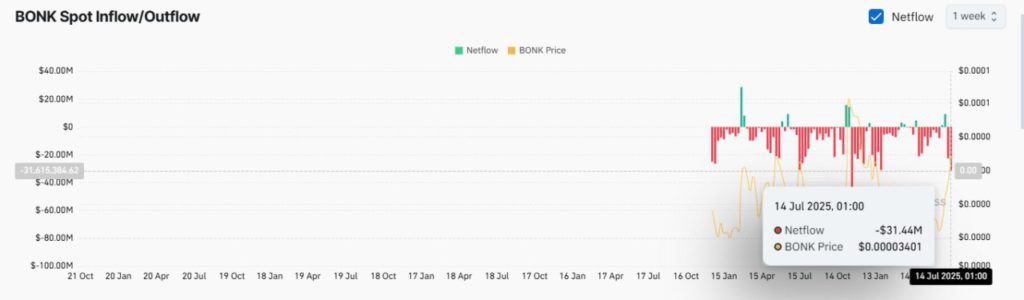

In the past week, there was an increase in Bonk (BONK) accumulation by investors which amounted to $33.22 million. Spot market players were the main players with purchases amounting to $31.44 million. These tokens were moved to private wallets signaling a long-term investment perspective, a strategy that often precedes market rises.

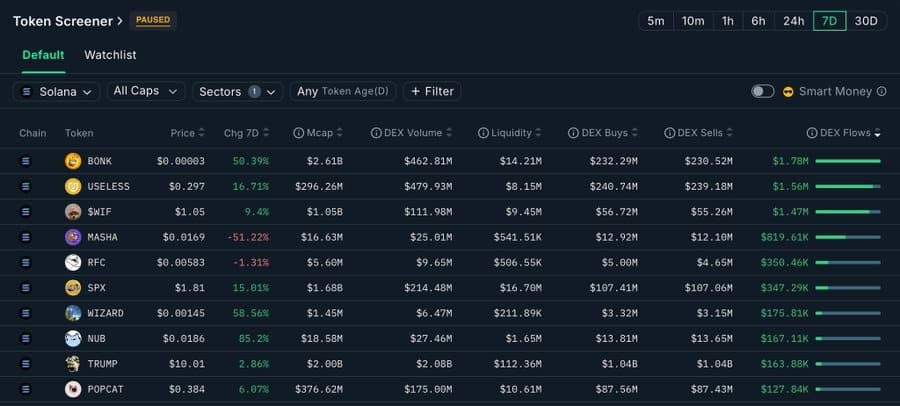

Smart Money investors didn’t want to be left behind either, contributing $1.78 million. Although the amount is smaller compared to the spot market, this is the largest fund flow from Smart Money investors for the memecoin category in the Solana ecosystem (SOL) over the past week.

Also Read: XRP Price Surges Again: Momentum Rising, Eyeing Key Resistance

Bullish Signals from the Derivatives Market

The derivatives market is showing a very bullish sentiment towards Bonk (BONK). Currently, the Open Interest Weighted Funding Rate remains above the positive threshold. Analysis from AMBCrypto shows that Bonk (BONK) has broken out of a bullish chart pattern with an upside target of $0.00003900.

At the current rate of accumulation, Bonk (BONK) appears to be in a good position to reach those targets and possibly even continue its rally higher. This suggests significant growth potential if the current momentum can be maintained.

Distribution Phase Continues

Despite aggressive buying from the spot market and Smart Money, the Accumulation/Distribution (A/D) ratio shows a different picture. The overall market is still in the distribution phase.

In the last 24 hours alone, the distribution volume reached 31.88 trillion Bonk (BONK), signaling that token sales outnumbered purchases. However, the A/D metric has recently shown a slight increase, indicating that the distribution phase may be starting to slow down. If this trend continues, Bonk (BONK) may be able to return to a long-term bullish path.

Conclusion

Although Bonk (BONK) shows enormous potential with significant accumulation from investors, the ongoing distribution phase could be a major obstacle. However, if this distribution trend can be overcome, Bonk (BONK) has a chance to continue its bullish trend and reach higher price targets.

Also Read: $2 Billion Fresh Money Injection, Bitcoin Ready to Fly Again? Analyst: Big Crypto Rally Signals!

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bonk racks up $33 mln in buys, but this might kill the buzz. Accessed on July 22, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.