Potential ONDO Price Increase of Up to 50%: What Will it Take for This to Happen in August 2025?

Jakarta, Pintu News – The crypto market is always full of interesting dynamics, and this time the eyes of all market participants are on Ondo Finance (ONDO). With the recent significant price increase, many are wondering if ONDO will continue its positive trend or will experience a downturn like in the past.

Market Sentiment Analysis

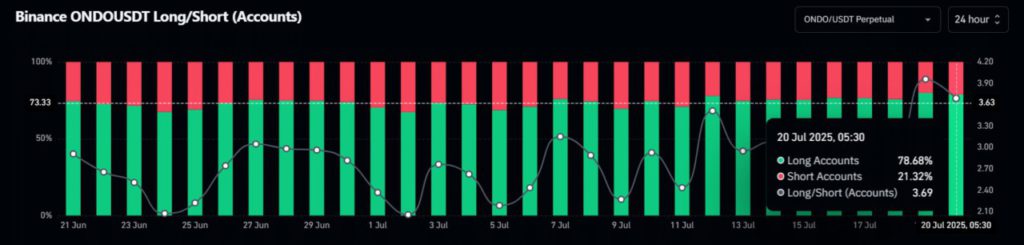

The latest data from CoinGlass shows that the Long/Short ratio for ONDOUSDT on Binance is 3.69, which signifies that there are far more traders going long than going short. This is a strong indicator that the current market sentiment is very bullish towards ONDO.

A total of 78.68% of traders on Binance chose a long position, while only 21.32% chose a short position. In addition, ONDO’s trading volume in the past 24 hours has increased by 60% compared to the previous day. This indicates a significant increase in investor participation, which could be because they are anticipating further price increases.

Also Read: Wealth Planning: J.P. Morgan Private Bank’s DCA Crypto Strategy, The Importance of Diversification!

Experts’ Predictions and Key Levels

A widely followed crypto expert recently predicted that ONDO could see a price increase of between 40% to 50% if it manages to close above $1.20. Currently, ONDO is at $1.07 and has shown a 4% increase in the last 24 hours. If ONDO manages to break and close above $1.15, this could be a catalyst to reach the $1.60 price target.

However, keep in mind that ONDO’s Relative Strength Index (RSI) is currently at 75, which suggests that the asset may be overbought. This could lead to a price correction, although strong market sentiment could reduce the influence of the RSI.

Price Movement and Accumulation Potential

In the past 24 hours, $1.20 million worth of ONDO tokens have exited exchanges, indicating potential accumulation by large investors. Token exits from exchanges often create buying pressure that can push prices up. This is another indicator that supports a bullish outlook for ONDO.

Technical analysis from AMBCrypto shows that ONDO is in an uptrend. Although it has reached this price level more than four times since the beginning of 2025 and has often experienced large sales, the current market conditions are different. With multiple retests of this level, resistance may have weakened, allowing ONDO to break out more easily.

Conclusion

With all these indicators, the chance for ONDO to achieve a significant price increase seems quite strong. However, investors should remain wary of a potential correction due to overbought conditions. Observing the daily close above the key level will be the key to predicting the next price movement.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ondo could soar by 50% soon, but only if this happens. Accessed on July 22, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.