Antam Gold Price Chart Today July 22, 2025: Latest Movement and Trend Analysis

Jakarta, Pintu News – The gold price remains an important indicator for investors and market participants in Indonesia. As of Tuesday, July 22, 2025, the latest charts and data from Brankas show an increase in gold buying prices for both the corporate and physical segments. With price fluctuations recorded in the last 6-month chart, investors increasingly need real-time data to determine the right investment strategy.

Antam Gold Buy Price Update Today

Based on data as of July 22, 2025 at 08.24 WIB, the purchase price of Antam gold through the Corporate Safe was recorded at Rp1,886,600 per gram, an increase of Rp19,000 from the previous price of Rp1,867,600 per gram. For the physical gold purchase price, the recorded value is IDR 1,946,000 per gram, also up by IDR 19,000 from the previous position at IDR 1,927,000 per gram.

This increase is a major concern for investors, especially amid the global trend of gold prices being driven by inflationary sentiment, central bank policies, and seasonal demand. The prices shown for Corporate Vaults are for institutional customers only, while individual prices can be viewed via the mobile app or the price chart feature on the official Brankas platform.

Also Read: Wealth Planning: J.P. Morgan Private Bank’s DCA Crypto Strategy, The Importance of Diversification!

Chart Analysis of Gold Price Movement in the Last 6 Months

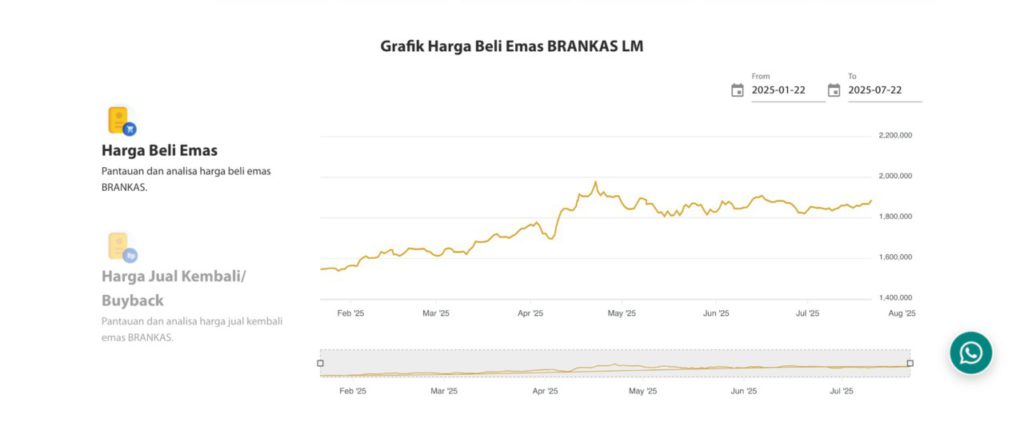

The graph of Brankas LM gold purchase price from January 22, 2025 to July 22, 2025 shows a significant upward trend, especially since March 2025. The price moved steadily in the range of Rp1,600,000 per gram at the beginning of the year, then began to climb sharply to break the Rp2,000,000 per gram mark in early May 2025.

After experiencing a sharp surge in the second quarter, gold prices corrected but remained at high levels, never dropping below IDR 1,800,000 per gram until July 2025. This movement indicates that buying interest remains strong, supported by hedging needs and anticipation of global market risks.

Factors Causing the Increase in Antam Gold Price

Some of the main factors driving the rise in gold prices include high inflation, global economic uncertainty, and monetary policies from central banks in various countries. In addition, seasonal demand in Indonesia also contributes to the price increase, especially in the August-October period, which is usually accompanied by gold purchases for weddings or long-term investments.

Not only global factors, local influences such as physical stock availability and demand from the corporate sector also play a role. With Antam gold prices continuing to move upwards, many investors are increasingly considering gold as an important part of their asset diversification portfolio.

Conclusion

Antam’s gold price as of July 22, 2025 shows a positive trend with consistent increases in recent months. The gold price chart from Brankas confirms the high market interest and the role of gold as a safe haven asset amid the dynamics of the world economy. For Indonesian citizens and investors, monitoring gold price movements regularly can help determine the right time to buy or sell gold, both for investment purposes and other needs.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BrankasLM. Gold Price Dashboard and LM Gold Price Chart. Accessed on July 22, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.