Ethereum Holds Strong at $3,700 — Is a Breakout to $4,000 Just Around the Corner?

Jakarta, Pintu News – As the price of Ethereum (ETH) moves closer to the $4,000 level, investors have started placing buy orders in anticipation of a possible price rally.

The activity of whales (large investors) also reinforces this suspicion. In fact, there could be a shortage of supply as the amount of ETH deposited into exchanges as well as the total ETH reserves on exchanges continues to decline.

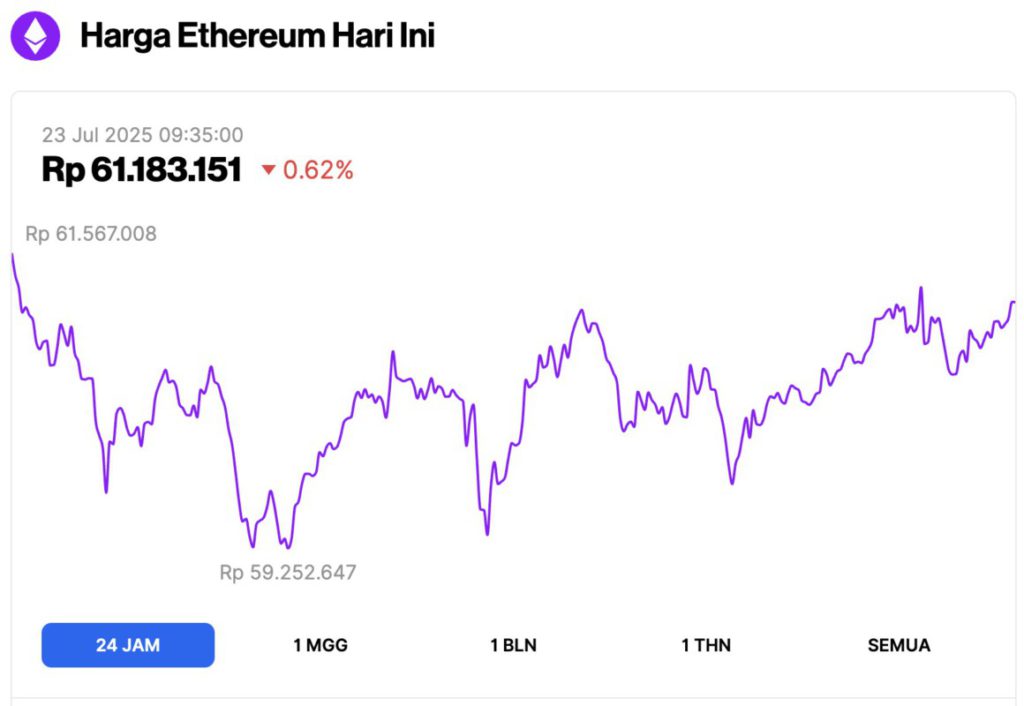

Ethereum Price Drops 0.62% in 24 Hours

As of July 23, 2025, Ethereum was trading at approximately $3,762, or around IDR 61,183,151. The price saw a modest decline of 0.62% over the past 24 hours. During this time, ETH dipped to a low of IDR 59,252,647 and reached a high of IDR 61,567,008.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $453.91 billion, with daily trading volume falling 1% to $42.6 billion in the last 24 hours.

Read also: Bitcoin Soars to $119K as Crypto Whale Moves $920 Million in Massive Power Play!

Whale Interest in ETH is on the Rise Again!

According to AMB Crypto, on July 22, 2025, there was a significant spike in whale activity. Whales-wallet addresses that control large amounts of liquidity-often influence market direction through their large transactions.

One such example is Aguila Trade, which recently closed its short position on ETH after losing more than $8 million and opened a long position instead.

According to data from HyperDash, this new long position is worth over $128 million and is currently recording an unrealized gain of $631,000 as of July 22.

Meanwhile, LookonChain also reported that another whale withdrew 13,244 ETH (worth $49.52 million) from the OKX crypto exchange and moved it to a personal wallet.

Such transactions generally signal an optimistic (bullish) long-term outlook, as investors show intentions to hold the asset instead of selling it in the near future.

Spot and On-chain Activity Support Bullish Sentiment

Significant inflows were recorded both in the spot market and through on-chain activities.

According to Spot Exchange Netflow data from CoinGlass, investors appeared to refrain from selling for the previous two consecutive days.

Now, these investors have accumulated more than $70 million worth of ETH and moved it to their personal wallets, indicating an optimistic market sentiment in the long run.

The report from Artemis also shows that there is considerable liquidity flow from other blockchains towards Ethereum.

Bridge Netflow from the external ecosystem reached the $4 million mark, indicating a capital rotation into ETH as investors seem to be preparing for a stronger price rally.

Read also: 3 Crypto Predicted to Rise in the Fourth Week of July 2025!

Activity on various exchanges also showed potential for further growth, while signs of a supply squeeze began to appear.

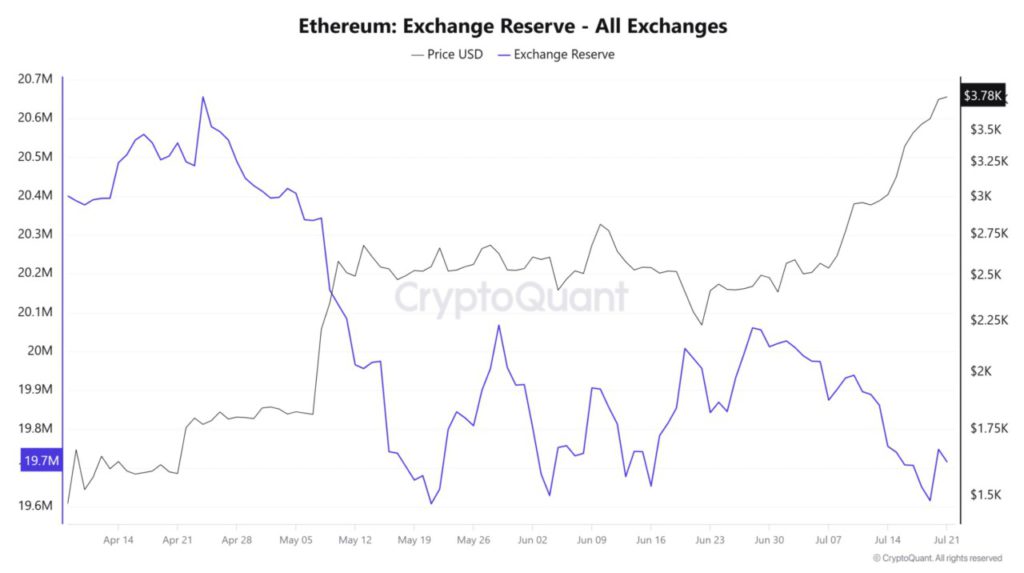

Exchange Reserves Decline as ETH Deposits Fall

The amount of ETH stored on exchanges has experienced a sharp decline. After increasing in recent weeks, the reserve is now showing a downward trend again.

At the time of writing, there are only around 19.7 million ETH available on exchanges. This indicates that investors prefer to withdraw their assets from exchanges, reducing the potential for a sell-off in the near future.

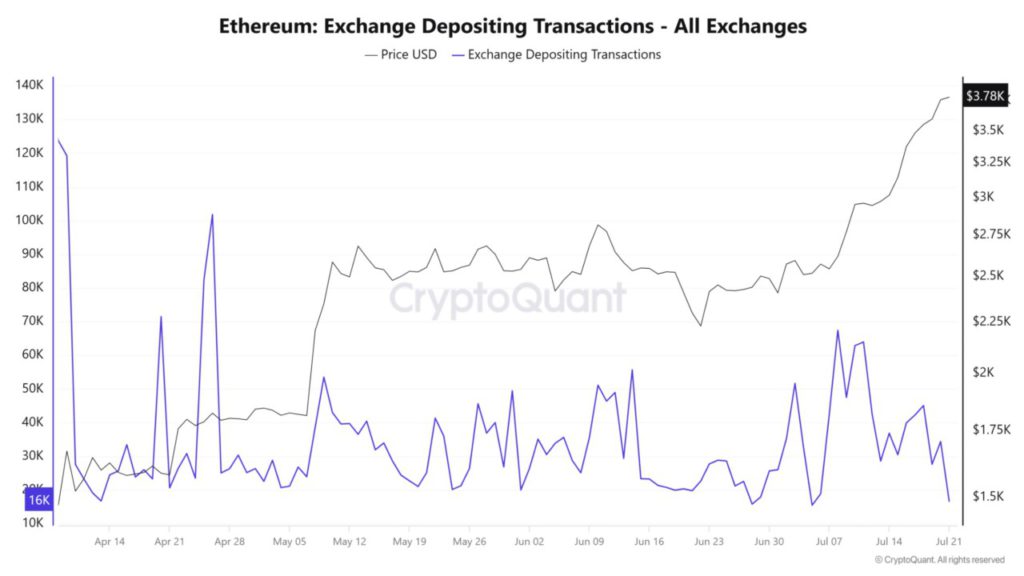

In fact, the number of wallet addresses depositing ETH into the exchange also dropped dramatically, reaching a low last seen on July 7.

Currently, there are only around 16,000 addresses actively depositing ETH, indicating less selling pressure-especially after ETH recorded a 54% price increase in the last four weeks.

If this trend continues, a reduction in the available supply of ETH could trigger a supply shortage, a situation where demand exceeds the availability of the asset, which could eventually push prices even higher.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Whales stack ETH as sellers vanish: Ethereum to $4K, closer than ever? Accessed on July 23, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.