Delta Hedging Strategy: The Modern Investor’s Secret Weapon Amidst Stock and Crypto Fluctuations!

Jakarta, Pintu News – Delta hedging is increasingly popular among savvy investors, both in the conventional stock market and in the cryptocurrency (crypto) world. This strategy has become one of the main techniques in managing portfolio risk amidst higher price volatility, especially when many investors start looking at digital assets such as Bitcoin (BTC), Ethereum (ETH), and Pepe Coin (PEPE). So, how does the concept of delta hedging actually work, and why is this strategy increasingly being looked at by market participants in the modern era?

What is Delta Hedging? Basic Workings and Objectives

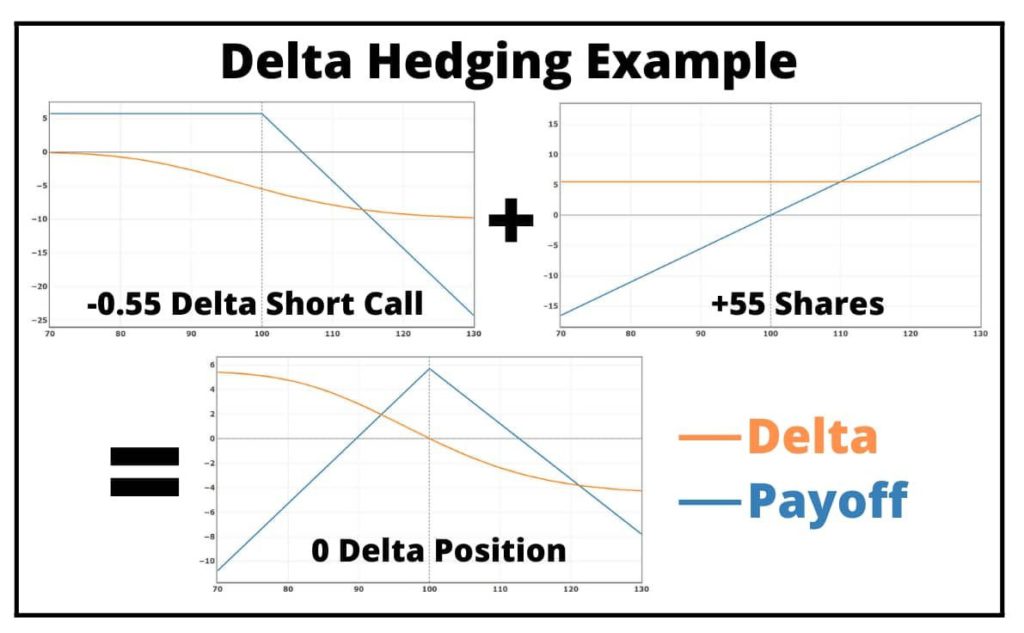

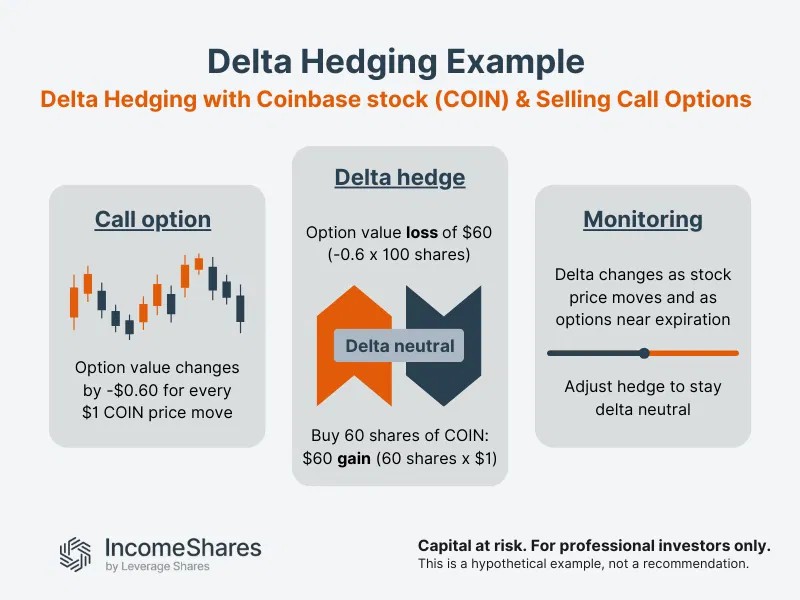

Delta hedging is a risk management strategy used to protect a portfolio from unwanted price movements, particularly in derivatives trading such as options. Delta itself is a measure of the sensitivity of an option’s price to changes in the price of its underlying asset, usually a stock or cryptocurrency. In other words, delta indicates how much the price of the option will change if the price of the underlying asset changes by one unit.

The way delta hedging works is quite simple but very effective. Investors will hedge their options position by buying or selling the underlying asset in proportion to its delta value. For example, if a trader has a call option with a delta of 0.5, then for every 1 option he can offset the risk by buying 0.5 units of the underlying stock or crypto. This strategy is especially relevant for those who trade in crypto markets, such as Bitcoin (BTC) or Ethereum (ETH), as volatility in digital markets is very high.

Also Read: Top Movers Crypto July 24, 2025: Launch, Goatseu, Movement plummet sharply, 3 other coins soar!

Benefits of Delta Hedging for Stock and Crypto Investors

Delta hedging offers the key benefit of hedging a portfolio against unwanted price movements. For equity investors, this technique is especially important when dealing with markets that move wildly due to global economic sentiment. With delta hedging, the risk of large losses due to sharp price swings can be minimized, while profit opportunities can still be optimized.

On the other hand, delta hedging has also been widely adopted in the crypto market. Cryptocurrency markets such as Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) are known for their rapid price movements. By using this strategy, investors can be more calm in the face of digital market turmoil. In fact, on crypto platforms that already provide derivatives features, delta hedging has become a standard strategy for professional traders.

Risks and Challenges in Delta Hedging Practices

While it may seem simple, delta hedging is not without its risks. One of the main challenges is the need for regular rebalancing, especially when the market is highly volatile. Too frequent adjustments can add to transaction costs and erode potential profits.

In the crypto market, the biggest challenge comes from extreme volatility and possible mispredictions. If the price of Bitcoin (BTC) suddenly jumps from US$60,000 to US$65,000 (equivalent to Rp976,200,000 to Rp1,057,550,000 at an exchange rate of US$1 = Rp16,270), investors need to immediately adjust their hedging position to avoid losing money. Therefore, in addition to technical understanding, execution discipline and risk management are also very important in executing this strategy.

Delta Hedging: The Future Trend of Stock and Crypto Investing

With the development of technology and the growing number of digitally-savvy investors, delta hedging is expected to continue to grow. Currently, many crypto and stock trading platforms already provide delta calculators and automation tools to make it easier for investors to hedge. As crypto assets such as Pepe Coin (PEPE), Solana (SOL) and others grow in popularity, delta hedging will become an important part of the modern investor’s toolkit.

Finally, this strategy is not just about hedging, but also a smart way to maximize opportunities in the digital trading era. Moreover, with the development of algorithms and artificial intelligence technology, delta hedging can be more efficient for both conventional stocks and cryptocurrency portfolios.

Also Read: Antam Gold Price Today July 24, 2025: It turns out that this is the latest graph and trend!

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Corporate Finance Institute. Delta Hedging. Accessed July 24, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.