Pi Network Dips 5% Today — But Chart Signals a Potential 40% Breakout Is Coming!

Jakarta, Pintu News – Reporting from BeInCrypto (7/23), the Pi Network coin remained stable at around $0.47 after the announcement of the “Buy Pi” feature with fiat which briefly pushed the price up to $0.52 – the first real spike in recent days.

Two technical signals on the lower time frame suggest that this may not be just a momentary bounce: the strength of the trend has returned, and the trigger of the second moving average is about to happen.

Pi Network Price Drops 5.5% in 24 Hours

On July 24, 2025, the price of Pi Network was recorded at $0.4486, a decrease of 5.5% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,278), then 1 Pi Network is IDR 7,302.

Read also: Pi Network Unveils Game-Changing “Buy” Feature — Now You Can Purchase Pi Instantly with Cash!

During this period, PI’s price moved within a range of $0.4453 to $0.4761, showing considerable volatility. In terms of market capitalization, PI now has a valuation of $3.46 billion, with a fully diluted valuation of approximately $5.33 billion.

Trading volume in the last 24 hours was also quite high, clocking in at $130 million, signaling intense buying and selling activity amid falling prices.

Trend Strength Returns, but Still Needs Confirmation

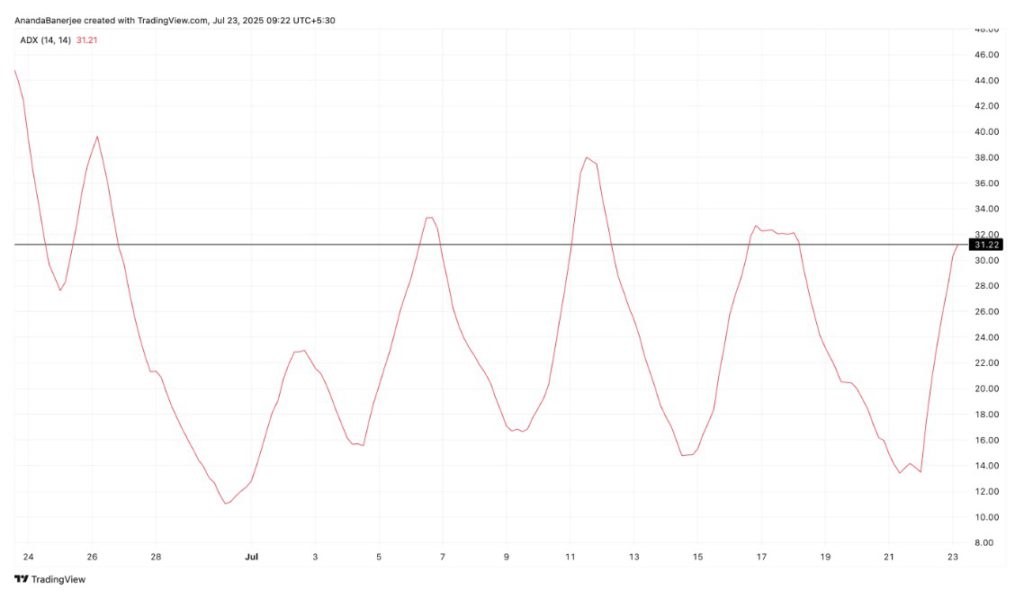

The Average Directional Index (ADX) indicator on the 4-hour chart (23/7) is back above the 30 level. This shows that the price movement has real strength, not just influenced by random sentiment.

However, the current ADX peak is still lower than the previous peak.

In simple terms, Pi Coin’s price trend does exist, but it’s not yet stronger than previous swings. A rise in the ADX to new highs – or at least staying above mid-20s levels – would strengthen confidence in the sustainability of the trend.

Analysis using the 4-hour chart (23/7) was the main focus as Tuesday’s price spike occurred within one day. Technical signals usually appear first on this time frame before being seen on the daily chart.

Note that the ADX measures the strength of the trend (from 0 to 100), but it doesn’t indicate the up or down direction, so it should be read in conjunction with price movements.

One EMA Trigger Still Waiting for Confirmation

The fast Exponential Moving Average (EMA) (period 20) has crossed the medium EMA (period 50), and this crossover is in line with the price increase from $0.45 to $0.52.

Read also: Pi Network is Predicted to Jump 60% this Year, What’s the Reason?

Something similar happened in late June, when the price jumped from around $0.56 to $0.66. But back then, the fast EMA failed to break the next slow EMA (100 period), and Pi Coin’s rally faded. Now, this second crossover is about to happen again-it’s just a matter of waiting for momentum.

If that crossover occurs this time while the ADX remains strong, the probability of a larger Pi price rally will increase.

On the 4-hour chart (23/7), the 200-period EMA (blue line) was crossed by the price yesterday, before encountering resistance. If the price can close cleanly above this line, then the price structure will be in line with the momentum.

Note that the EMA gives more weight to recent prices than older prices.

So, when the shorter EMA crosses the longer EMA from below, it signals an acceleration in price movement.

Pi Coin Key Price Levels to Watch Out For

The daily chart shows key levels in the big picture. Here a trend-based Fibonacci extension is used, which connects three key points: the late June low at $0.47, the price peak at around $0.66, and the mid-July drop to $0.42.

Read also: Mass Liquidations Loom: Are These 3 Altcoins About to Crash?

Tuesday’s candle (07/22) managed to break three Fibonacci levels in one day: 0.236 at $0.46, 0.382 at $0.49, and 0.5 at $0.51. Currently, the price of Pi is moving flat in the $0.46-$0.49 range.

If the daily price closes above that range, the next target is $0.54 (0.618 level), and then $0.66 – which is the previous peak. This means a potential upside of about 40% from current levels, if momentum continues and the long-awaited EMA crossover signal actually occurs.

An inverted bullish hammer candle pattern formed on Tuesday’s rebound, indicating that buyers started to enter as the price neared the low.

The uptrend invalidation signal is quite clear: if the price closes below $0.46 again, the ADX drops below the mid-20s, and the 20 EMA fails to break the 100 EMA, then Pi Coin’s price will likely return to the $0.42 range.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Coin Teases a Quick 40% Burst If This One EMA Cross Confirms. Accessed on July 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.