What Impact Have Bitcoin ETFs Had on the Recent BTC Price Surge?

Jakarta, Pintu News – The approval of spot Bitcoin ETFs in the United States has triggered a significant surge in the price of Bitcoin (BTC), attracting billions of dollars into regulated ETF products. This article will dig into how ETF fund flows have translated into price action, supported by real data from July 2024 to July 2025.

Check out the full analysis in this article!

Bitcoin ETF Launch and Initial Market Reaction

On January 10, 2024, the approval of a spot Bitcoin ETF by the US Securities and Exchange Commission (SEC) marked a significant milestone for the crypto market. Products from financial giants like BlackRock (IBIT), Fidelity (FBTC), and Ark Invest (ARKB) got the green light to launch.

Unlike the Bitcoin futures ETF that has been trading since October 2021, the spot ETF holds real Bitcoin (BTC) as the underlying asset. This provides a regulated and structured pathway for traditional financial institutions, pension funds, hedge funds, and retail investors to gain exposure to Bitcoin (BTC).

In the days and weeks following the ETF approval, BTC surged from $45,000 to over $73,000 by March 2024. This rise was driven mainly by institutional capital flowing into spot ETFs.

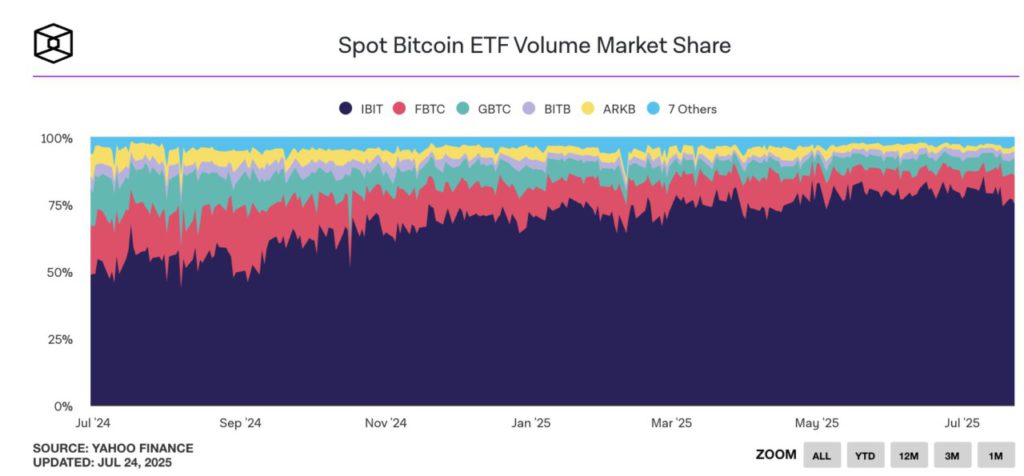

On-chain data and ETF flow trackers confirm that ETFs have been the dominant force in absorbing available BTC supply, especially during periods of strong demand.

Read also: MEXC Research Study: 67% of Generation Z Traders Use AI to Manage Risk

Billion ETF Inflows and Bitcoin Price Acceleration

The real impact of Bitcoin ETFs is evident when analyzing inflows and price performance throughout 2024 and 2025. According to data from Cointelegraph, the spot Bitcoin ETF recorded a total inflow of $6.62 billion during a 12-day stretch in July 2025, which included two consecutive days with inflows exceeding $1 billion each.

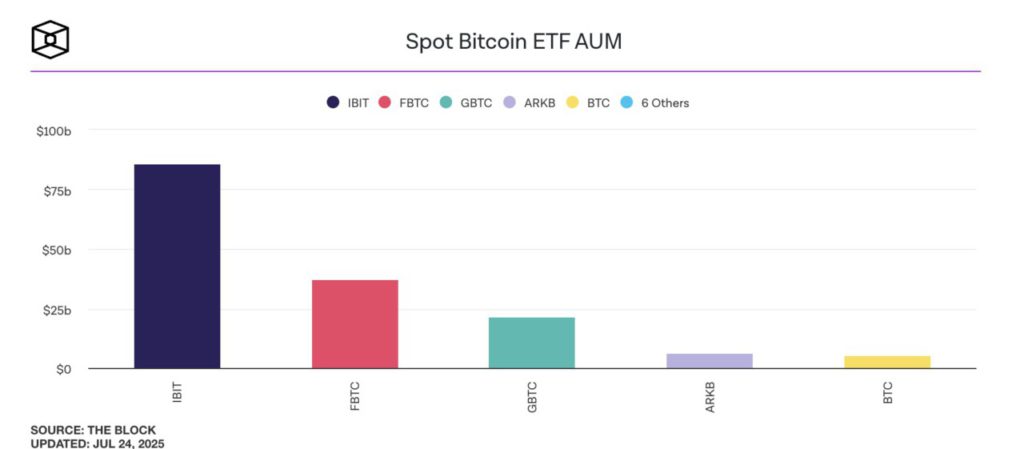

On July 10, the ETF attracted $1.18 billion, followed by $1.03 billion on July 11. As of mid-July 2025, the cumulative total net inflow into all US-listed spot Bitcoin ETFs had surpassed $54.75 billion. The total assets under management (AUM) of these ETFs reached about $152.4 billion, which represented about 6.5% of the total Bitcoin market capitalization at that time.

Read also: Solana Block Capacity Jumps 20%, What’s the Impact?

Price Performance: From $45K to Over $123K

The impact on Bitcoin (BTC) price was dramatic. In March 2024, just a few months after the launch of the ETF, Bitcoin (BTC) surged to a new record of over $73,000. ETF inflows and growing institutional legitimacy directly contributed to this rise.

Bitcoin then broke the $100,000 mark on December 5, 2024 – driven by continued inflows and regulatory optimism associated with the new US administration. Even more significant is Bitcoin’s performance in 2025. By mid-July, the price had surpassed $123,000, marking a nearly 65% increase since April of the same year.

MarketWatch reported that ETF inflows reached $14.8 billion in 2025 alone, emphasizing how institutional demand has outpaced the retail-led cycle. In a striking daily example, Bitcoin surged above $118,000 as the ETF attracted $1.18 billion in inflows, triggering a short squeeze that accelerated price gains.

Conclusion

In 18 months, Bitcoin ETFs have transformed BTC from a speculative asset to a pillar of institutional portfolio strategies. Backed by over $150 billion in assets, driving daily inflows in the billions, and supported by an increasingly clear regulatory framework, ETFs are now a central pillar of Bitcoin’s price structure.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NFTEvening. The Impact of Bitcoin ETFs on BTC Price: Real Data Analysis. Accessed on July 25, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.