3 Crypto Trading Strategies: The Essential Guide All Crypto Traders Should Know!

Jakarta, Pintu News – The ever-evolving crypto market offers endless opportunities for traders. However, high volatility requires the right strategy to maximize profits and minimize risks. This article will discuss three crypto trading strategies that every trader should know.

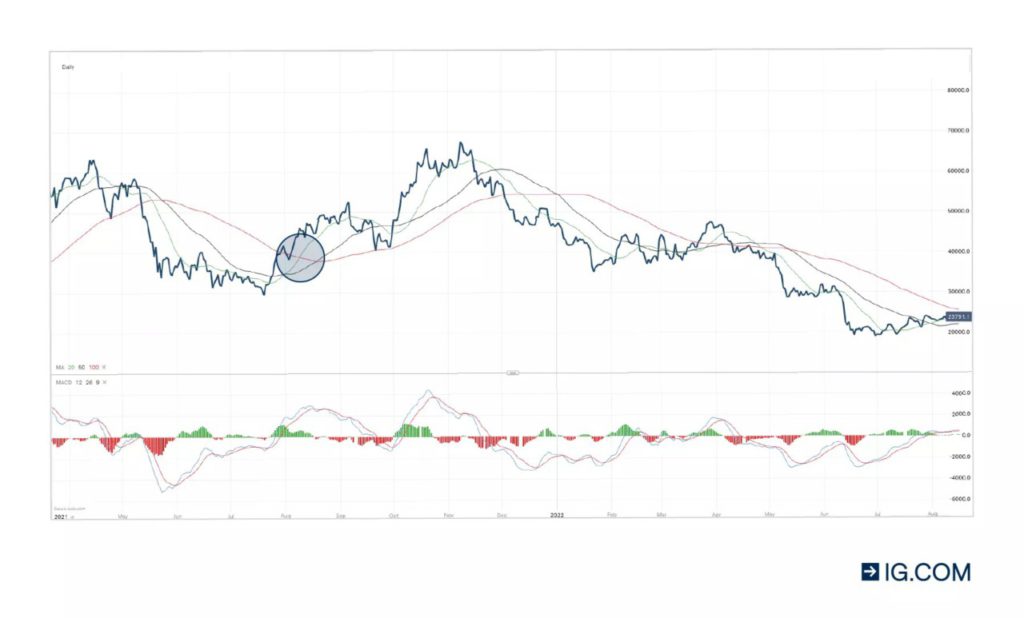

1. Moving Average Crossover Strategy

Moving Average (MA) is an indicator often used in technical analysis to identify the direction of market trends. The MA crossover strategy utilizes the crossover between two MAs: one short-term and one long-term. When the short-term MA crosses the long-term MA from bottom to top, it signals a buy signal known as a golden cross.

Conversely, a death cross, when the short-term MA crosses the long-term MA from top to bottom, signals a sell signal. This strategy is effective in trending markets and allows traders to enter the market at the start of a trend. However, it is important to combine with other indicators to confirm the signal and avoid false signals. Traders should also consider the volatility of the crypto market which can affect the accuracy of MA signals.

Also Read: Cardano (ADA) 2025 Price Prediction: Governance Drama and Investor Fate, What Happened?

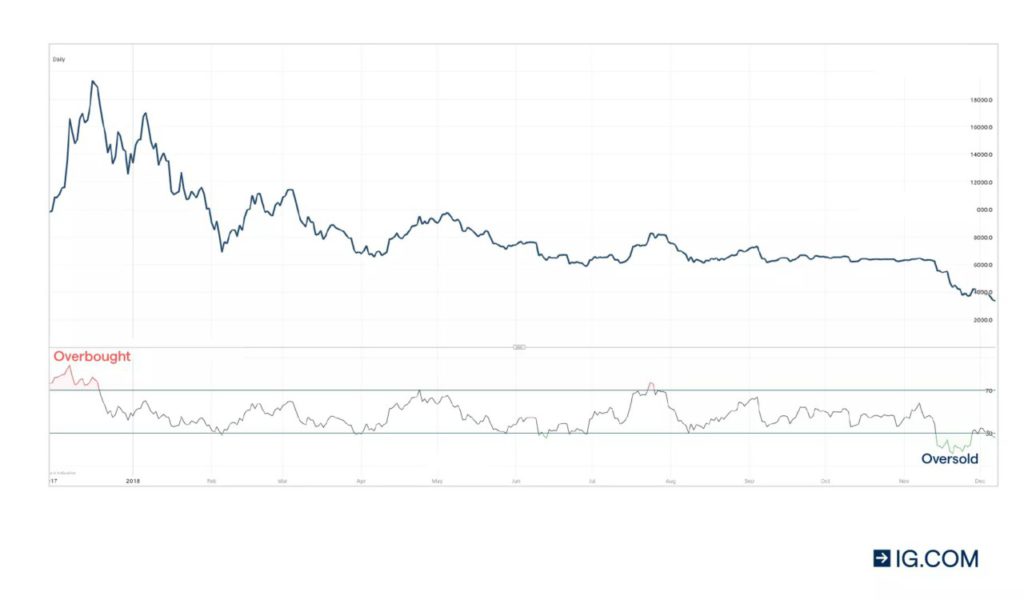

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that helps traders identify overbought and oversold conditions. RSI measures the speed and change of price movement. RSI values above 70 usually indicate that the asset may be overbought, while values below 30 indicate that the asset may be oversold.

Trading strategies using the RSI are particularly useful in oscillating market conditions as they can provide buy or sell signals when the asset price reaches extremes. Traders should be on the lookout for divergences between the RSI and the asset price, which could indicate a potential trend reversal. As with other indicators, the RSI is more effective when used in conjunction with other technical analysis tools.

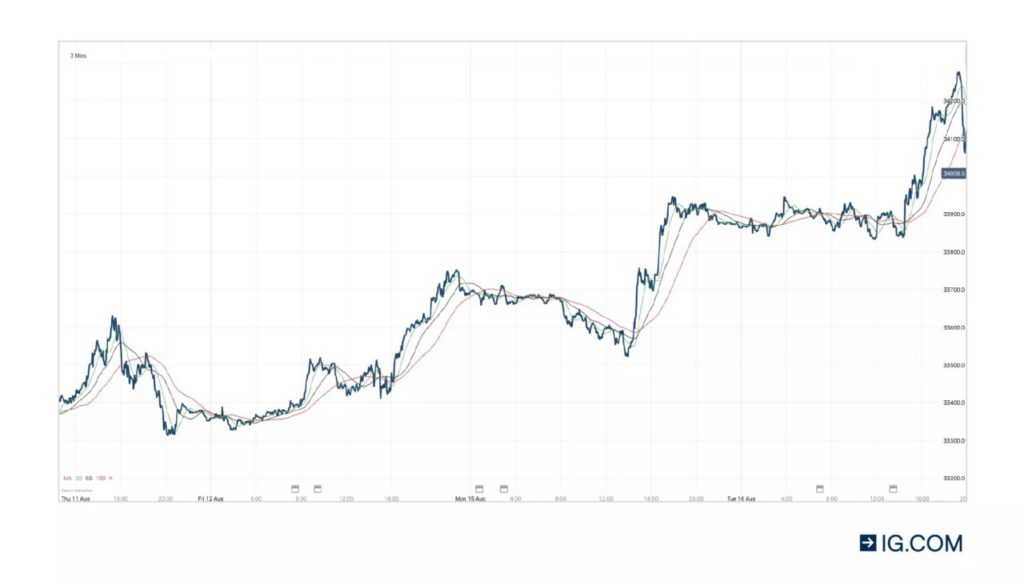

3. Scalping: A Short-Term Strategy

Scalping is a trading technique that aims to capitalize on small price movements. It involves opening and closing positions quickly, often within minutes or even seconds. Scalping relies heavily on technical analysis and often uses leverage to increase profits from small price movements.

While scalping can be highly profitable, it is also high-risk, especially in the highly volatile crypto market. It is important for scalpers to have strong discipline, effective risk management, and the ability to make quick decisions. The use of a trading platform that is responsive and has fast order execution is crucial for success in scalping.

Conclusion

Choosing the right crypto trading strategy is key to succeeding in this dynamic market. Whether it’s using Moving Average Crossover, RSI, or Scalping, each strategy has its advantages and disadvantages. It is important for traders to fully understand the mechanics and risks associated with each strategy, and combine them with solid market analysis to make informed trading decisions.

Also Read: 3 Cryptos to Buy Before Trump’s New Tariffs in August 2025!

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- IG. The 5 Crypto Trading Strategies That Every Trader Needs to Know. Accessed on July 25, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.