Dogecoin Plunges 7% in a Day as Investors Rush to Cash Out After 6-Month High!

Jakarta, Pintu News – Dogecoin (DOGE) experienced a sharp price drop of 14% after experiencing a significant price spike at the beginning of the month on July 24.

The price drop was mainly due to profit-taking after reaching a 6-month high, as investors sought to secure their newly-earned profits.

However, there is still hope that DOGE’s gains can be sustained, depending on the next moves of key investors. So, what is the current price movement of DOGE?

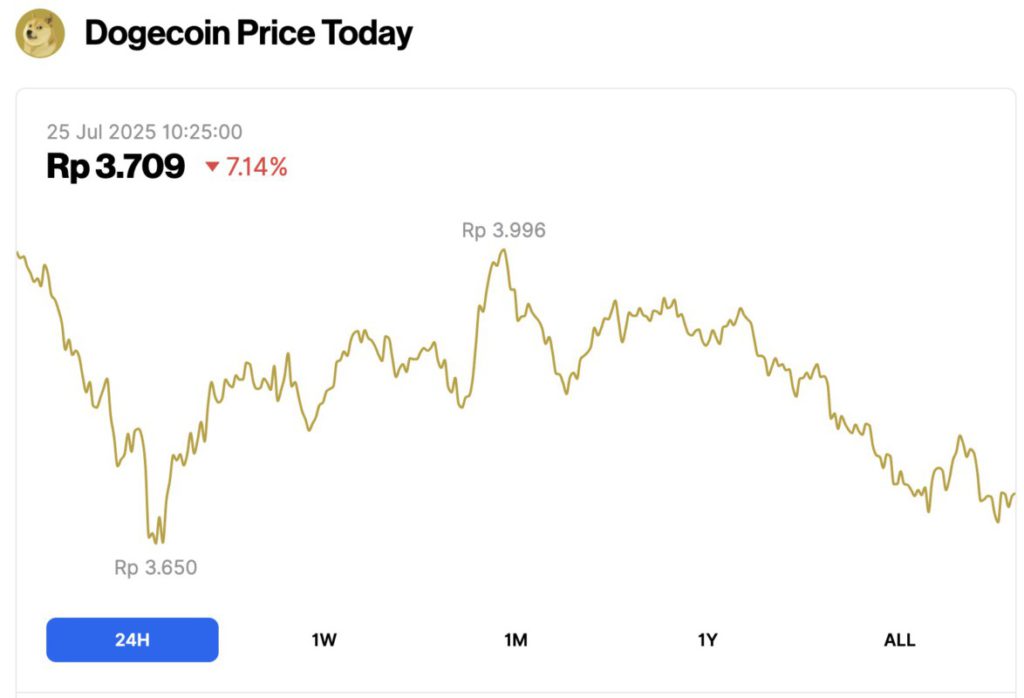

Dogecoin Price Drops 7.14% in 24 Hours

On July 25, 2025, Dogecoin saw a sharp 7.14% drop in just 24 hours, with the price falling to $0.2266, or approximately IDR 3,709. During the day, DOGE traded as low as IDR 3,650 and peaked at around IDR 3,996.

At the time of writing, Dogecoin’s market cap stands at around $34.08 billion, with trading volume dropping 4% to $4.36 billion within 24 hours.

Read also: Ethereum Crashes to $3,600 — Is a Drop to $2,800 Coming Next?

Dogecoin Investors Are Selling

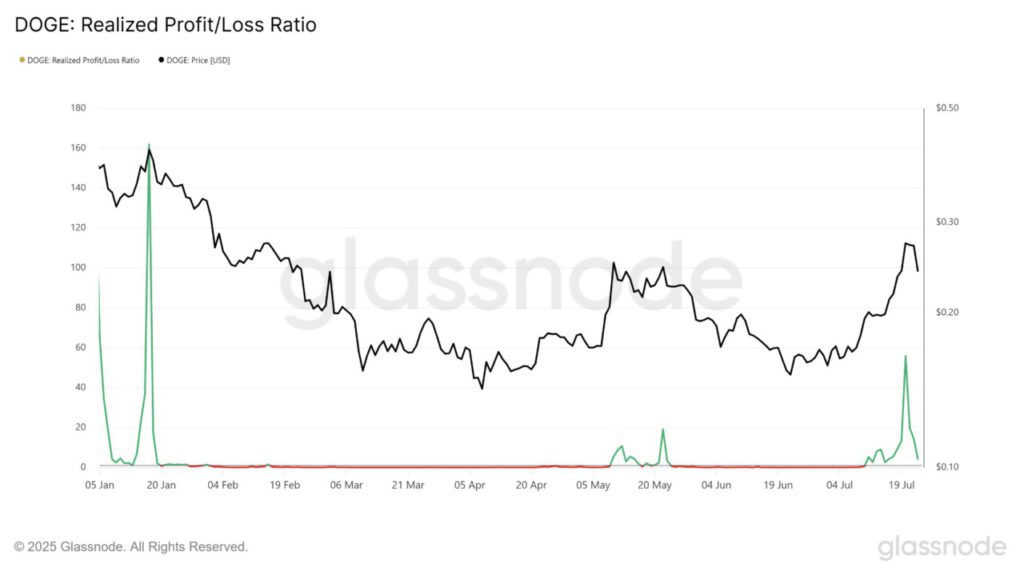

This week, the realized gain/loss ratio for Dogecoin jumped after a significant price spike in the previous week.

This surge in profit-taking reached the highest level in 6 months, indicating that many investors chose to sell and secure their profits.

These profit-taking investors are likely starting to lose faith in Dogecoin’s potential for further price gains, prompting them to exit the market.

This behavior from short-term holders has contributed greatly to the recent decline in DOGE prices. This sudden change in investor sentiment reflects broader market uncertainty, where traders are reluctant to wait for further upside.

As a result, the meme coin’s short-term price outlook is facing pressure.

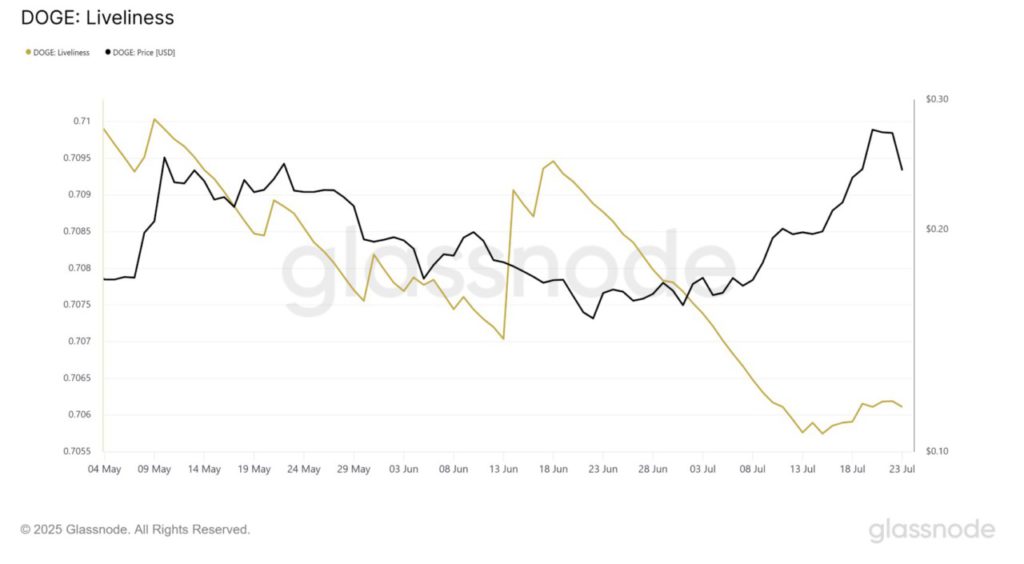

Despite the profit-taking, Dogecoin’s overall macro momentum has not been disrupted, as evidenced by the decrease in Liveliness.

This indicator measures the activity of long-term holders (LTHs), who tend to have a significant influence on the price of coins. Currently, Liveliness continues to decline, signaling that LTHs are reluctant to sell their holdings.

Read also: Dogecoin Skyrocketed 340% Last Time – MACD Bullish Flip Hints Another Rocket Ride

The stability provided by LTHs was crucial in supporting the Dogecoin price during previous market fluctuations. Their unwillingness to sell, despite recent price movements, may prevent further significant declines.

DOGE Price May Experience Further Decline

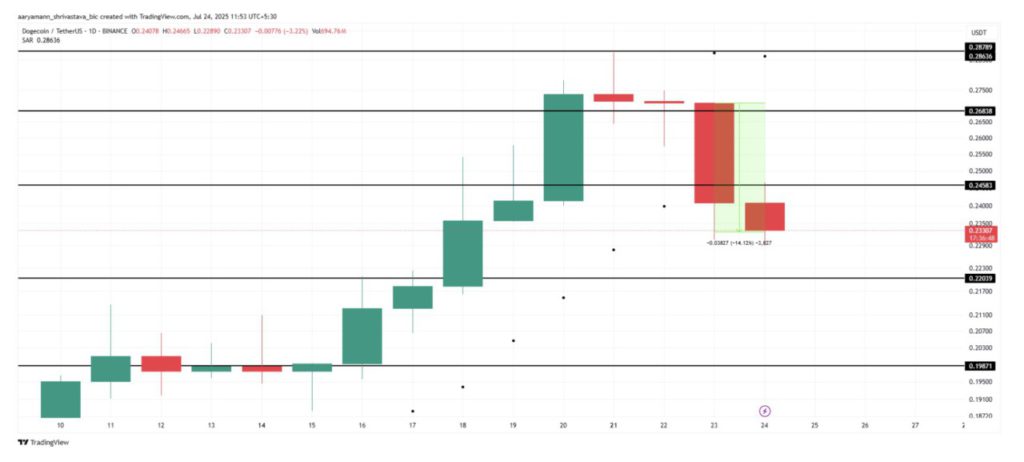

As of July 24, Dogecoin was trading at $0.233, below the key resistance level of $0.245.

Despite significant gains earlier in the month, the altcoin has now lost most of those gains, with prices down by 14%. The current price movement suggests a bearish reversal, and the chances of a quick recovery seem slim.

Given the recent surge in selling activity, it is likely that Dogecoin will continue to face downward pressure. If the selling continues, the price could fall past the $0.220 support level, potentially testing the $0.198 level in the next few days.

As profit-taking continues, the chances for a short-term recovery are decreasing, indicating a longer bearish trend.

However, if Dogecoin manages to reclaim the $0.245 level as support, the altcoin could recover its recent losses.

With the support of the long-term holder resistance, seen on Liveliness, a successful bounce off this level could push the price towards $0.268. This would invalidate the bearish thesis and allow DOGE to regain momentum.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Dogecoin Price Falls as Profit Taking Rises. Accessed on July 25, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.