2 Crypto that’s Good for the Long Term Besides Ethereum (ETH)

Jakarta, Pintu News – The cryptocurrency market has shown historically that early investors can make huge profits in a short period of time.

While the mega returns of previous years may not always be the case, cryptocurrencies like Bitcoin (BTC) and Solana (SOL) still have the potential to outpace traditional assets like stocks, bonds, and property.

This article explains why both digital assets are worth considering for long-term investment in crypto!

Bitcoin (BTC): Iconic Crypto and Value Protection

Bitcoin (BTC) was the first cryptocurrency to be recognized worldwide and is almost always the entry point for new investors. Its brand recognition adds value as most cryptocurrencies have no intrinsic value from revenue or development.

Slowly, large institutions began to accept Bitcoin, providing a long-term boost of confidence. This trend continues to strengthen as more pension funds, hedge funds, and corporations include Bitcoin in their portfolios.

In the past year, Bitcoin’s price has risen by around 75%, indicating a strong bullish sentiment in the crypto market. The US government’s policy support has also strengthened this momentum-such as President Trump’s passage of the Genius Act on July 18, which creates a regulatory framework for stablecoins pegged to the US dollar.

This regulation could pave the way for blockchain-based assets to enter the mainstream market and indirectly strengthen Bitcoin’s legitimacy. If US finances weaken further, including the weakening value of the US dollar, Bitcoin could become a digital safe haven that increases in value relative to fiat currencies.

Read also: These 3 Altcoins are Predicted to Print ATH in August 2025 – Can it Increase 300%?

Solana (SOL): High Performance and Revenue Staking

Unlike Bitcoin, which derives its value from trust, Solana (SOL) has built its reputation on technical performance and superior functionality. Launched in March 2020, Solana studied the weaknesses of previous networks to create a faster and more scalable blockchain.

With its Proof-of-History (PoH) verification system, Solana is capable of processing up to 65,000 transactions per second, making it an ideal platform for dApps. High activity on Solana generates demand for SOL as a utility token to pay transaction fees.

Interested in having a passive source of income? Solana offers a staking feature where users can temporarily lock their SOL tokens to help validate transactions on the network.

Stakers earn new tokens as rewards, similar to interest on bank deposits. This process not only increases network security, but also provides passive income for SOL holders. As the volume of transactions and users of decentralized applications increases, the need for SOL staking grows.

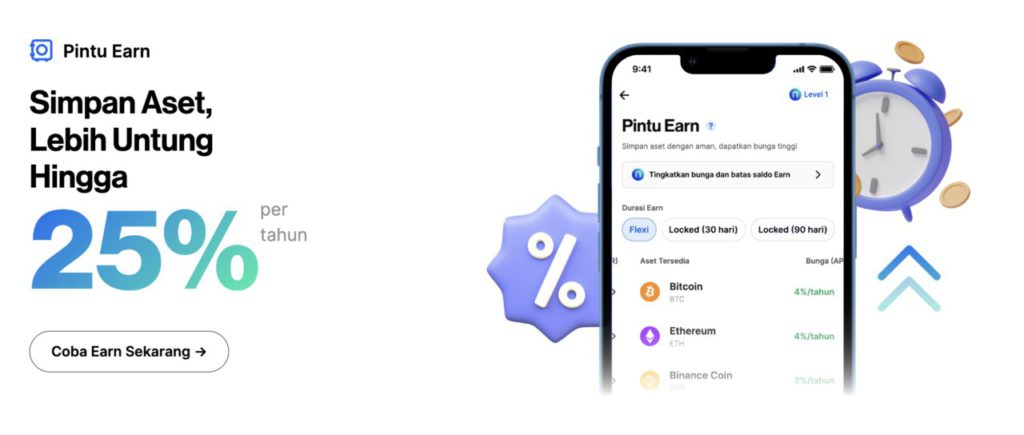

Pintu Earn: A Passive Strategy for Long-Term Crypto Investing

One of the more popular ways of long-term crypto investment is to utilize the Pintu Earn feature. This feature allows traders to earn up to 25% per year, simply by storing assets in the Pintu app without the need for active trading.

Two options are available: Flexi Earn and Locked Earn. Flexi Earn provides interest paid every hour and the balance can be withdrawn at any time. Locked Earn offers higher interest, with a choice of 30-day or 90-day lock duration. This strategy is suitable for investors who want passive income from crypto with minimal risk.

Conclusion

Overall, Bitcoin and Solana represent two sides of a strong crypto investment strategy: Bitcoin as a store-of-value asset with institutional adoption, and Solana as an active blockchain with income opportunities through staking. Both offer potential long-term advantages if you can withstand market volatility.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Yahoo Finance. Got $1,000? 2 Top Cryptocurrencies to Buy and Hold Forever. Accessed July 28, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.