3 August Crypto Predictions: XRP’s Hidden Potential, ETH’s Unstoppable Rally & BTC’s Resistance

Jakarta, Pintu News – The cryptocurrency market continues to show interesting dynamics with the price movements of Ripple (XRP), Ethereum (ETH), and Bitcoin (BTC) stealing the show. Various technical and psychological factors are at play in determining the next price direction for these three digital assets.

1. Ripple (XRP): Potential Double Top Danger

Ripple (XRP) has recently shown significant gains, with prices jumping from below $2.30 to over $3.50. However, a double top pattern known as a bearish indicator may be forming. This strong momentum could be hiding newly emerging technical risks.

If the price of Ripple (XRP) returns to the $3.50 area and fails to sustain gains, it could print the second peak of the double top. This could indicate a price reversal in the short or medium term. The Relative Strength Index (RSI) being close to 75 also adds to the concerns of potential market exhaustion.

Also Read: Top 4 Cryptos to Buy in Q3 Altcoin Season, Bitcoin’s Dominance Declines!

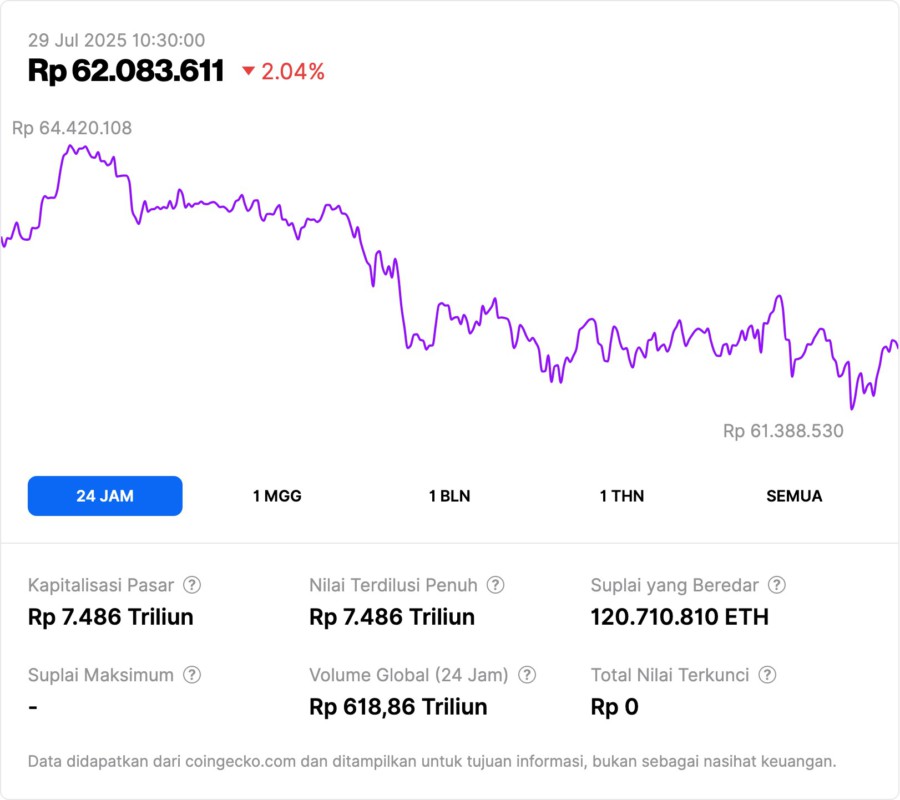

2. Ethereum (ETH): Relentless Rise

Ethereum (ETH) continues to show impressive performance with a rise of over 40% in recent weeks. With the current price at $3,888, Ethereum (ETH) doesn’t seem to be showing any signs of slowing down. This rise was supported by high volumes and the breakdown of the previous resistance at $2,900.

Any consolidation that occurs is brief and not deep, indicating high demand. Although the RSI has reached overbought territory at 82, Ethereum (ETH) could historically stay in this state for a considerable amount of time before a significant correction occurs. The next psychological resistance is near $4,000, which could encourage more inflows if successfully broken.

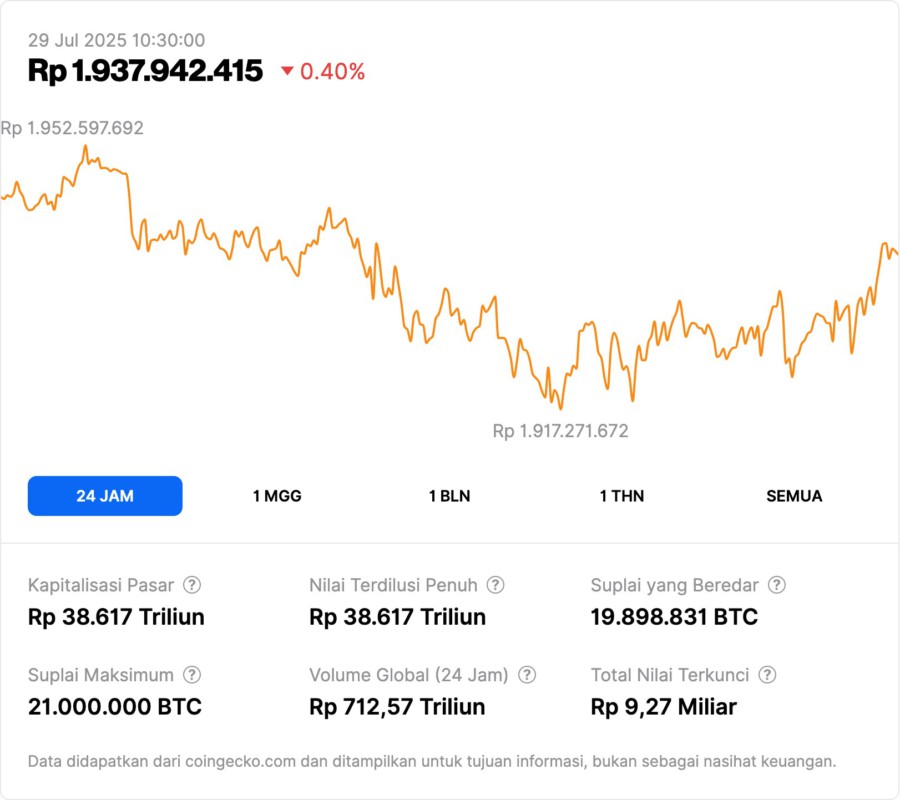

3. Bitcoin (BTC): Setting Key Resistance

Bitcoin (BTC) has established $120,000 as a clear resistance level. Despite several attempts to break this level, Bitcoin (BTC) is still experiencing rejection around this horizontal resistance zone. This indicates significant selling pressure or profit-taking activity.

The current consolidation below resistance does not necessarily indicate bearish sentiment. This could be an opportunity for the market to reset indicators such as the RSI, which is currently at a neutral 61. If Bitcoin (BTC) fails to break out, the price may retreat to the $111,000-$108,000 support range.

Conclusion

The market dynamics for Ripple (XRP), Ethereum (ETH), and Bitcoin (BTC) are constantly evolving with various technical factors influencing price movements. Investors and traders should pay attention to technical indicators and trading volumes to anticipate possible trend changes.

Also Read: 10 Potential 2025 Crypto for 2025 Year-End Profits! Any of your favorite coins?

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. XRP Has Hidden Danger Brewing, Ethereum’s ETH Unstoppable Rally Continues, Bitcoin (BTC) Clear. Accessed on July 29, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.