Ethereum price skyrocketed in August! 5 Strong Signals ETH is Ready to Set a New Record?

Jakarta, Pintu News – The month of August 2025 is in the spotlight of crypto investors after Ethereum (ETH) again approached the $4,000 level and rose more than 2.5% in the last 24 hours.

This sharp rise was driven by a surge in ETF demand, dwindling exchange reserves, and the strength of ETH relative to Bitcoin (BTC). Many analysts believe this could be the start of a new wave towards an all-time high, especially after a 55% rally during July. What are the main factors that could push ETH prices higher this month? Check out the listicle review below!

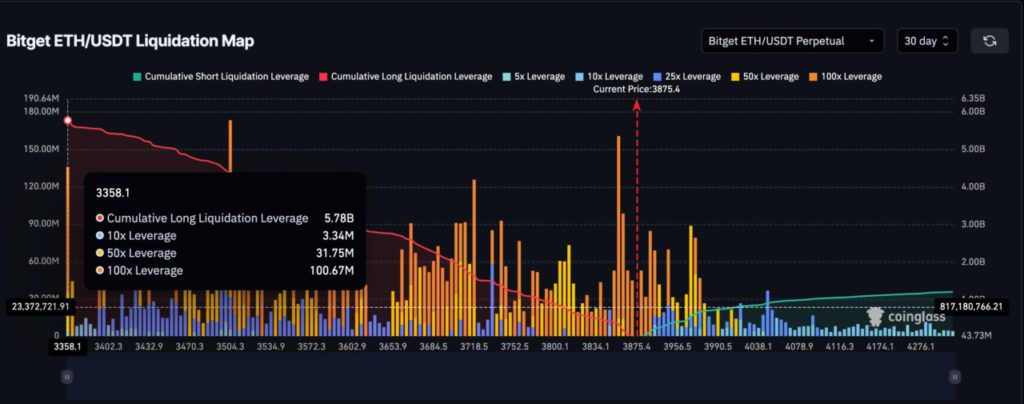

1. Massive Leverage & ETF Funds: Ready to Trigger the Big Squeeze?

Bitget data shows that leveraged longs worth more than $5.78 billion (IDR 94.864 trillion) are now piling up in the $3,358-$3,875 price zone (IDR55,034,010-IDR63,623,625). If the ETH price moves above $3,900 (IDR63,940,500), there could be a short squeeze that forces massive liquidation of short positions.

In July alone, Ethereum ETF inflows reached $5.12 billion (IDR83.905 trillion)-a yearly high. The majority of the funds came from large institutions, not retail investors, which adds to the strength of the crypto’s fundamentals. With the combination of leverage and the influx of institutional funds, the chances of a price spike are even greater in August.

Also Read: Top 4 Cryptos to Buy in Q3 Altcoin Season, Bitcoin’s Dominance Declines!

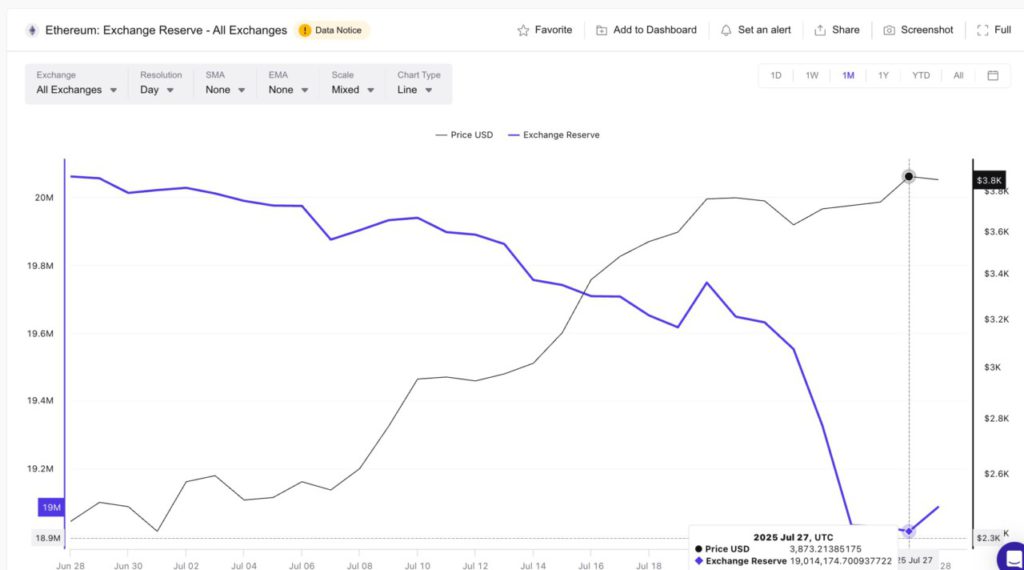

2. Exchange Reserves Dwindle, Demand Remains High

Although ETH has risen more than 57% from last month’s low, ETH reserves on exchanges have dropped to their second lowest level in a year. This drop in reserves comes despite several large wallets selling ETH, signaling retail and institutional demand is really absorbing the selling pressure.

This phenomenon usually indicates that the supply on the spot market is increasingly limited, so the potential for Ethereum (ETH) prices to rise is stronger. If this trend continues, the combination of high demand and low availability could fuel a new record in the cryptocurrency market.

3. ETH/BTC Ratio Rises Significantly, a Sign of “Altseason” Beginning?

The ETH/BTC ratio is now at 0.032, a jump of almost 40% from the June low. This surge is backed by strong technical signals-the four major EMAs (20D, 50D, 100D, and 200D) are close to golden cross, a pattern that usually marks a major bullish trend in crypto.

If the ETH/BTC ratio continues to rise and a golden cross occurs, it could trigger altseason, which is a massive wave of gains in major altcoins such as Ethereum (ETH), Ripple (XRP), and even Pepe Coin (PEPE). Historical patterns show that ETH’s rise against Bitcoin (BTC) often triggers bullish trends in the cryptocurrency market.

4. Key Price Area: $3,919 and Target Toward ATH

Ethereum (ETH) price is currently testing an important resistance level at $3,919 (IDR64,225,305), right at the 0.236 Fibonacci extension. If the daily close succeeds above this level, the upward momentum could take ETH to the following targets:

- $4,173 (Rp68,440,335)

- $4,378 (Rp71,803,110)

- $4,583 (IDR 75,165,885)

- $4,874 (Rp79,997,130)

A break above $4,874 (IDR 79,997,130) could very well pave the way to a new all-time high for ETH. However, if it fails to hold above $3,919, ETH could potentially drop and test support around $3,510 (IDR57,575,950).

5. Risk and Strategy: Don’t Ignore Crypto Volatility

Although the bullish opportunity is huge, the risk of volatility is still lurking. If ETH fails to hold key levels or there is a large leveraged liquidation action, the price could correct back to the consolidation zone.

Crypto investors are advised to keep an eye on important support and resistance levels and adjust trading or investment strategies accordingly. Portfolio diversification, securing profits gradually, and keeping up to date with the latest news about Ethereum (ETH) and the cryptocurrency market is highly recommended.

Conclusion

The month of August 2025 brought great optimism for Ethereum (ETH) to score a new all-time high, supported by an influx of institutional funds, depleting exchange reserves, and technical strength against Bitcoin (BTC). However, volatility remains a major factor that every crypto investor needs to be aware of.

Also Read: 10 Potential 2025 Crypto for 2025 Year-End Profits! Any of your favorite coins?

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price in August: Will There Be a New All-Time High?. Accessed July 29, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.