Ethereum Surges to $3,800 on July 30 — Is a New All-Time High Coming in August?

Jakarta, Pintu News – Ethereum (ETH) price is flirting with the $4,000 level again, up more than 1% and trading around $3,810. This rise has rekindled hopes of further gains, possibly even setting a new all-time high.

While the situation feels familiar, the backdrop this time is quite different. Towards the end of July, ETH was in the midst of a network of converging catalysts: large leveraged bets, fund flows from well-capitalized ETFs, dwindling supply on exchanges, as well as strengthening against Bitcoin (BTC).

All these factors set the stage for a possible big surge in ETH in August.

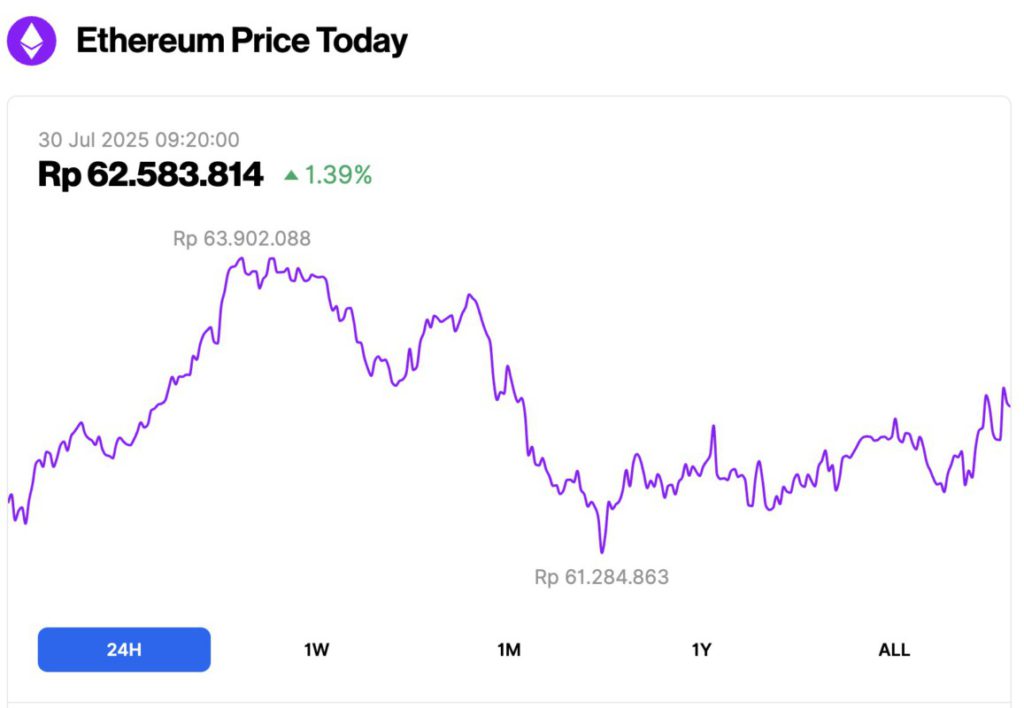

Ethereum Price Up 1.39% in 24 Hours

As of July 30, 2025, Ethereum was trading at approximately $3,810, or around IDR 62,583,814 — marking a 1.39% gain over the past 24 hours. During this time, ETH dipped to a low of IDR 61,284,863 and climbed to a high of IDR 63,902,088.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $459.6 billion, with daily trading volume falling 1.39% to $35.8 billion in the last 24 hours.

Read also: 3 Trending Crypto on CoinGecko Ready to Explode in Early August 2025!

Heavy Leverage Pile at the Bottom: Can ETF Fund Flows Stabilize This Zone?

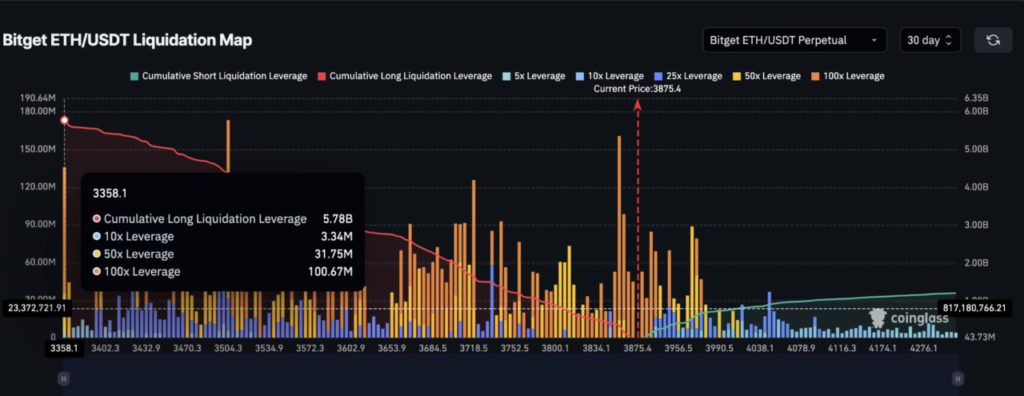

According to Bitget’s latest ETH/USDT liquidation map, there is more than $5.78 billion of cumulative long leverage currently stacked between the $3,358 to $3,875 price range. With the price of ETH now at the upper end of that zone, this means that ETH is near a vulnerable area.

If the price goes higher, this zone could turn into a price launchpad. However, if it slips, it could trigger a cascade liquidation in a row.

What distinguishes this leverage cluster from previous accumulations is the type of funds that support it.

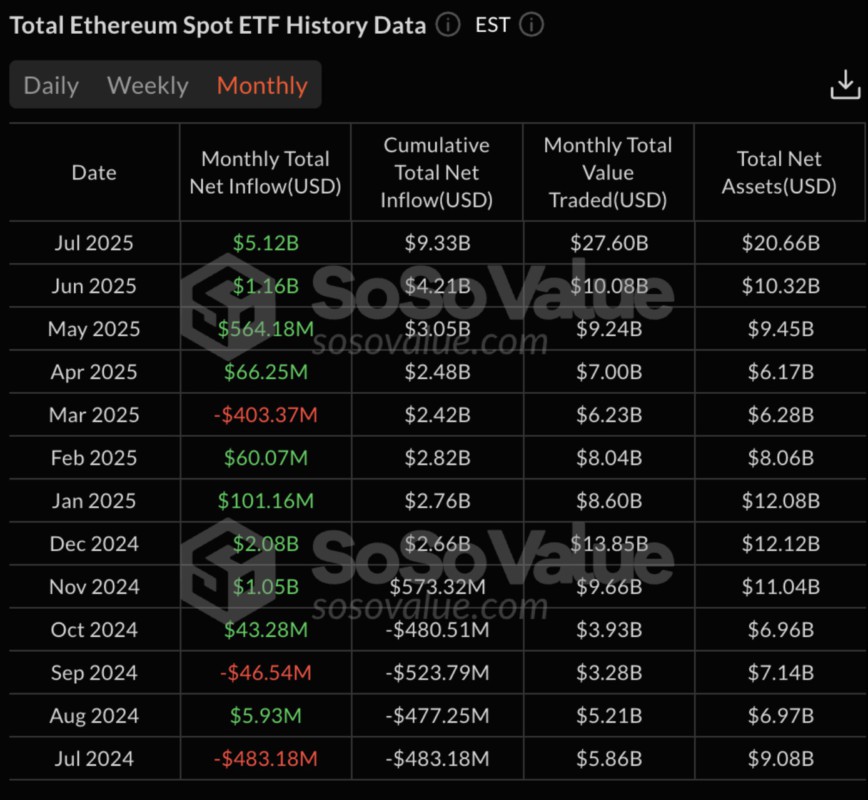

In July 2025, the Ethereum ETF recordednet inflows of $5.12 billion – the highest monthly figure in the past year in dollar terms. These are not just retail investors. This is institutional power coming in, evident both in spot allocations and in derivatives instruments.

It is this confidence from institutional players that gives the bulls some breathing room, amidst such a high-risk leverage trap. There is no reason to think that July’s ETF fever will not continue into August.

If ETH is able to break back through the $3,900 level with momentum, it could trigger a forced short squeeze, especially with over $1 billion of short positions waiting to be liquidated. Yes, even the short positions are quite large.

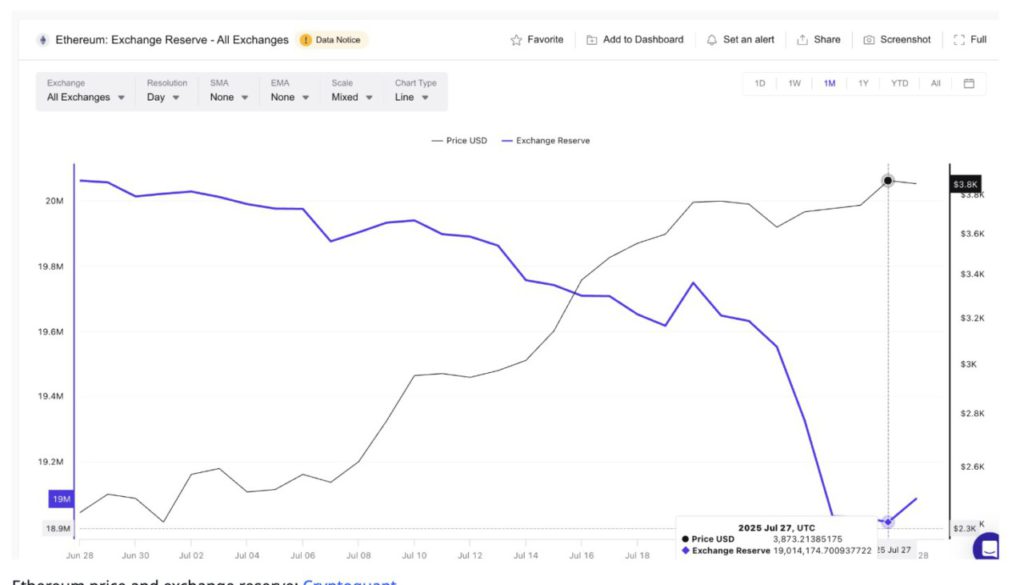

Reserves on the Exchange Add Another Layer of Optimism

Adding to the bullish sentiment is data on ETH reserves on exchanges that remain low. Although ETH has risen more than 57% from last month’s low, the number of holdings on exchanges has not increased.

In fact, monthly reserves on the exchange are currently at their second lowest in more than a year.

It’s not just about low supply. More striking is the fact that while large wallets are selling, reserves on exchanges are not soaring.

Read also: Top 3 Memes of Tokens Hunted for High Spikes This Week!

This indicates supply absorption – where demand from retail and institutional investors managed to absorb the selling pressure.

When funds from ETFs started coming in and reserves on exchanges actually shrank during the price rise, the conclusion was simple: market confidence was strong, and the pace of buyers outpaced sellers.

ETH/BTC Ratio Surges; A Sign of Altseason Beginning?

When viewed in a broader context, the ETH/BTC ratio shows a bullish signal of its own. The pair has risen to the 0.032 level – an increase of nearly 40% from the June low – and is now on the verge of completing a rare series of golden crossovers on the 20-day, 50-day, 100-day, and 200-day EMAs (Exponential Moving Averages).

Only one technical move remains: The 50-day EMA (orange line) must surpass the 200-day EMA (blue line).

If that happens, it would confirm a fully bullish market structure – a pattern that has historically often preceded long altcoin rallies.

Against the current backdrop: strong fund flows from ETFs, dwindling exchange reserves, and a huge pile of leveraged longs – this crossover is not just symbolic. It could be the technical validation the bulls need to push the momentum even deeper in August.

Ethereum Price Movement: Key Resistance Defines Battle Zone

With Ethereum’s performance continuing to outperform Bitcoin, this strength is likely to have a direct impact on ETH/USD price movements soon.

The ETH/BTC ratio has historically often been an early indicator for breakouts against the USD, and with the golden crossover nearing completion, ETH momentum seems ready to move on to the next level.

Currently, ETH is pressuring the Fibonacci extension 0.236 level at $3,919. If the price is able to break and close daily above this level, upward momentum could be triggered, with the following targets:

- $4.173 (Fib 0.382)

- $4.378 (Fib 0.5)

- $4.583 (Fib 0.618)

- $4.874 (Fib 0.786)

A move above $4,874 would pave the way for Ethereum price to reach a new all-time high (ATH). And considering ETH has recorded a 55% gain in just the month of July, the possibility of reaching ATH is now increasingly realistic.

However, if it fails to hold above $3,919, the rally could stall and ETH risks dropping to retest the support level around $3,510 – the trendline level that serves as the uptrend validation limit.

It’s a line that the bulls must defend to avoid re-entering a broader consolidation phase. Also keep in mind, a price drop could trigger the liquidation levels discussed earlier.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. New All-Time High In Sight? What To Expect From Ethereum In August. Accessed on July 30, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.