Bitcoin Holds at $117K Today – Is BTC Flashing Early Sell Signals Ahead of a Major Correction?

Jakarta, Pintu News – As reported by AMB Crypto, Bitcoin’s (BTC) move is now facing its first serious test.

As the price approached the $120K psychological barrier, long-term holders started taking profits or cashing out some of their assets. The latest data shows a shift into net selling territory.

Although Open Interest remains relatively stable, the slight decline shows early signs of repositioning among investors.

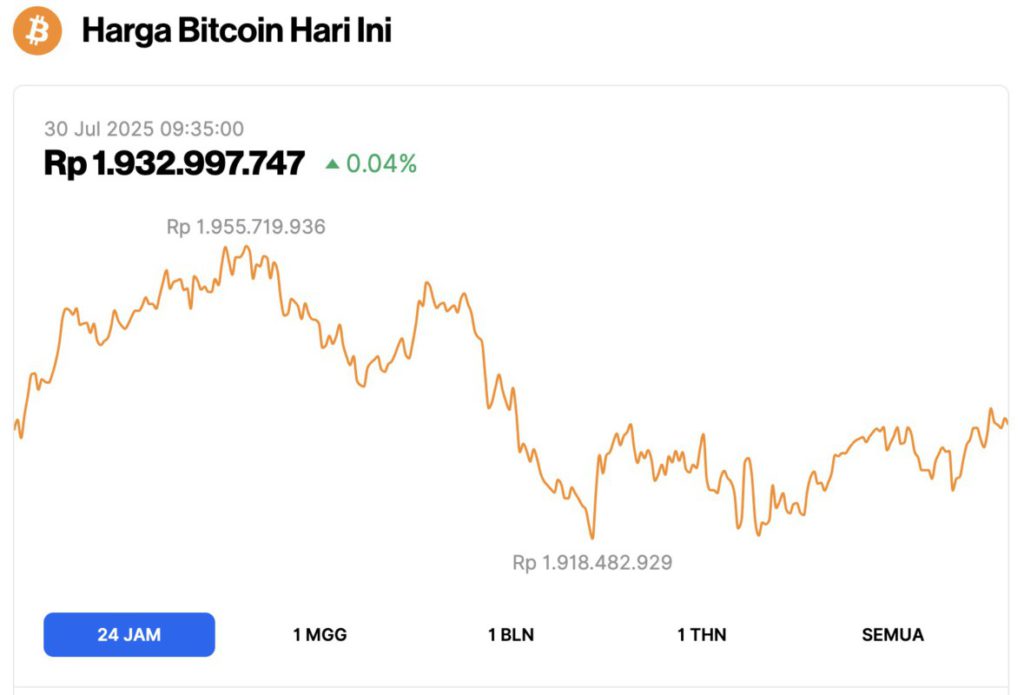

Bitcoin Price Up 0.04% in 24 Hours

As of July 30, 2025, Bitcoin was trading at $117,948, equivalent to IDR 1,932,997,747 — marking a slight 24-hour gain of 0.04%. Over the same period, BTC dipped to a low of IDR 1,918,482,929 and climbed to a high of IDR 1,955,719,936.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.34 trillion, with trading volume in the last 24 hours rising 5% to $67.82 billion.

Read also: Ethereum Surges to $3,800 on July 30 — Is a New All-Time High Coming in August?

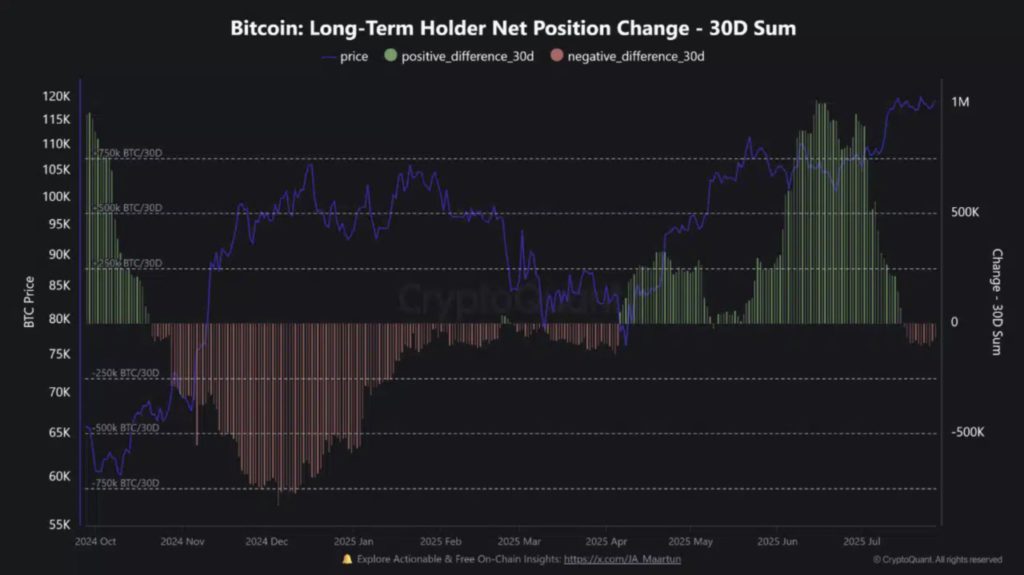

Profit Taking Begins at $120K Level

On-chain data shows that long-term Bitcoin holders started entering net selling territory just as BTC hit the $120K mark.

Although the decline is still moderate, the reversal in the 30-day Net Position Change indicator hints at the initial phase of the distribution process.

The trigger for this movement is likely a combination of profit realization and institutional rebalancing.

Notably, Galaxy Digital’s reported sale of 80,000 BTC adds to the pressure from the sell side-this is not just a sell-off from retail investors.

For now, the situation looks more like a reshuffling strategy than a massive exit. However, if more whales take part, the market narrative could quickly change.

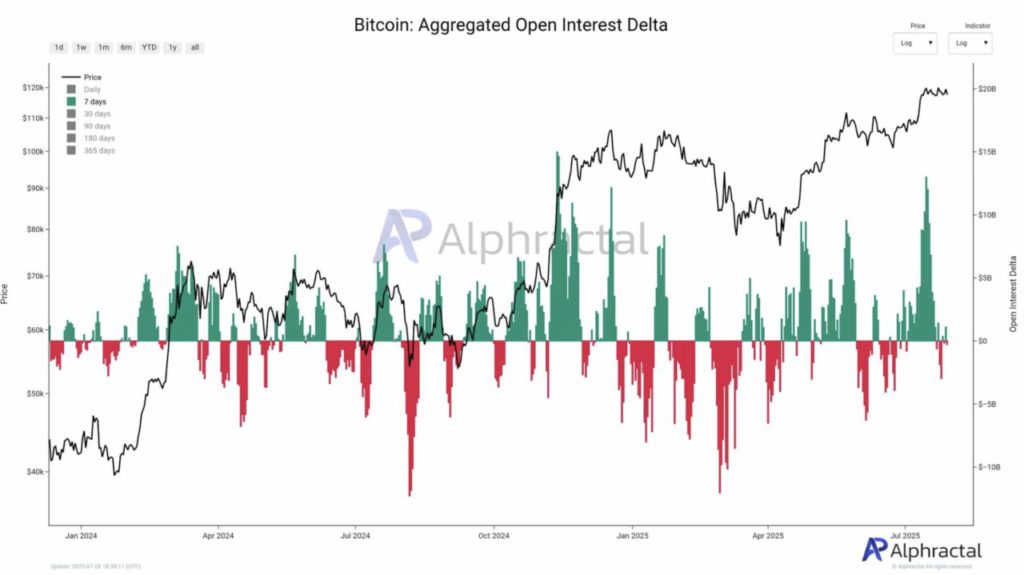

Open Interest Starts to Decline

Bitcoin’s 7-day Aggregated Open Interest Delta has entered negative territory again, but this movement has not shown the speed of a massive exit.

This mild decline indicates a partial unwind, most likely from large players reducing exposure or closing positions after a strong rally.

Read also: 3 Trending Crypto on CoinGecko Ready to Explode in Early August 2025!

Instead of being a bearish signal, it is more like a strategic pause. With prices still holding near the All-Time High (ATH), the data suggests selective profit-taking.

Momentum Cooled, but Bulls Still Survived

At the time of writing, Bitcoin is consolidating slightly below the $120K level – showing signs of a temporary pause, not a reversal.

The RSI is at 59 – down from the overbought territory, but not yet indicating weakness.

Meanwhile, On-Balance Volume (OBV) was flat at around 1.76 million, signaling the absence of fresh buying pressure. Despite the uncertainty, price action remained stable, with no aggressive sell candles emerging.

For now, the bulls still seem to be holding on to their gains while waiting for a new catalyst. However, without an increase in volume, the upside momentum may remain limited.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin’s $120K resistance triggers early sell signals. Accessed on July 30, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.