Bitcoin’s Grip Loosens—Is This the Start of a Full-Blown Altcoin Season?

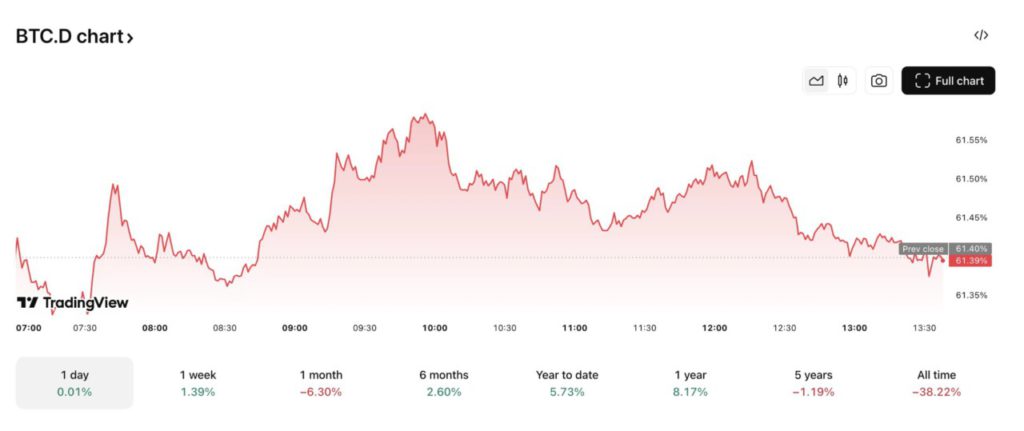

Jakarta, Pintu News – In recent weeks, the Bitcoin Dominance Index (BTC.D)-which measures Bitcoin’s market share compared to the entire cryptocurrency market-has experienced a sharp decline of 6.30%.

According to technical analysts, this could be an early signal of the coming Altseason, which is expected to occur in the next 3 to 6 months.

Bitcoin’s Dominance Weakens, is Altseason Coming?

Based on observations from a number of renowned market analysts, BTC.D is currently undergoing crucial structural changes.

Read also: Bitcoin Holds at $117K Today – Is BTC Flashing Early Sell Signals Ahead of a Major Correction?

One of the striking things is the formation of a bearish cross on the 3-week timeframe. This is often considered an important technical indicator signaling a potential trend reversal.

In addition, BTC.D has officially broken its three-year uptrend line. This is widely seen as one of the strongest signals that Bitcoin’s market dominance is starting to erode.

“Bitcoin dominance has lost its uptrend over the past 3 years. This is the biggest sign of the upcoming Altseason and parabolic pump,” Ash Crypto said.

Crypto Market Now Resembles Playbook 2021

Merlijn, a veteran trader, highlighted that the current market conditions are very similar to the 2021 “playbook”, where a major altcoin season once took place.

According to him, Bitcoin Dominance has entered “Phase 4” – a clear stage of decline – which paves the way for capital rotation into altcoins.

Once this shift fully takes place, there will likely be a strong cycle of capital rotation from Bitcoin to other altcoins.

One of the other key indicators highlighted is the ETH/BTC pair. In the context of BTC.D’s decline, many experts believe that Ethereum will lead the next wave of altcoin market growth.

In recent weeks, ETH has shown gains against BTC, indicating that capital is slowly starting to shift away from Bitcoin (BTC). Investors seem to be looking for more profit potential from assets with smaller capitalization.

In addition, a crypto investor named Ted stated that in the next 3-6 months, Ethereum (ETH) and various altcoins could experience significant growth.

Read also: 3 Trending Crypto on CoinGecko Ready to Explode in Early August 2025!

While short-term dips are possible to shake outweak hands, structural trends suggest that the altcoin market is gearing up for a cyclical rally.

Short-Term Barriers for Altseason

However, not everyone agrees that Altseason is about to begin. Some analysts are of the opinion that BTC.D is currently still holding in the 60-61% demand zone, which could be a strong support level to maintain Bitcoin’s market dominance in the short term.

Crypto Candy analysts emphasize that unless BTC.D is really able to convincingly break out of this zone, altcoins will probably continue to struggle and show slow growth.

“As long as this 60-61% zone remains, we may not see strong momentum in alts. In the near term, price movements could be slow and accompanied by retracements,” the analyst said.

Investors are therefore advised to remain patient and closely observe price movements and capital flows in the short term.

The growth of altcoins is unlikely to be instantaneous; instead, the shift could be gradual as the market slowly moves away from Bitcoin’s dominance towards a more diversified asset rotation cycle.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Dominance Records Sharp Decline – Is Altseason Finally Here? Accessed on July 30, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.