Market Structure: Uncovering the Dynamics of Business Competition

Jakarta, Pintu News – Market structure in economics refers to the classification and differentiation of industries based on the degree and type of competition in the sale of goods or services. Certain characteristics of these markets influence the behavior and outcomes achieved by firms operating within them. By understanding these characteristics, it is possible to determine how firms interact and compete in the market.

Perfect Competition

Perfect competition occurs when many small firms compete against each other with similar products. In this market, firms have no influence over product prices and consumers have complete information about the goods being sold and their prices. Although idealized, this market structure rarely occurs in the real world due to various criticisms, it is still useful as a comparison in economic analysis.

In perfect competition, every firm is free to enter or exit the market unhindered. This creates an environment where no single firm can control the market or set prices. The products sold are considered homogeneous, so the only factor that differentiates sellers is price.

Also Read: 5 Hot Altcoins of 2025: Crypto that Analysts Predict to Soar 100x in Altseason 2025!

Monopolistic Competition

Monopolistic competition is a market that exhibits features of both monopoly and competition. Here, firms can differentiate their products through quality or branding. Despite competition, firms in this market tend to ignore the impact of their prices on competitors and focus more on marketing strategies and product differentiation.

In the short term, firms in monopolistic competition can maximize profits and enjoy monopoly-like profits. However, these profits diminish over time with the entry of new firms offering different products, which ultimately reduces the demand and profits of existing firms.

Oligopoly

Oligopoly is a market structure where there are only a few large firms that dominate the market. The products sold can be similar or different, but the important thing is that any pricing or production decisions by one firm will affect the decisions of other firms. This creates a highly strategic and interdependent dynamic among market players.

In oligopolies, companies often enter into agreements to divide the market or limit production, known as cartels. While this can lead to enormous profits, it is also high-risk as it violates fair competition laws. Loyalty to these agreements is often tested, and non-compliance can result in price wars that harm all parties.

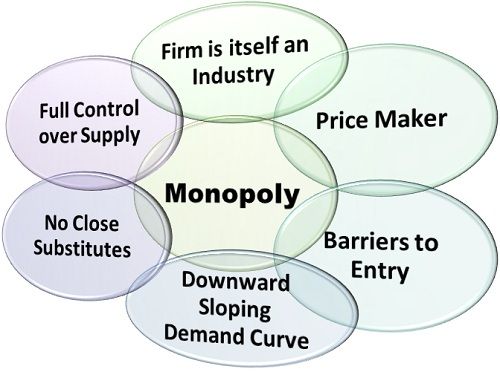

Monopoly

In a monopoly market structure, there is only one firm that dominates the entire industry with no competitors. This firm has complete control over the price and production of goods.

Factors such as exclusive ownership of resources, patents, government licenses, or high set-up costs can prevent other firms from entering the market. Monopolies are often criticized for being able to set prices higher than they would be in a more competitive market. This can result in lower efficiency and a lack of innovation due to the lack of competitive pressure.

Conclusion

Understanding market structure is key to analyzing how firms operate and compete in the global economy. By knowing the characteristics of each market structure, businesses and policymakers can formulate more effective strategies to face market challenges and capitalize on opportunities.

Also Read: 5 Viral New Crypto to Watch in 2025: Which is the Most Potential Cryptocurrency?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Corporate Finance Institute. Market Structure. Accessed on July 30, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.