4 Warning Signs Ethereum (ETH) Will Experience a Price Correction in August 2025!

Jakarta, Pintu News – Ethereum (ETH), as one of the most sought-after crypto assets after Bitcoin (BTC), is now showing some worrying signs. Although the price of Ethereum (ETH) is still holding above $3,800, there are several indicators that point to a potential price drop in the near future.

Here is an in-depth analysis of four warning signs that investors and market watchers should look out for!

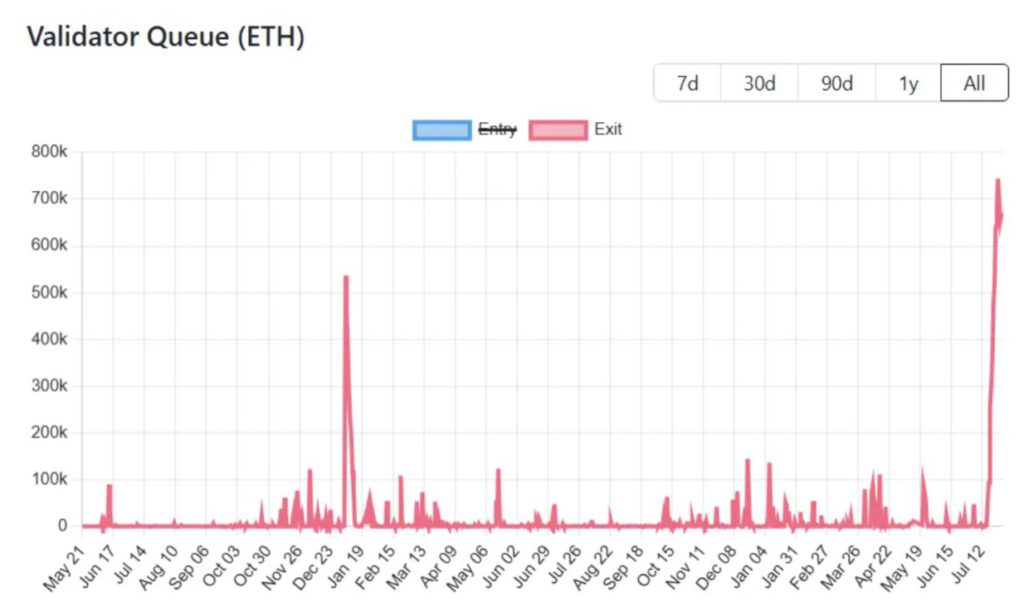

More than 700,000 ETH Ready for Disbursement

The latest data from ValidatorQueue shows that more than 700,000 Ethereum (ETH) is in the queue to be cashed out, the highest amount in the last four years. This indicates that many users and institutions are preparing to withdraw the Ethereum (ETH) they have staked.

The motivation behind this could be to take profits or reallocate their assets. This could create selling pressure in the market, due to the increased supply of Ethereum (ETH) available for sale. If not matched by strong demand, the price of Ethereum (ETH) may see a decline.

Read also: Breaking: Bitcoin and Ethereum ETFs Get Green Light from SEC for In-Kind Redemptions

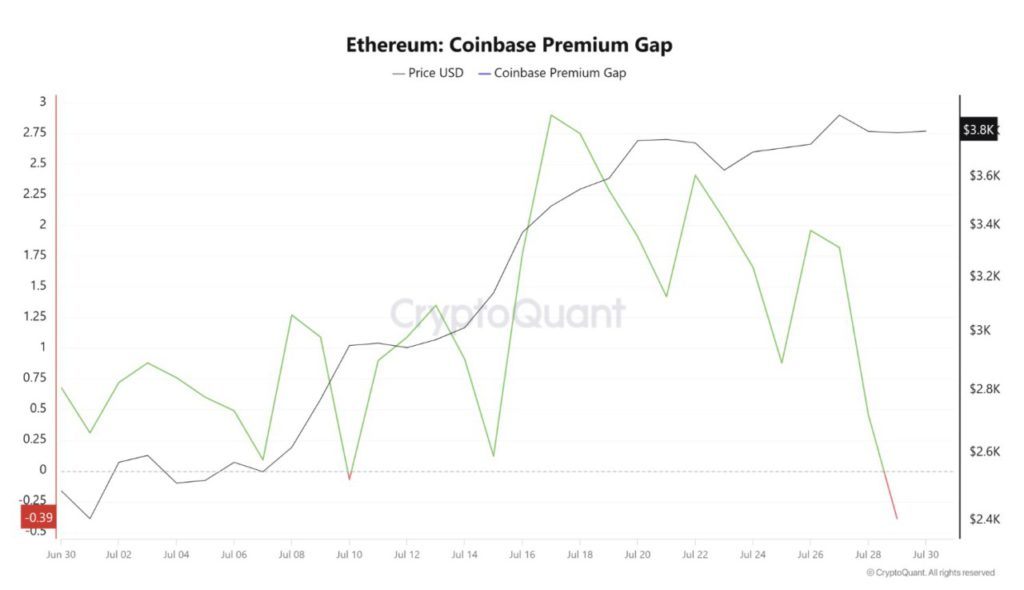

Coinbase Ethereum (ETH) Premium Gap Goes Negative

One indicator often used to gauge investor interest from the United States is the Coinbase Ethereum (ETH) Premium Gap. According to data from CryptoQuant, this gap has turned negative at the end of July.

This shows that the price of Ethereum (ETH) on Coinbase is lower compared to Binance, which could be an indication of decreased interest from US investors.

This change is important because US investors are often the main drivers of price movements in the crypto market. When their interest wanes, it could be a signal that the price of Ethereum (ETH) may be on the decline.

Read also: Bill Miller: “Every Company Will Have Bitcoin in the Next 20 Years!”

Net Taker Volume Shows Negative Numbers

Analysis from Maartunn shows that Ethereum (ETH) Net Taker Volume registered a negative figure of $231 million at the end of July. This means that the number of sell orders exceeded buy orders significantly.

This is a strong bearish indicator, showing that selling pressure in the Ethereum (ETH) market is increasing. This imbalance between buyers and sellers could accelerate the price decline if this trend continues.

Also read: Michael Saylor’s Grand Strategy: $2.46 Billion Bitcoin Purchase!

Ethereum (ETH) Sale by Ethereum Foundation

The Ethereum Foundation has sold a total of 25,833 Ethereum (ETH), worth nearly $100 million, in recent months. This information, also shared by Maartunn, adds to concerns about a potential Ethereum (ETH) price drop.

Sales by large entities such as the Ethereum Foundation could affect the market perception of Ethereum (ETH). This sale may be part of a cash management strategy, but it still signals to the market that even the core institutions that support Ethereum (ETH) also see the need to reduce their exposure. This could be interpreted as a lack of confidence in Ethereum’s (ETH) near-term prospects.

Conclusion

Although Ethereum (ETH) still enjoys its status as a highly desirable crypto asset, some of the warning signs that have been outlined above suggest that there could be a price correction on the horizon.

Investors should consider these factors in making their investment decisions and may need to prepare strategies to deal with potential market volatility.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Ethereum Price Correction in August. Accessed on July 31, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.