Antam Gold Price Chart July 31, 2025: Prices Slowly Weaken, What’s Happening?

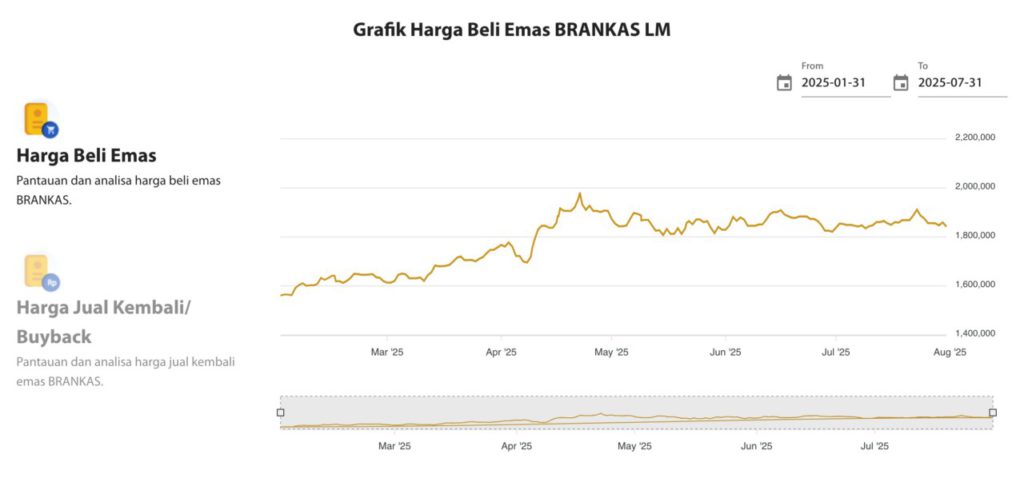

Jakarta, Pintu News – On July 31, 2025, Antam’s gold price chart recorded a significant drop of Rp 17,000 per gram, from Rp 1,918,000 to Rp 1,901,000. This article presents complete data and analysis of LM (Precious Metal) gold movements in list style as well as contextually linking it to crypto and cryptocurrency dynamics.

1. Antam Gold Daily Price Decline

On Thursday’s trading, the price of Antam gold produced by Mulia Metal was recorded to have fallen from IDR 1,918,000 per gram to IDR 1,901,000, recording a correction of 0.89% in one day. Meanwhile, the buyback or resale price of gold also fell deeper by Rp 18,000, from Rp 1,764,000 to Rp 1,746,000 per gram. The difference between the purchase price and the resale price reached around IDR 155,000 per gram, illustrating the margin that Antam investors need to pay attention to in the precious metals line.

Also Read: 5 Shocking Predictions: Pi Network (PI) Price in August 2025, Potential to Soar or Plummet?

Antam Gold Price List per Size

The prices for Antam gold bullion fractions as of July 31, 2025 are as follows: 0.5 g at IDR 1,000,500; 1 g at IDR 1,901,000; 2 g at IDR 3,742,000; 5 g at IDR 9,280,000; 10 g at IDR 18,505,000; up to 1,000 g at IDR 1,841,600,000. The data shows a general pattern: the price per gram tends to be higher in small bar sizes as the printing cost per unit is higher. Investing in large denominations often gives a more economical price per gram.

🧾 3. Monthly Trends and Historical Comparisons

When compared to the price one week ago on July 24, 2025 (IDR 1,945,000/gr), the price of Antam gold has decreased by around IDR 44,000 or 2.26% in the last seven days. However, when compared to the beginning of July (IDR 1,896,000), on a monthly basis gold still recorded an increase of 0.26%. Longer back, Antam gold purchases since January or October 2024 still provide a profit of more than 50% when sold today.

⚠️ 4. External Factors: Fed Policy & Relationship with Crypto

The decline in gold prices was triggered by the US Federal Reserve’s decision to hold interest rates steady with no indication of an immediate cut. This caused global spot gold to drop by more than 1%, thus weakening the rupiah. On the other hand, the dynamics in the crypto market and cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Pepe Coin (PEPE) also affected fund flows.

Global uncertainty has made some investors choose gold as a safe haven, while others are looking for high return opportunities through volatile crypto. The spot gold price closed at around USD 3,352.8 per ounce, and if converted to rupiah using an exchange rate of USD = IDR 16,452, the price per gram is around IDR 1,747,000 (because 1 ounce ≈ 31.1035 grams).

5. Overview: Profit or Loss in Short-Term vs Long-Term Perspective

For short-term investors, the daily drop of IDR 17,000 indicates a potential risk if bought the day before. But for gold holders since the beginning of the year or last year, profits remain substantial as the long-term trend remains positive Kontan Data Center. For example, a purchase at the end of January 2024 at IDR 1,144,000 provides a gain of more than 50% when sold today.

Conclusion

The Antam gold price chart as of July 31, 2025 shows a sharp daily correction, but the long-term trend is still favorable. Price data by bar size, explanation of the difference in purchase and buyback prices, as well as the macro context with interest rate policy and its relation to the crypto market provide a complete picture for investors who want to decide when is the best time to buy or sell LM Antam gold.

Also Read: 7 Facts How Ethereum Changed the World of Crypto & Cryptocurrency Over 10 Years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Precious Metals. Accessed July 31, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.