Antam Gold Price Chart Today, August 1, 2025: Stable Amid Market Uncertainty

Jakarta, Pintu News – Antam gold price as of August 1, 2025 is still a major concern for investors and market players who want to keep their portfolios safe, including amid global market trends and the rise of crypto assets and cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Pepe Coin (PEPE). This article summarizes the latest Antam gold prices and price movement trends in recent months, complete with charts to help you make investment decisions.

1. Antam Gold Price Today: Unmoving

Based on data as of Friday, August 1, 2025 at 08:07 WIB, the purchase price of physical Antam gold is at the level of IDR 1,901,000/gram. Meanwhile, for the corporate BRANKAS category, the price remains at IDR 1,841,600/gram. Both prices were recorded unchanged (Rp 0) compared to the previous day. This indicates price consolidation amidst the volatility that often occurs in the gold and crypto markets.

The previous prices for both categories were also the same as today, signaling stability in a short period of time despite fluctuations in both precious metal and cryptocurrency prices in global markets. With neither an increase nor a decrease in prices, many investors tend to wait and see, waiting for the next signal from the market.

Also Read: 5 Shocking Predictions: Pi Network (PI) Price in August 2025, Potential to Soar or Plummet?

2. Trend Chart of Antam Gold Price in the Last 6 Months

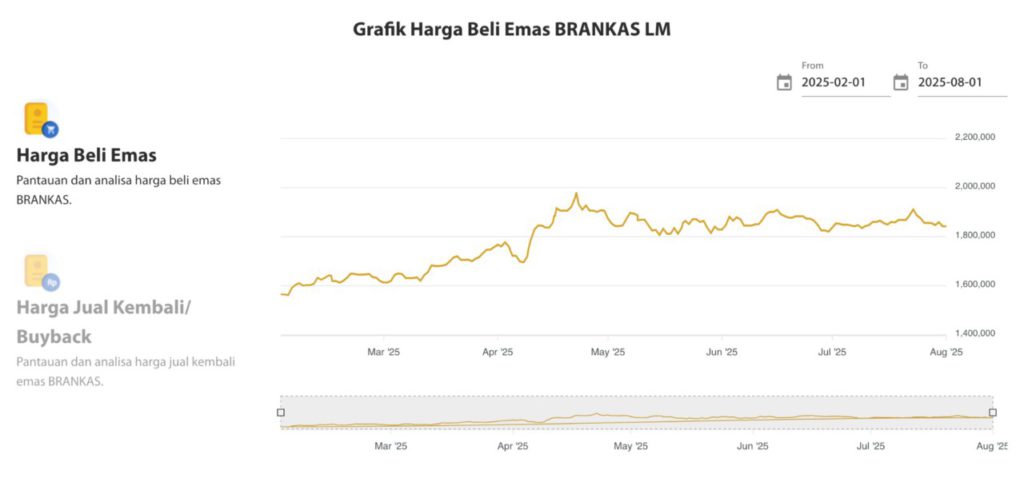

The Antam gold price chart (BRANKAS LM) from February to early August 2025 shows a significant upward pattern until it peaked in mid-May 2025 at around IDR 2,000,000/gram. After that, there was a correction and consolidation, with prices tending to stabilize in the range of IDR 1,800,000 – IDR 1,900,000/gram.

The sharp rise at the beginning of the year was largely triggered by global economic uncertainty, exchange rate fluctuations, as well as a shift in investor interest between gold and cryptocurrencies. Many market participants used gold as a safe haven asset, especially when crypto experienced high volatility. However, starting mid-year, the trend of gold prices was more stable, in line with the movement of cryptocurrencies that began to show consolidation.

3. Gold vs Crypto Comparison and Investment Implications

In recent months, the correlation between gold and crypto assets such as Bitcoin (BTC), Ethereum (ETH), and other altcoins has grown closer. When crypto markets are volatile, some investors return to physical gold and derivative products such as BRANKAS gold as hedging instruments. However, for young investors, crypto remains attractive due to its much greater growth potential, although the risks are also high.

With Antam gold prices stabilizing today, investors may consider a diversification strategy-combining gold and cryptocurrency investments in a portfolio. This helps manage risks and opportunities, as well as capitalize on momentum in both assets.

4. When is the Right Time to Buy Gold?

When gold prices are moving steadily, like today, it is usually a fairly safe time for long-term investors to accumulate. Investors can also take advantage of the periodic purchase feature or dollar cost averaging, while monitoring market sentiment in both gold and cryptocurrency.

For short-term traders, flat price conditions like now are usually waiting for new triggers, whether from global economic data releases, central bank policies, or price movements in the crypto market that could cause new sentiment in the gold market.

Conclusion

Antam’s gold price as of August 1, 2025 is at a stable level, amid a trend of market consolidation. Although there are currently no price changes, it is still important to monitor movements in both the gold and cryptocurrency markets as part of a modern investment strategy.

Also Read: 7 Facts How Ethereum Changed the World of Crypto & Cryptocurrency Over 10 Years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Antam. Gold Price Today. Accessed August 1, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.