7 Harmonic Patterns in Trading that Traders Must Know for Maximum Profits!

Jakarta, Pintu News – Harmonic patterns are important tools in the trading world that help traders identify potential trading opportunities and price trends. This article will take an in-depth look at the top seven harmonic patterns that every trader should know.

What is a Harmonic Pattern?

Harmonic patterns are patterns on a chart that are used in trading strategies to predict future market movements. They use Fibonacci numbers to identify possible price changes or trend reversals. By recognizing these patterns, traders can make more informed and precise trading decisions.

Harmonic patterns help in identifying price trends by observing geometric loops on the price chart. This allows traders to spot opportunities before significant changes in price occur, giving them an edge in decision-making.

Also Read: 5 Shocking Predictions: Pi Network (PI) Price in August 2025, Potential to Soar or Plummet?

7 Most Popular Harmonic Patterns

Here are seven harmonic patterns most commonly used by traders:

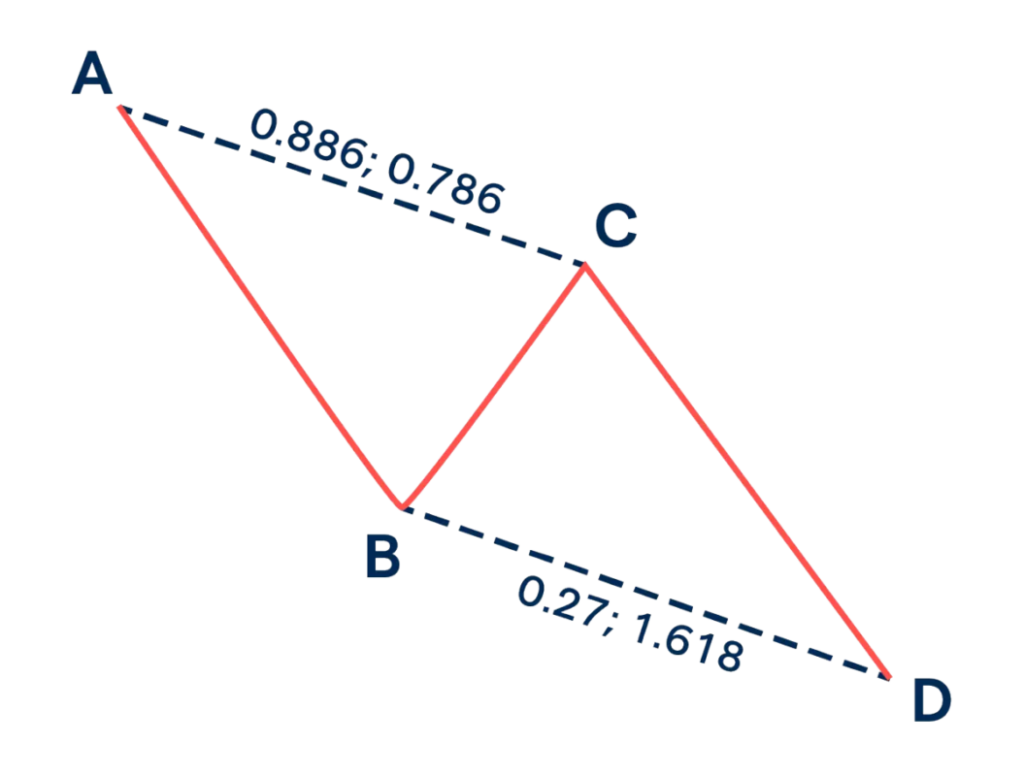

- ABCD Pattern

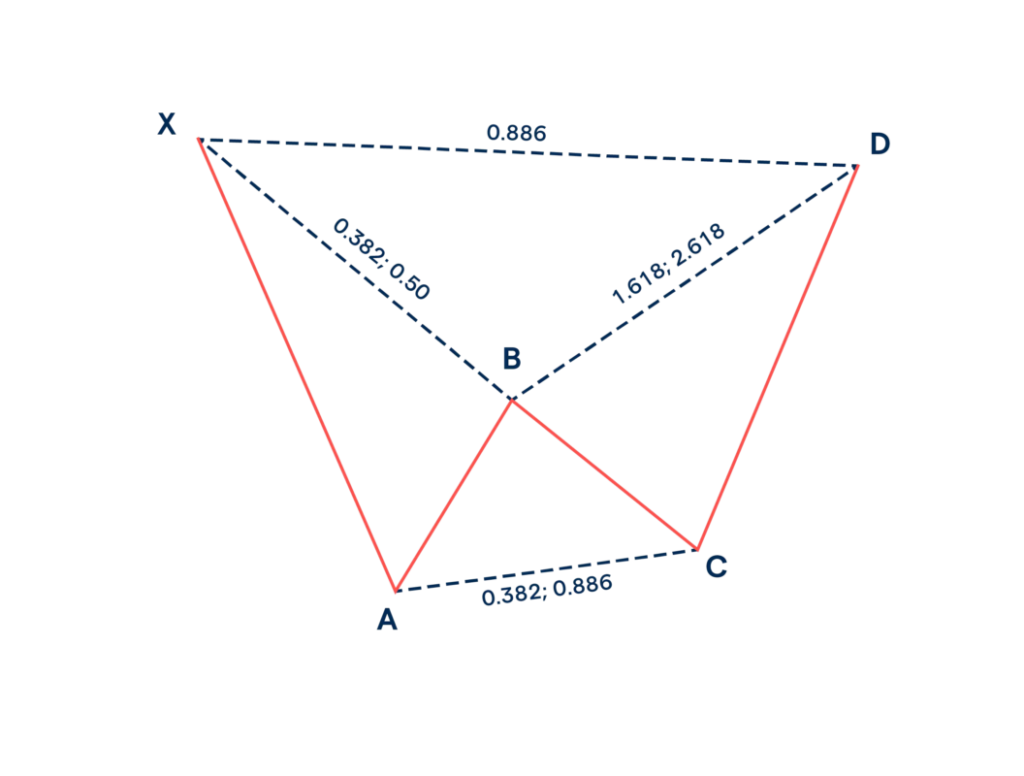

- BAT Pattern

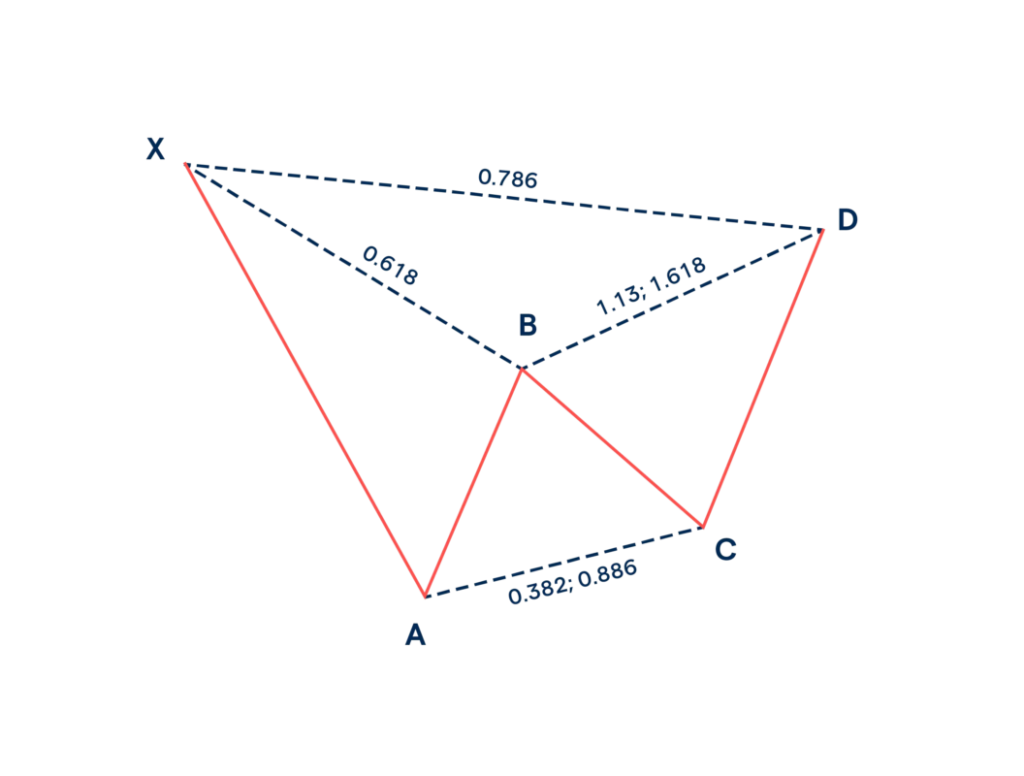

- Gartley Pattern

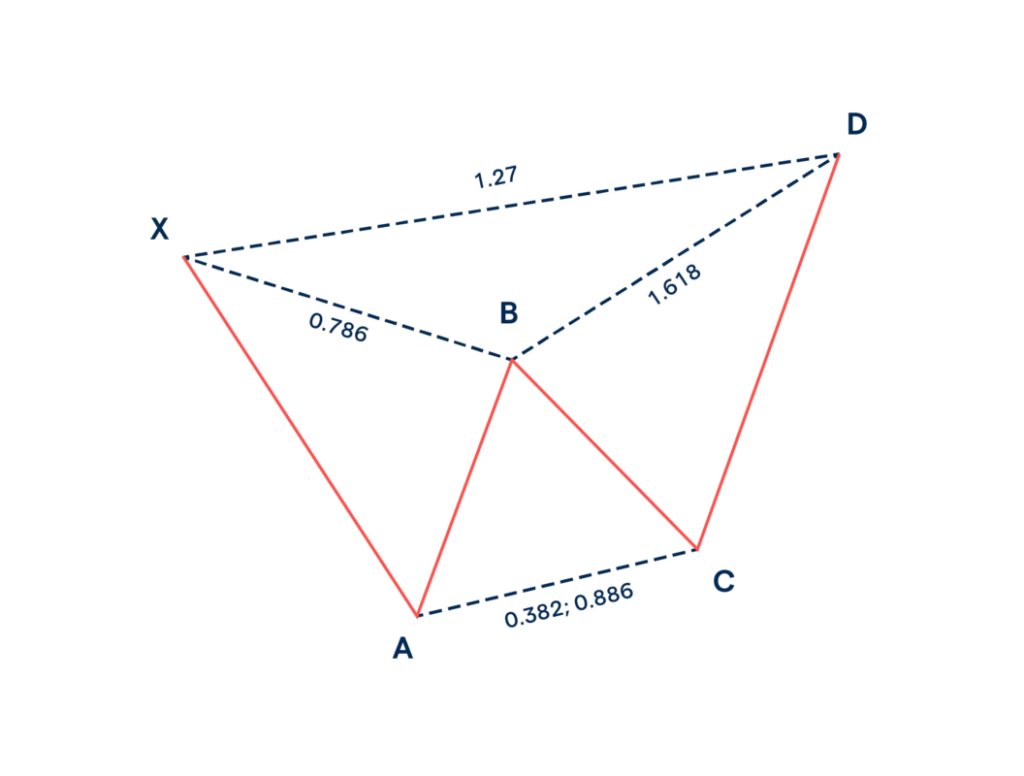

- Butterfly Pattern

- Crab Pattern

- Deep Crab Pattern

- Shark Pattern

Each pattern has unique characteristics that signal a potential reversal or continuation of the trend. For example, the ABCD pattern is simple but effective in indicating the possible end of the current trend.

Why are Harmonic Patterns Popular in Forex Trading?

Harmonic patterns are very popular among forex traders because of their adaptability to the rapidly changing dynamics of the foreign exchange market. When used correctly, these patterns can provide early warnings of conditions that might lead to price drops.

The accuracy of harmonic patterns in predicting price movements makes them a favorite among traders looking for tools to optimize their trading strategies. They provide insights based on historical data that can increase the chances of success in trading.

Start Trading with Harmonic Patterns

To start trading using harmonic patterns, the first step is to understand and identify them in a trading chart. This requires an understanding of how to apply Fibonacci numbers in different market contexts.

After identifying the pattern, traders should observe market conditions to determine if the pattern indicates a reversal or continuation of the trend. This allows for more strategic and data-driven decision-making in trading.

Conclusion

Harmonic patterns are an invaluable tool in every trader’s arsenal. By understanding and applying these patterns, traders can increase the probability of success in volatile markets. Learn and practice the use of these patterns to optimize trading strategies.

Also Read: 7 Facts How Ethereum Changed the World of Crypto & Cryptocurrency Over 10 Years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- IG. Top 7 Harmonic Patterns Every Trader Should Know. Accessed on August 1, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.