3 Surprising Crypto Recovery Trend Facts in 2025: Ethereum Soars, Bitcoin Falls Behind!

Jakarta, Pintu News – The crypto and cryptocurrency market in 2025 has shaken investors again with a surprising fact: the price recovery of Ethereum (ETH) has far outperformed Bitcoin (BTC) despite continued selling pressure in the range of USD 4,000 (equivalent to IDR 65,808,000).

This phenomenon sparked big questions among market participants, especially when Ethereum remained strong against massive profit-taking. This article reviews the reasons and key data behind ETH’s recovery, and why this trend could signal major changes in the global crypto ecosystem.

1. ETH bounces back amid big sell-off, Bitcoin slumps

In recent weeks, Ethereum (ETH) has managed to rebound faster than Bitcoin (BTC), even as selling pressure continues from large and institutional investors. Despite being stuck at the psychological level of USD 4,000 (equivalent to IDR 65,808,000), the price of ETH was able to survive and climb back above the major moving averages. Unlike Bitcoin, whose price has remained relatively stagnant despite having rallied earlier in the year, ETH has seen a solid price rally even when the crypto market has been sideways.

The constant selling pressure on ETH comes from wallet whales, exchanges, and derivatives market participants who sell ETH in large volumes. However, strong buying power from retail and institutional investors absorbed the supply. This signals an accumulation interest in ETH as one of the main assets in the cryptocurrency world, while also confirming the resilience of Ethereum’s fundamentals amid high volatility.

Also Read: 5 Shocking Predictions: Pi Network (PI) Price in August 2025, Potential to Soar or Plummet?

2. ETFs and New Fundamental Narratives Drive ETH

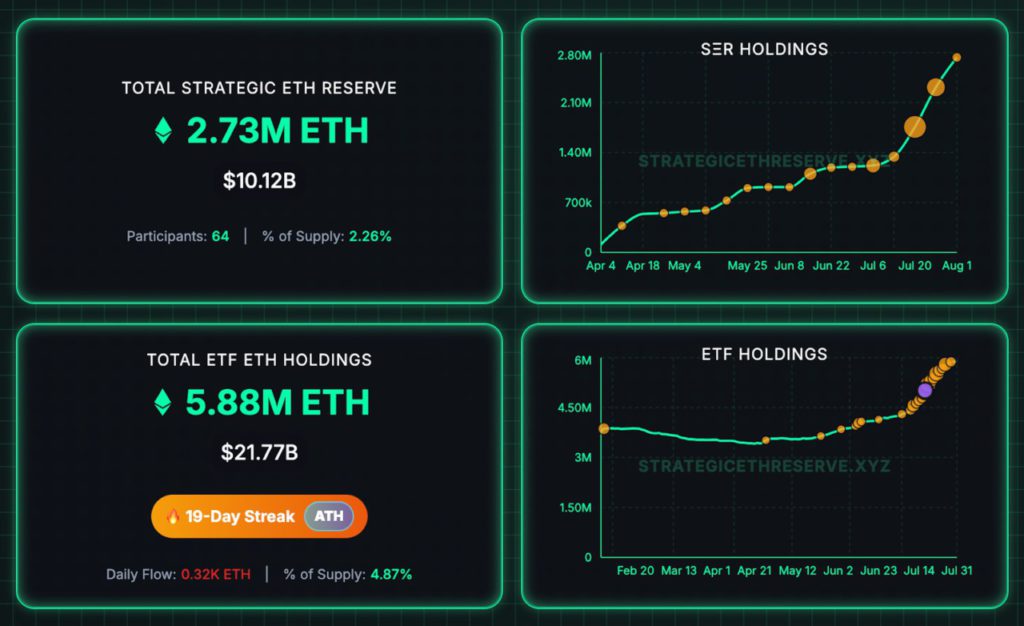

One of the main drivers behind ETH’s aggressive recovery is the high expectation of the launch of an Ethereum spot ETF in the United States. If this ETF is approved, institutional access to ETH will increase dramatically, potentially triggering new liquidity and significant price spikes. Market participants are comparing the impact of an ETH ETF to the previously successful Bitcoin (BTC) ETF that increased institutional interest in crypto.

On the other hand, the Ethereum ecosystem is thriving thanks to innovations in DeFi, NFTs, and tokenization of real-world assets. The use of ETH blockchain technology in real-world applications is expanding, and the “ultra sound money” narrative – due to the deflationary supply of ETH – is gaining traction. This combination of ETF factors, technology, and fundamental narratives is the main reason why Ethereum (ETH) could outperform Bitcoin (BTC) in this year’s crypto cycle.

3. Onchain Data and Market Sentiment Favor ETH Bullish Trend

Analysis of onchain data shows a huge spike in ETH transactions and an increase in new wallet activity on the Ethereum network. ETH’s weekly transaction volume rose significantly, even as selling pressure remained high. Many analysts think that this surge is a sign of capital rotation from Bitcoin (BTC) to major altcoins such as Ethereum (ETH) and Ripple (XRP), as the cryptocurrency market begins to look for new opportunities beyond Bitcoin’s dominance.

The crypto market sentiment is also driven by positive speculation regarding institutional adoption and potential ETF approval. With price conversion to rupiah, ETH’s psychological level of USD 4,000 equals around Rp65.8 million, making ETH even more attractive to domestic investors looking to diversify their cryptocurrency portfolio. Historical data also shows that ETH’s bullish momentum often marks the beginning of altseason, where other altcoins such as Pepe Coin (PEPE) also get a boost.

Conclusion

Ethereum’s (ETH) dominance in this year’s crypto price recovery trend is an important signal for investors and traders looking to capture momentum. While Bitcoin (BTC) remains the main benchmark, ETH’s surge driven by ETF accumulation, innovation, and sentiment confirms that the cryptocurrency landscape continues to evolve dynamically. With the right strategy and monitoring of market sentiment, Ethereum could become one of the most prospective assets throughout 2025.

Also Read: 7 Facts How Ethereum Changed the World of Crypto & Cryptocurrency Over 10 Years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. ETH recovery outpaces Bitcoin despite constant selling at $4K – Here’s why. Accessed August 1, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.