Ethereum Surges 3% Today — But Is a Drop Below $3,000 Looming?

Jakarta, Pintu News – Ethereum (ETH), the leading digital currency after Bitcoin (BTC), has experienced a significant drop from its July peak of $3,941.

Now, Ethereum (ETH) is under immense pressure with a potential drop below $3,000 in the coming weeks, triggered by several technical and on-chain indicators.

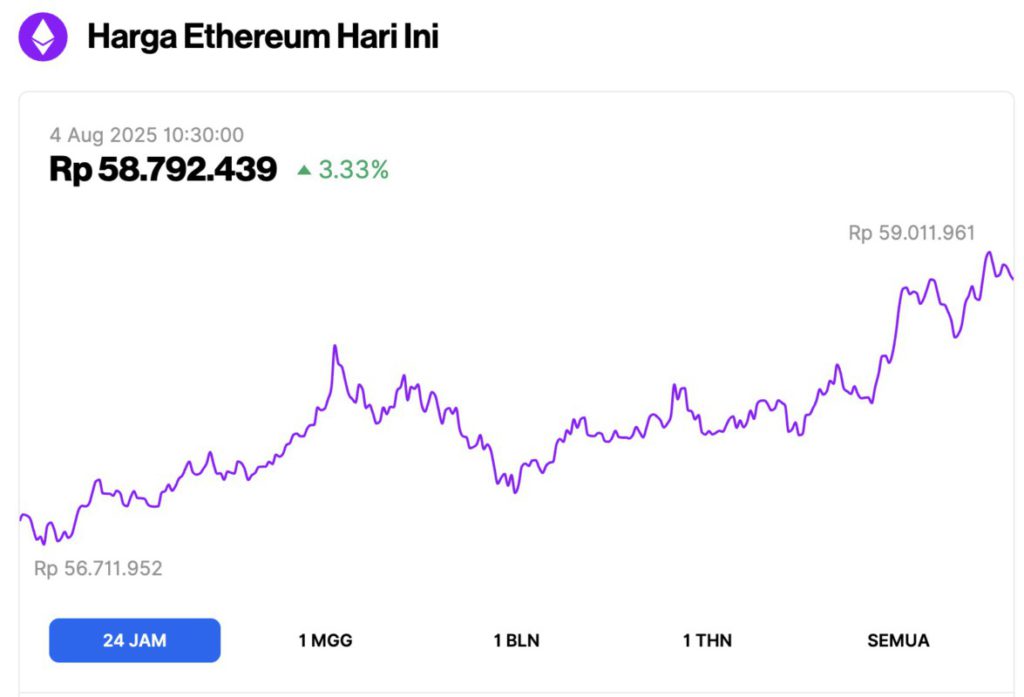

Ethereum Price Up 3.33% in 24 Hours

On August 4, 2025, Ethereum traded at roughly $3,560, or about IDR 58.79 million, marking a 3.33% gain in the past 24 hours. Over the same period, ETH swung between a low of around IDR 56.71 million and a high near IDR 59.01 million.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $429.88 billion, with daily trading volume dropping 30% to $21.7 billion within the last 24 hours.

Read also: Top 3 Crypto Coins to Hunt for August 2025!

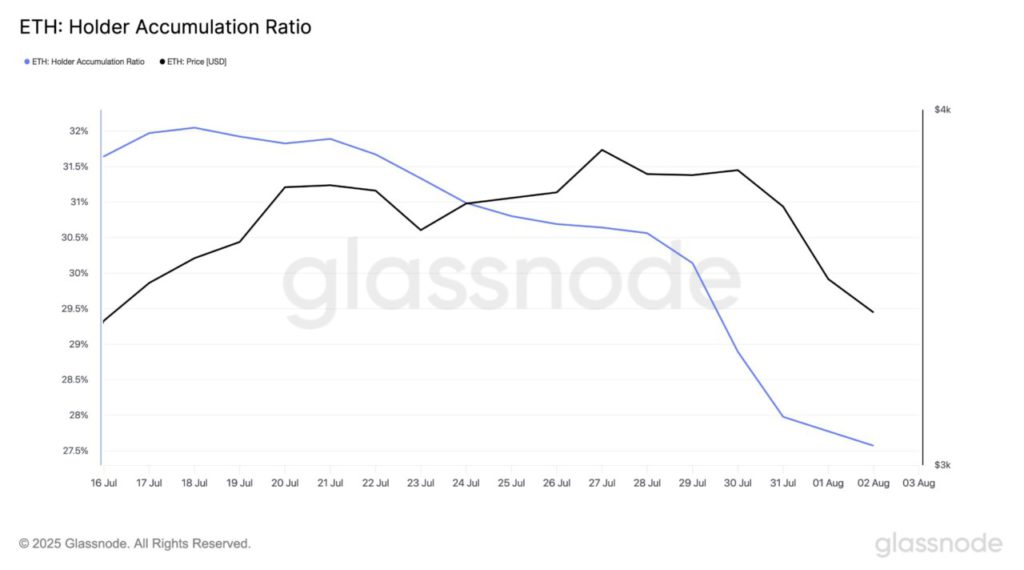

Decline in Accumulation and Bearish Signal

Data from Glassnode shows that the Ethereum (ETH) Holder Accumulation Ratio hit a two-month low of 27.57% last Saturday (Aug 2). This signals that investors are starting to be less aggressive in adding to their Ethereum (ETH) holdings.

This ratio measures the percentage of addresses that increased their Ethereum (ETH) balance compared to those that reduced or maintained their balance. When this ratio increases, it indicates accumulation behavior that usually occurs in bullish phases when confidence in future price growth is high.

However, a drop in the ratio as seen today indicates a decrease in conviction and an unwillingness to buy when prices drop. With reduced accumulation, Ethereum (ETH) lacks the buying pressure usually required to sustain a rebound.

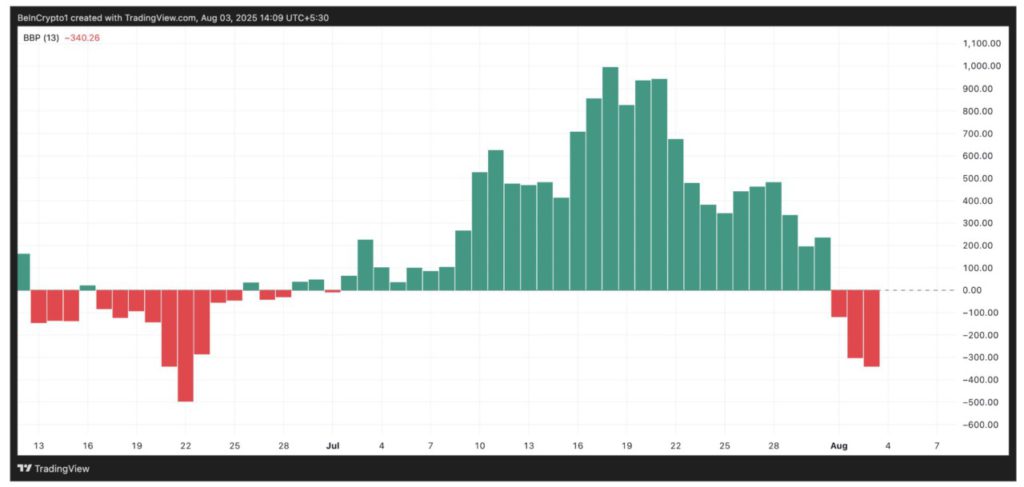

Elder-Ray Index Shows Bearish Dominance

The Elder-Ray Index for Ethereum (ETH) has shown red histogram bars over the past three trading sessions, confirming that bearish dominance has overruled the bulls.

Currently, the index stands at -342.73. This indicator measures the strength of bulls and bears in the market. When it produces green histogram bars, it indicates strong buyer dominance and increasing upside momentum.

Read also: Top 4 Crypto with Big Profits on the Horizon, According to Analysts!

Conversely, the bearish momentum grows as ever-expanding red bars appear, indicating that selling pressure is not only present but also increasing as the day progresses.

Potential Decline to $2,745

On August 3, Ethereum (ETH) briefly traded at $3,457, just below the key resistance level at $3,524. If accumulation continues to weaken, bearish momentum could drag the price down towards the next major support at $3,067.

If this support floor is broken, Ethereum (ETH) may slip further to test the $2,745 zone. Conversely, a new wave of demand could change sentiment and trigger a recovery.

In this case, Ethereum (ETH) might try again to break the $3,524 resistance. A successful breakout could pave the way for a longer rally towards the $3,859 level.

All in all, with various indicators pointing to further downside potential, investors and market watchers should be wary of Ethereum (ETH) price movements in the coming weeks.

Constant monitoring of technical and on-chain indicators will be essential to capture these fast-changing market dynamics.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. ETH Price at $3,000: Risk Accumulation Pattern. Accessed on August 4, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.