Ethereum (ETH) Surges 60%: Will August Bring Bigger Gains?

Jakarta, Pintu News – Ethereum (ETH) experienced significant gains in July, with a nearly 60% increase driven by record fund flows into ETFs and increased retail profits. On-chain and derivatives data shows strong accumulation by long-term holders and “whales”. More than 1 million Ethereum (ETH) has been withdrawn from centralized exchanges in the past two weeks, signaling that long-term holders are beginning to dominate.

Ethereum (ETH) Investor Profile Changes After July Hike

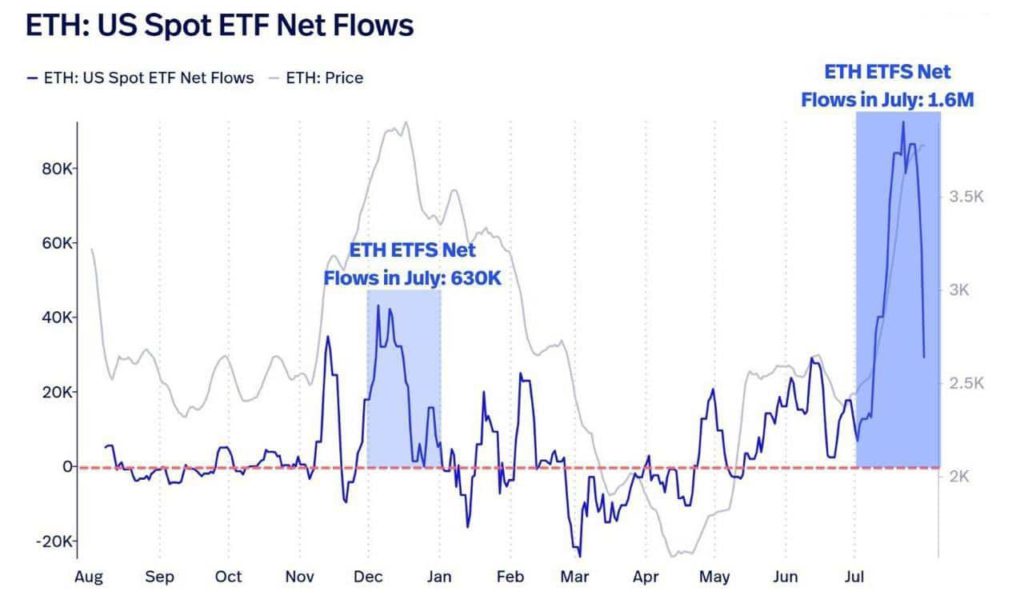

Ethereum’s (ETH) price rise in July not only boosted its position among the top crypto assets by market capitalization, but also changed investor dynamics. ETF net flows set a record with over 1.6 million Ethereum (ETH) in July. Meanwhile, retail investors started to secure their profits, which provided an opportunity for more stable investors to accumulate.

More than 1 million Ethereum (ETH) has been withdrawn from exchanges in the past two weeks, indicating strong long-term conviction. This massive withdrawal is a strong indicator that long-term investors are anticipating further price spikes.

Also Read: 5 Crypto that Can Bring Bigger ROI than Bitcoin: Analysts’ Picks?

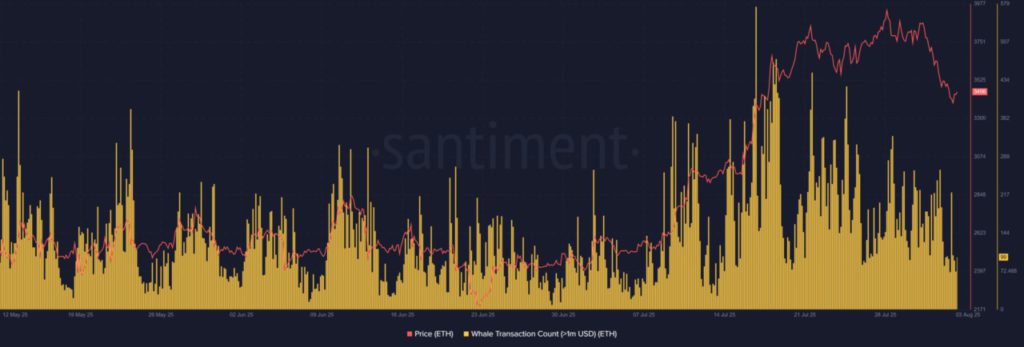

Whales on the Move as Market Structure Strengthens

During July, transactions worth over $1 million peaked in recent weeks, signaling interest from high net worth investors. This accumulation by “whales” coincided with the withdrawal of over 1 million Ethereum (ETH) from exchanges, confirming confidence in the market.

Meanwhile, Open Interest in Ethereum (ETH) Futures stands at around $22.4 billion, with a stable Funding Rate at around 0.0049, according to data from Coinalyze. This suggests that despite the correction, interest in Ethereum (ETH) derivatives remains strong.

Momentum Slows, But Ethereum (ETH) Remains Stable

Although Ethereum’s (ETH) momentum has slowed since its July surge, the price is trying to stabilize above the $3,450 mark. The Relative Strength Index (RSI) is at 52.41, a neutral zone.

Meanwhile, the Moving Average Convergence Divergence (MACD) showed a bearish crossover, but the declining red histogram bars indicated that the selling pressure is starting to weaken. This consolidation phase could be a launching point if buyers regain their strength. With the broader market sentiment and on-chain signals still trending positive, Ethereum (ETH) has the potential to rally again.

Conclusion

With all the indicators and market movements taking place, investors and market watchers will continue to monitor Ethereum (ETH) to see if this positive trend will continue into August. Whether this is the start of a bullish trend or just a temporary uptick, time will tell.

Also Read: 5 Crypto Ready to Pump After Bitcoin Consolidates in August 2025, Don’t Miss Out!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum rallies 60%, has its best month in years; will August bring more gains?. Accessed on August 4, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.