Solana Is Getting Scooped Up at Bargain Prices — Could a Major Rebound Be Next?

Jakarta, Pintu News – Popular altcoin Solana (SOL) appears to be struggling to maintain its upward momentum since reaching a cycle high of $206 on July 22.

In just the past week, it has already fallen about 14%, reflecting a decline in short-term investor confidence.

However, on-chain data suggests that the coin could potentially experience a recovery in the near future. Early signs indicate a shift in sentiment that could trigger a rebound in the upcoming trading sessions.

Long-term holders start accumulating Solana

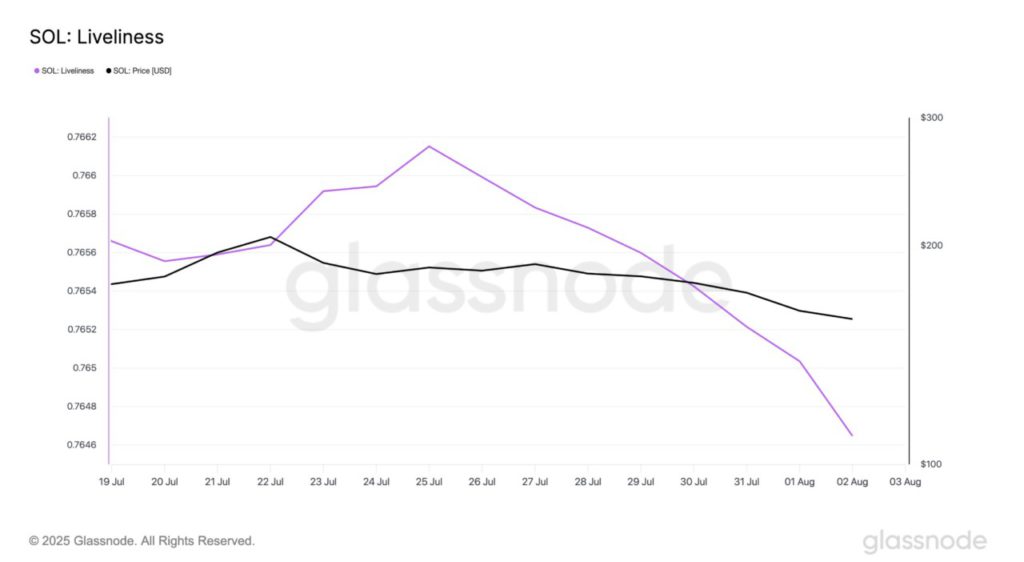

While short-term traders continued to sell their holdings,long-term holders ( LTHs) re-entered the accumulation phase. This change in behavior is evident from the consistent decline in Solana Liveliness since July 25.

Read also: Will Bitcoin Crash to $100,000? Arthur Hayes Shares His Prediction

According to Glassnode, this metric-which monitors the movement of previously inactive tokens-dropped to a weekly low of 0.76 yesterday. This confirms the reduced sell-off of SOL LTHs.

The Liveliness metric tracks the movement of long-stored tokens by calculating the ratio of coin days destroyed to total coin days accumulated. If the number rises, it indicates more old tokens are being moved or sold, usually indicating profit-taking by LTHs.

Conversely, as is the case with the SOL, when this metric falls, it means that those investors are removing assets from the exchange and choosing to hold their holdings.

Holder Net Position Change Solana Naik

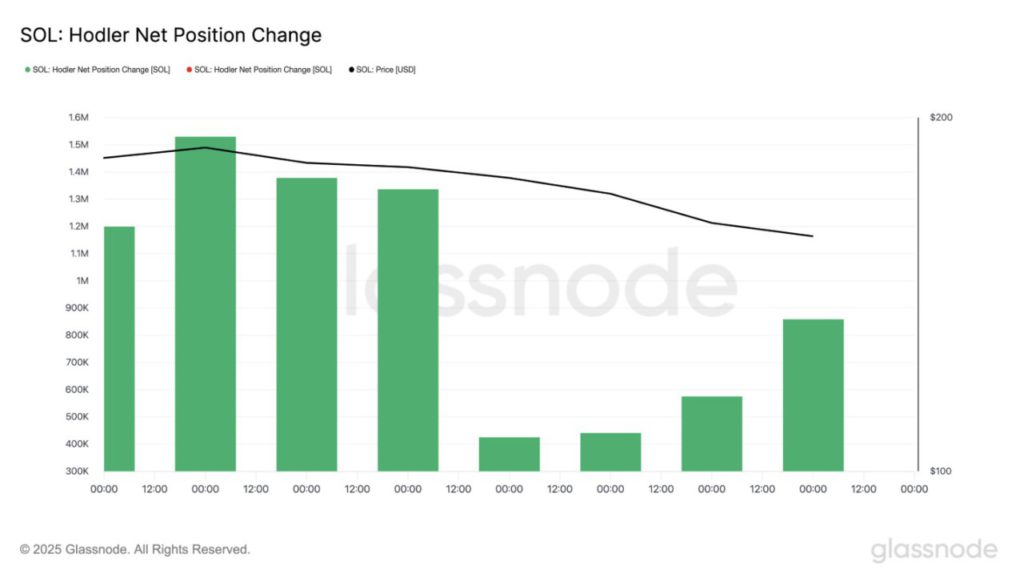

Moreover, since July 30, SOL’s Hodler Net Position Change has shown a consistent rise. This confirms that more coins are being moved into long-term storage, despite the sluggish price movements of these assets.

Glassnode data shows that this metric-which measures the change in 30-day supply held by long-term holders(LTHs)-jumped by 102% in the last four days.

When this metric goes up as it is now, it signals that LTHs prefer to increase their holdings of coins rather than sell them.

Solana Traders Sell Loss – Is Bottom Starting to Form?

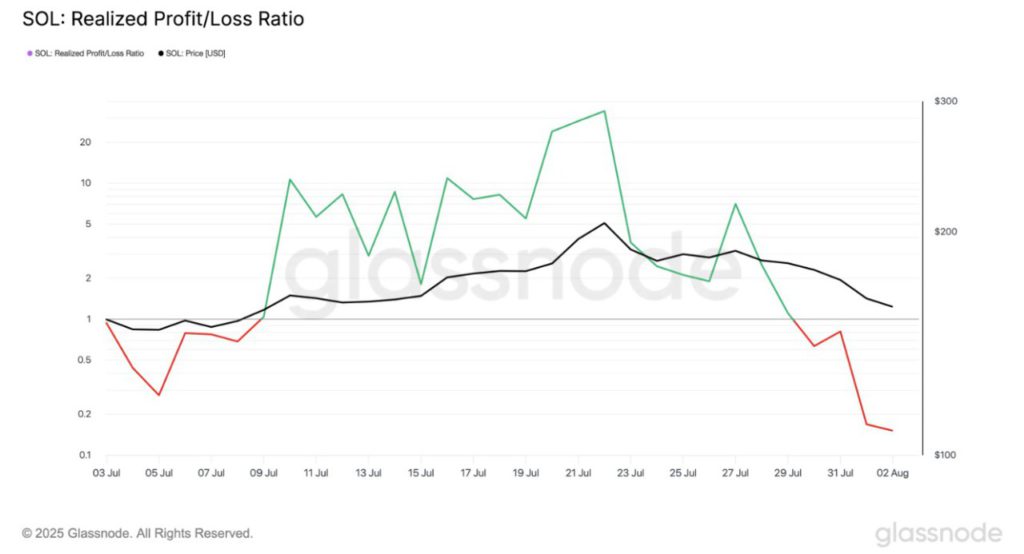

The continued decline in SOL’s Realized Profit/Loss Ratio supports the bullish outlook previously mentioned.

On-chain data shows that this metric closed at a 30-day low of 0.15 on August 2, signaling many traders who exit positions are still doing so at a loss.

Historically, markets tend to stabilize when most participants sell below their cost of capital.

Read also: 3 Tokens that Investors Will Hunt for Besides XRP!

With fewer holders willing to offload their tokens at a loss, selling pressure could ease. This opens up opportunities for SOL to find a local bottom before bullish catalysts emerge that could potentially trigger a rebound.

Solana at the Crossroads, Support at $158.80 Tested

On August 3, Solana (SOL) briefly traded at $160.55, still holding above the key support floor of $158.80.

If buying pressure increases, Solana (SOL) could initiate a bullish reversal and move towards $176.33.

However, if the selling continues and the support floor weakens, the price of Solana (SOL) could drop to $145.90. This situation puts Solana (SOL) in a critical position, where any further price movements will be heavily influenced by market dynamics and investor sentiment.

Overall, with strong indications of long-term holders accumulating again and on-chain data showing loss-making sales, there is great potential for Solana (SOL) price recovery in the near term.

Investors and market watchers should constantly monitor these indicators to make informed investment decisions amidst high market volatility.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. SOL Price Slips as Long-Term Holders Keep Buying. Accessed on August 4, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.