Bitcoin Holds at $114K as Analysts Eye a Potential Surge to $124K

Jakarta, Pintu News – Bitcoin (BTC) price opened the week at $114,505 on Monday, August 4. Throughout the weekend, BTC barely left a gap on the CME exchange, so there is still a chance for the price to recover.

Some analysts predict prices will soon face resistance levels, and potentially even break $124,000, as the likelihood of the Federal Reserve cutting interest rates in September increases.

Then, how is the current Bitcoin price movement?

Bitcoin Price Drops 1.07% in 24 Hours

On August 5, 2025, Bitcoin was trading at $114,341, roughly IDR 1,870,137,212, after slipping 1.07% in the past 24 hours. During that period, BTC dipped to an intraday low of IDR 1,869,794,654 and climbed as high as IDR 1,898,608,205.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.27 trillion, with trading volume in the last 24 hours rising 13% to $54.39 billion.

Read also: Ethereum Climbs to $2,600 — Could $4,000 Be the Next Stop?

Bitcoin Price Poised for Recovery

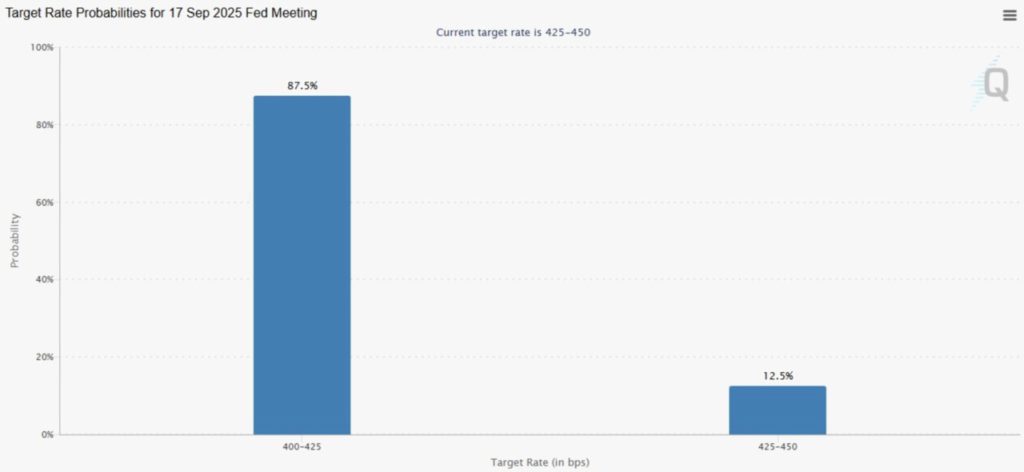

The chances of the Federal Reserve cutting interest rates next month are increasing. Data from CME FedWatch shows that 87% of investors believe there will be an interest rate cut of 25 basis points. If it does happen, the new interest rate will be in the range of 4% to 4.25%.

The last time the Fed cut interest rates was in December 2024. Usually, when interest rates are cut, investors’ risk appetite increases. The value of the dollar tends to weaken, but investors see this move as a positive signal for the economy.

Under these conditions, the Bitcoin price has the potential to experience a significant rally in September. In fact, this rally could start a few days before the Fed’s meeting on September 17, as traders often buy in advance so that when the decision is announced, the market has already “priced in” the effect.

Therefore, while BTC prices are currently falling, this weakness is likely to be temporary. Analysts also seem optimistic, with many speculating on how high the “crypto king” could soar.

BTC recovery on the horizon, analysts predict $124,000 breakthrough

Renowned analyst Crypto Raven predicts the price of Bitcoin (BTC) could potentially reach $124,000.

Read also: Which Crypto to Buy Today: SUI, LINK, and XLM, Ready to Rocket in August?

He bases his projections on the volume profile, which is the area where trading activity is highest and is often a “magnet” for price movements, both up and down.

According to Raven, in the short term, Bitcoin price is likely to drop first to the range of $110,000 to $112,000, before starting to bounce upwards. He places the resistance level at $118,000, which could later become a “stepping stone” towards the $124,000 target.

This optimism does not only come from Raven. Daan Crypto also thinks that the current price drop is a normal pattern that often occurs at the beginning of the month. In his post on X, he stated:

“Most likely we will see a big move this month… In a long-term uptrend, there is usually a short dip at the beginning of the month before prices resume rising.”

Both analysts emphasize short-term projections, but Bitcoin’s price prediction for 2025 indicates the potential for bigger gains towards the end of the year.

In short, the next six weeks could be a very interesting period for Bitcoin. If the Fed does cut interest rates as many expect, it’s not impossible for BTC to push towards $124,000.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price Prediction As September Rate Cut Odds Soar to 87% – Analysts Eye $124K Next? Accessed on August 5, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.