Whale Locks 3.3 Million Pi Network Coins in 24 Hours, Daily Unlocks Drop Drastically!

Jakarta, Pintu News – Pi Network recently recorded a significant increase in the number of token keys by its users.

As of August 4, more than 3.3 million PI tokens had been locked, demonstrating strong confidence in the network’s long-term vision. A drop in the number of tokens unlocked daily from 9 million to less than 5.9 million also adds to the interesting market dynamics.

Token Key Demonstrates Belief in Pi Network’s Long-Term Vision

The latest data from the Pi Network community shows that a total of 3,349,768 PI tokens, or about 0.13% of the total circulating supply, have been locked for periods of two weeks or more.

Read also: 3 Altcoins Rumored to be Listing on Binance

This suggests that Pioneers, as Pi Network users are known, would prefer not to sell the tokens they have been mining for years at prices below $0.4.

Instead, many of them are hopeful that Pi Network will achieve significant real-world usage. Although Pi Coin experienced a sharp price drop in early August, reaching a new low of $0.32, the price later recovered slightly to $0.36.

As of August 4, Pi Coin is trading around $0.32 as the support level and $0.40 as the resistance level. The market is still in a bearish state, but the token’s key action could be an early indicator of recovery.

Technical Challenges and Price Pressure

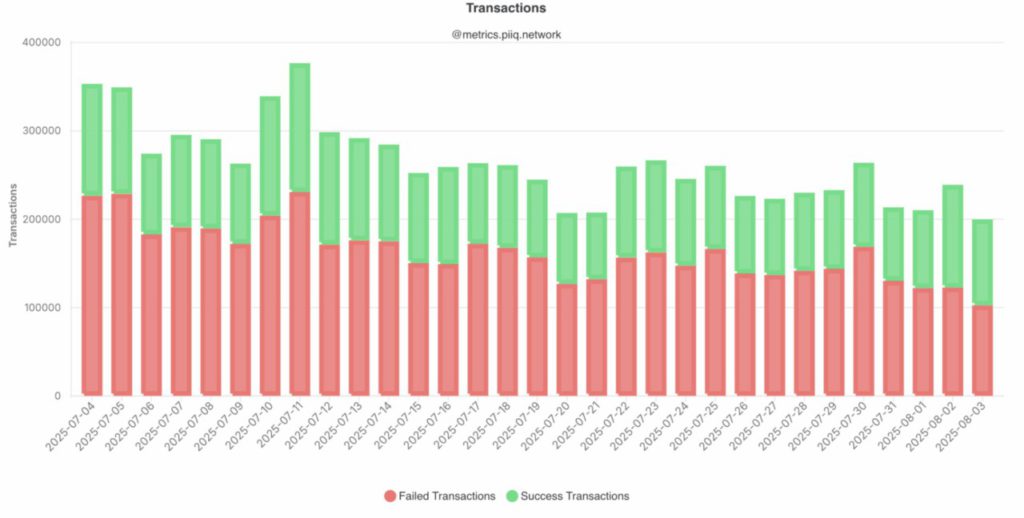

Pi Coin faced significant technical challenges, mainly related to the high number of failed transactions.

According to data from PiDoor, approximately 102,604 out of 200,000 daily transactions failed, with the failure rate reaching 53%. The decrease in the number of transactions from July to August also indicates a possible decrease in user interest in the platform.

Pi Coin’s price as of August 4 was at $0.3553, down 4.59% in a day. In addition, the decrease in the number of tokens opened each day to less than 5.9 million indicates that fewer liquid tokens are entering the market each day.

If demand increases, this reduction could lead to upward price pressure and help control inflation.

Read also: Whale Pi Network Raids 331 Million Pi Coin: Is This a Bullish Sign?

Bitget Promotion and Network Enhancement

Bitget, a crypto exchange, is running a promotion for Pioneers who deposit Pi Network tokens. The aim is to increase liquidity and support the market.

Some Pioneers argue that new token keys and network upgrades could pave the way for a Pi Network revival.

In addition, market analysis by Coingape shows that the Pi Coin price has potential for recovery due to the formation of widened bollinger bands. The whales seem to be buying at the low point, with on-chain activity showing massive purchases of 350 million PI tokens.

However, predictions of a Bitcoin (BTC) price drop by Robert Kiyosaki and Arthur Hayes could affect the price of Pi Coin in the future.

In conclusion, with the various dynamics taking place in Pi Network, the market seems to be divided. Despite technical challenges and price pressure, new measures such as token locks and promotions by Bitget give hope for a recovery.

However, it is important to monitor the influence of the broader Bitcoin (BTC) market, as these fluctuations can have a significant impact on all crypto assets, including Pi Coin.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Whales Lock 3.3M Pi Coins in 24 Hours as Daily Unlocks Drop from 9M Tokens to 5.9 Million; Recovery Ahead. Accessed on August 5, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.