Pi Network Slides 4% Today — What’s Next for Pi Coin?

Jakarta, Pintu News – PI Network token plummeted to a new record low on August 1 and has since entered a consolidation phase, with near-stagnant price movements.

These sluggish market conditions reflect investor confusion, where traders are still waiting for the next big move that could determine the PI’s next direction of travel.

Pi Network Price Drops 4.6% in 24 Hours

On August 6, 2025, the price of Pi Network was recorded at $0.3405, a decrease of 4.6% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,374), then 1 Pi Network is IDR 5,575.

Read also: Mysterious Whale Bought 350 Million Pi Network Tokens, What Happened?

During the last 24-hour period, the PI price moved in a range of $0.34 to $0.357. This decline also reduced the market capitalization to around $2.65 billion, while the fully diluted valuation is in the range of $4.08 billion.

The last 24 hours’ trading volume was recorded at $53.8 million, with 7.78 billion PIs outstanding out of a total supply of 11.97 billion PIs.

PI Prices Trapped Between Fear and Hope

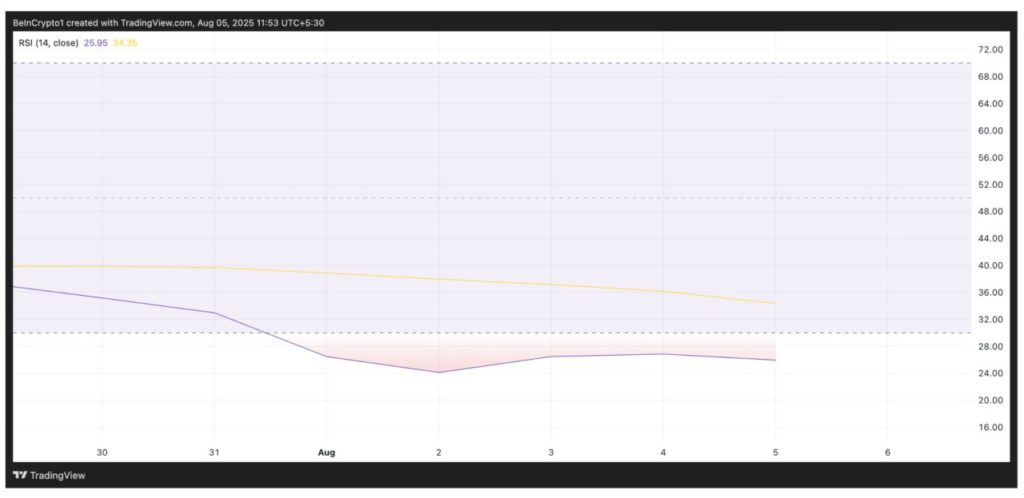

Reporting from BeInCrypto (5/8), technical indicators on the PI/USD daily chart confirm this stagnation condition.

For example, PI’s Relative Strength Index (RSI) has been flat since the sideways trend started, signaling a relative balance between buying and selling pressure in the market.

RSI is an indicator that measures the overbought and oversold condition of an asset. The value scale is in the range of 0 to 100.

Values above 70 indicate the asset is in an overbought area and has the potential to correct downward, while values below 30 indicate oversold and the possibility that prices could rebound.

When the price movement is flat like this, it means that there is a tug-of-war between buyers and sellers, where neither side is strong enough to push the price up or down significantly.

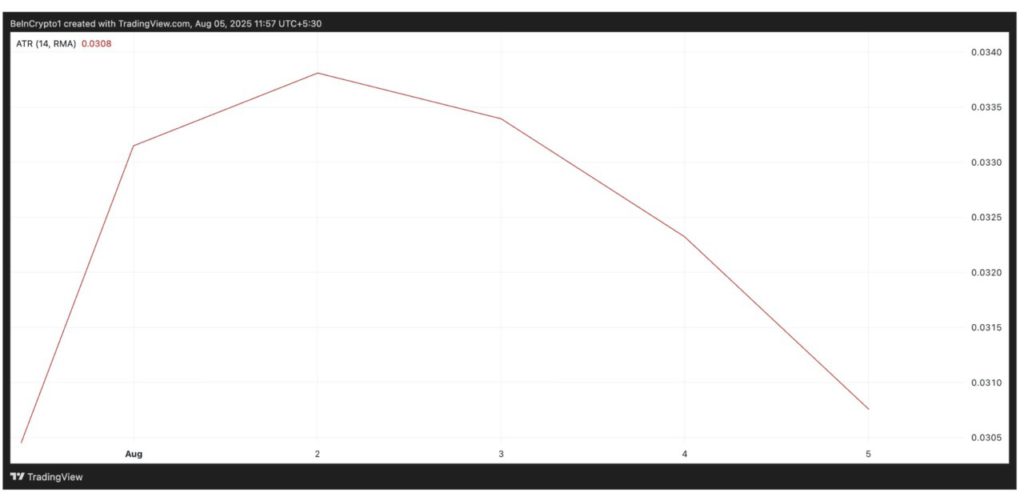

In addition, the Average True Range (ATR) of PI has also been steadily declining since August 2, confirming the market confusion. Currently, the ATR is at 0.03.

ATR is an indicator that measures the level of price volatility in a given period. A decrease in ATR indicates less volatility, where price changes become smaller and less frequent.

Read also: Dogecoin Tanks 5% Today — But Could a 2024 Rally Pattern Send DOGE Back Toward $0.50?

This is common in consolidation phases, when the market is waiting for the breakout moment that determines the next trend direction. For traders, this is a period of uncertainty, where there is little commitment to enter the market.

PI Moves in a Narrow Range, Ready to Break Out in a New Direction-But Where?

PI buyers seem hesitant to enter the market, worried that the price could still drop further, especially as the project continues to unlock new tokens.

According to PiScan data, in the next 30 days there will be 166.21 million PI tokens released to the market, worth approximately $59 million at current prices.

If the surge in supply from the unlocking process continues to suppress market sentiment, PI prices could break the lower boundary of its range and retest the all-time low of $0.32.

However, upside opportunities remain if new demand emerges. In this scenario, PI prices could potentially rise to the $0.44 area.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. PI Network Struggles at New Low as Market Awaits Its Next Major Shift. Accessed on August 6, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.