Ethereum Edges Up to $3,600 — But Why Are the Big Players Pulling Back?

Jakarta, Pintu News – Over the past two weeks, the overall crypto market has performed sluggishly, keeping Ethereum’s (ETH) movement confined within a narrow range.

Since July 21, the altcoin has repeatedly tried to break through the resistance level around $3,859, but it has remained stuck and found support around $3,524.

With momentum starting to fade, a number of key on-chain metrics now indicate that ETH is likely to experience a prolonged flat consolidation phase, or even a potential further price drop.

Then, how is the current price movement of Ethereym?

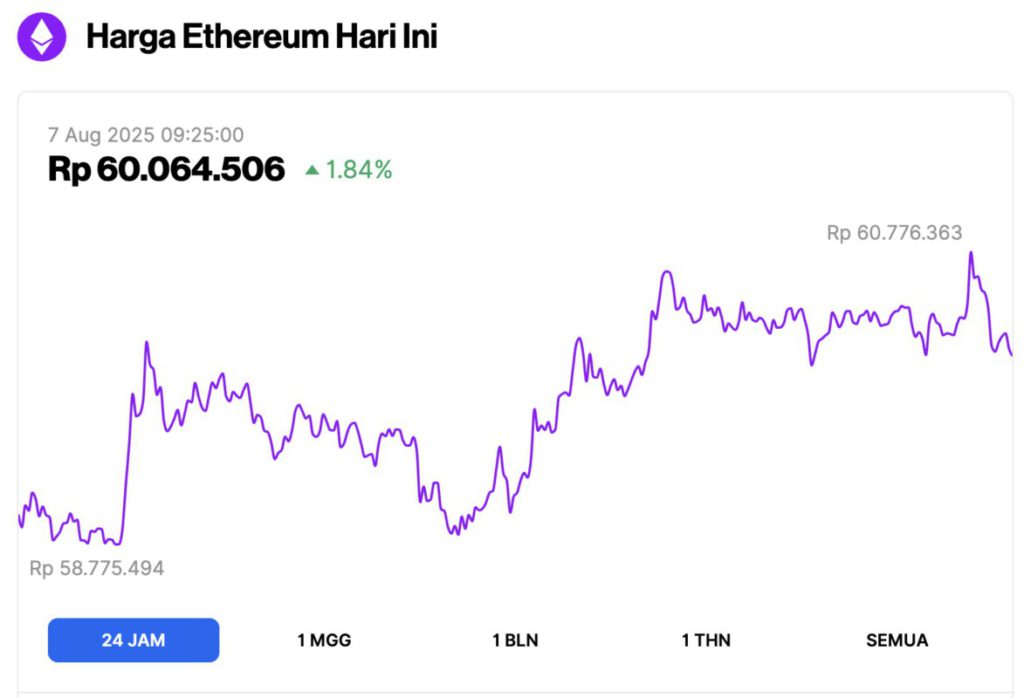

Ethereum Price Up 1.84% in 24 Hours

On August 7, 2025, Ethereum was trading at around $3,660, or approximately IDR 60,064,506, marking a 1.84% increase over the past 24 hours. Throughout the day, ETH hit a low of IDR 58,775,494 and climbed to a high of IDR 60,776,363.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $441.97 billion, with daily trading volume falling 20% to $25.61 billion within the last 24 hours.

Read also: Bitcoin Hits $114K — Is a Drop to $95K Next, or Will It Rally to $119K?

Ethereum’s Big Players Begin to Retreat

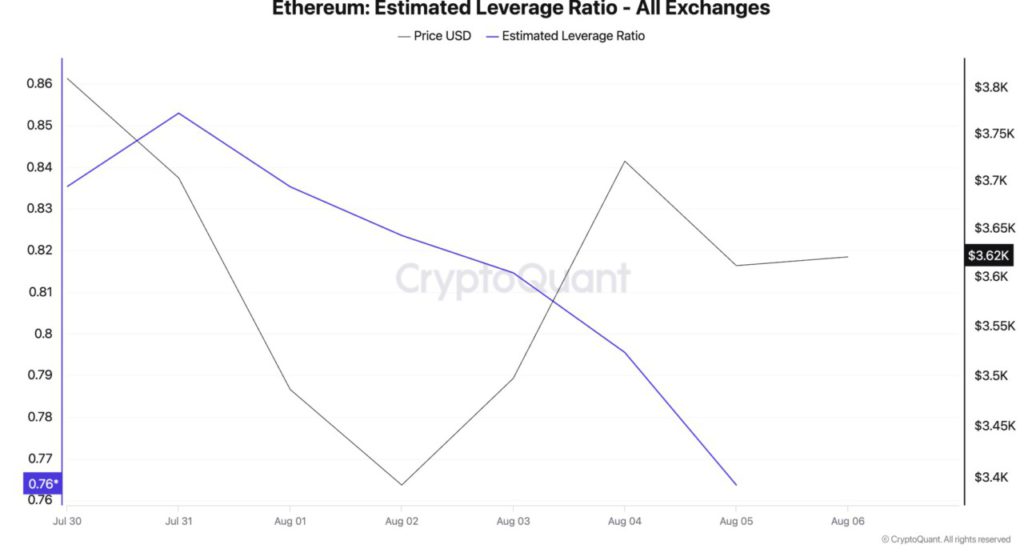

According to data from CryptoQuant, Ethereum’s declining estimated leverage ratio (ELR) across crypto exchanges reflects falling investor confidence as well as lower risk appetite from futures traders. Currently, ETH’s ELR is at a weekly low of 0.76.

ELR is a metric that measures the average leverage used by traders when making asset trades on crypto exchanges. It is calculated by dividing the open interest of the asset by the amount of asset reserves held by the exchange.

ETH’s ELR decline indicates market conditions where traders are reluctant to take highly leveraged positions. Investors are becoming cautious about ETH’s short-term prospects and are avoiding positions that could increase potential losses.

If this downward trend in speculative activity continues, the likelihood of a price breakout in the near future will become smaller, and ETH could potentially remain in a narrow price range.

Whale Accumulation Activity Declines

Not only that, the accumulation activity of ETH whales also decreased in the past week, most likely because they started to realize profits.

Based on data from IntoTheBlock, netflows from large holders of ETH fell by 224% in the past seven days, signaling the retreat of large investors from the ETH market.

Read also: Shiba Inu Whale Transactions Increase, Crypto Analysts Predict SHIB to Rally?

A whale is a wallet address that controls more than 0.1% of the total coin supply in circulation. Their netflow measures the difference between the amount of coins they buy and sell in a given period.

If netflows increase, it means that whales are buying more coins – usually as a signal they anticipate a price increase.

Conversely, as is the case with ETH right now, a decrease in netflows indicates increased selling activity and a tendency to take profits.

Bull vs Bear Battle: Will the $3.524 Level Hold or Break?

The aforementioned data points to declining confidence in the potential upside of ETH prices in the short term. Large holders also appear reluctant to allocate large capital to the market at this time.

If this condition persists, selling pressure on ETH could increase, which could eventually trigger a break of important support at $3,524.

If this support is broken, ETH prices could potentially drop further to the $3,067 range. However, if the bulls take back control, they could push the price through the resistance level at $3,859.

If successful, ETH has a chance to return to trading above $4,000.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Why ETH Price Rally Is on Hold. Accessed on August 7, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.