Is the Era of Bitcoin’s Rise Over? Check out the latest analysis!

Jakarta, Pintu News – In recent times, Bitcoin (BTC) has reached new record high prices, but there are indications that the bullish trend may be starting to fade. CryptoQuant analyst Maartunn has issued a detailed analysis of the current state of the Bitcoin market. This analysis includes the dynamics of selling by long-term holders and the late intervention of retail buyers into the market.

Sales by Long-term Holders

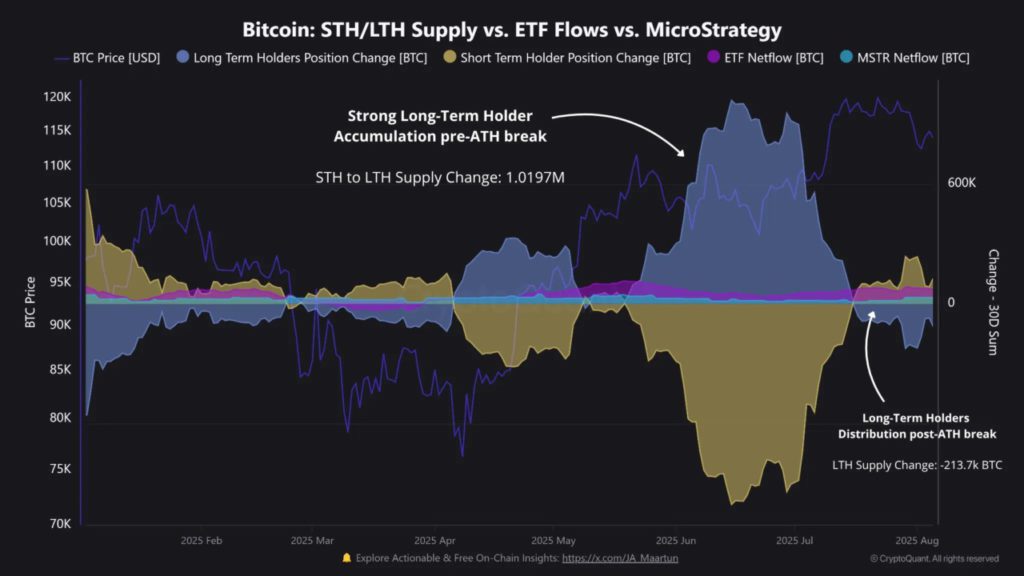

Maartunn highlighted that long-term holders started selling their assets at the peak of market strength. This can be seen in the movement of ancient wallets that have transferred around 80,000 BTC after being inactive for approximately 14 years. This behavior created significant selling pressure in the market, which could be an early indication of a change in the Bitcoin market trend.

This selling behavior is not only limited to large entities, but also reflects the general sentiment among long-term Bitcoin holders. This activity suggests that there may be a tendency to secure profits given the upcoming market uncertainty. This is a critical moment that could determine the direction of Bitcoin price in the coming months.

Also Read: XRP 2026 Price Prediction: Potential to Touch $10, Solana the Main Challenger? Here’s the Analysis!

Retail Buyer Intervention and Corporate Support

On the other hand, retail buyers started entering the market after Bitcoin reached its all-time high (ATH) at $123,000. However, they seem to be too late as the momentum has started to wane with the current price ranging between $113,000-$115,000. Although there is support from corporate buying by companies such as Strategy and Metaplanet, this is not enough to keep Bitcoin at the $120,000 price level.

These purchases, while significant, have not been enough to stabilize prices amid mounting selling pressure from short-term holders and fund withdrawals from listed products such as ETFs. This suggests that the market may be entering a more volatile phase, where price support could be more difficult to maintain in the absence of significant new capital flows.

Technical Analysis and Future Projections

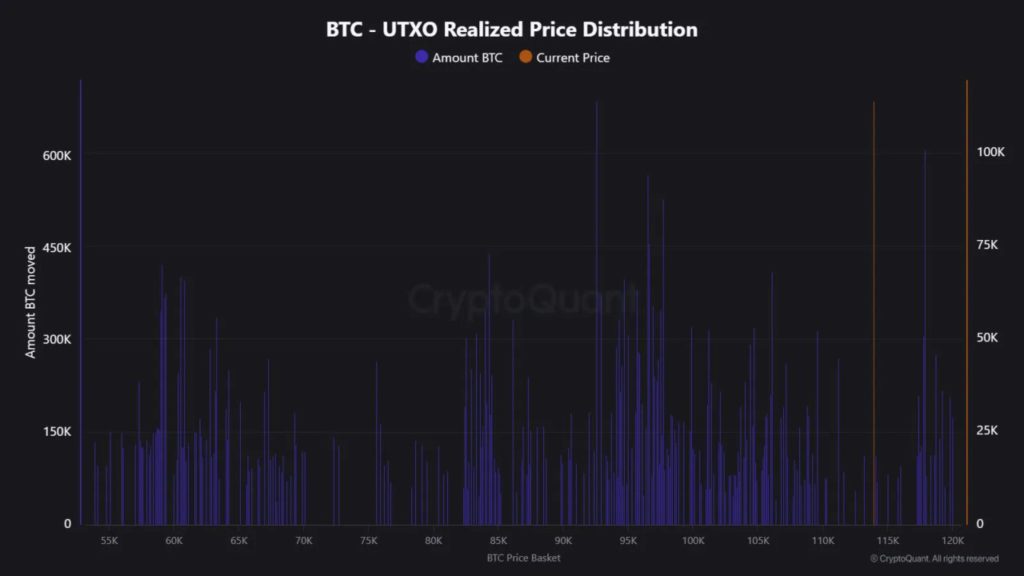

From a technical perspective, Maartunn points out that Bitcoin is currently finding support around the previous breakout zone, which is around $112,000. This corresponds to the chart structure and on-chain price distribution, which shows strong support in the $108,000-$112,000 range. This area is important because it is the point where a large volume of coins last changed hands.

However, if Bitcoin fails to maintain this support and the price falls below $112,000, it could signal a significant change in market behavior. For now, Maartunn considers the current price drop as a normal post-ATH drawdown. However, failure to hold this support could mean the beginning of a larger trend change.

Conclusion

With various dynamics at play, the Bitcoin market is currently at a crossroads. Long-term investors’ decision to take profits and increased activity among retail buyers point to a critical period for Bitcoin. Going forward, close monitoring of price support and investor behavior will be key to understanding Bitcoin’s future direction.

Also Read: Dogecoin Rises 3.5% Amid Death Cross Pattern, What Does It Mean for the Crypto Market? (7/8/25)

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Bull Run Already Over? Whales Bailing. Accessed on August 7, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.