Bitcoin Sideways at IDR 1.8 Billion, Why is the Crypto Market Down Today (8/7/25)?

Jakarta, Pintu News – Bitcoin (BTC) price is observed to move sideways in the range of Rp1.8 billion as of August 7, 2025, after experiencing corrections in recent days. The global crypto market capitalization has also shrunk sharply, with weakness touching various major assets including Ethereum (ETH) and Ripple (XRP).

This pressure was driven by a combination of macroeconomic factors, such as weak US economic data, a strengthening dollar, as well as investor concerns over the direction of interest rate policy. So, what exactly caused the crypto market to weaken today?

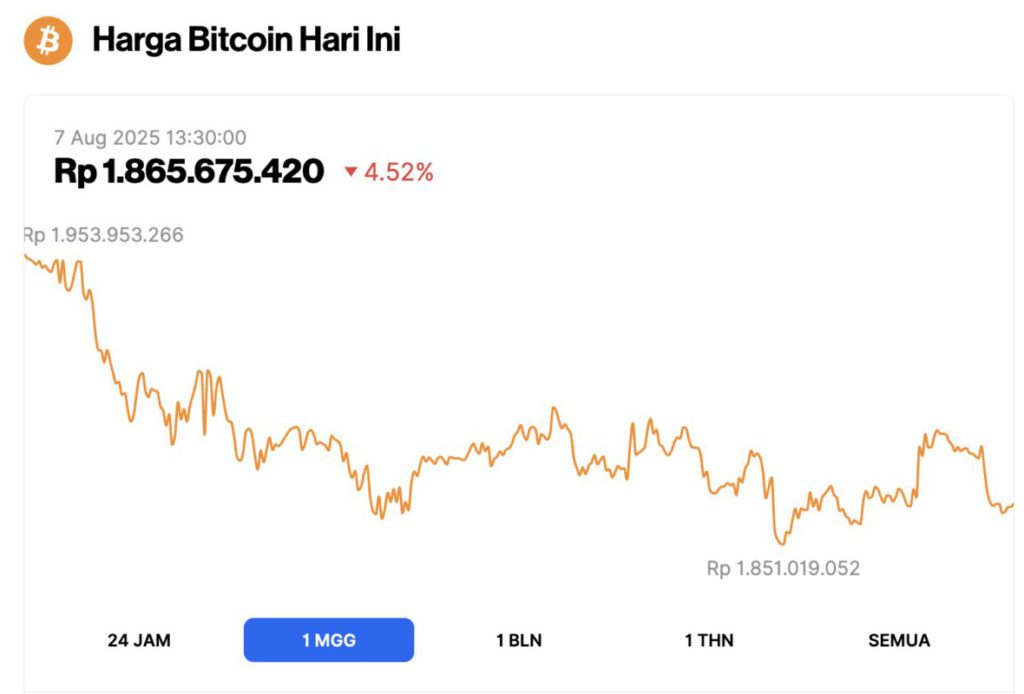

Bitcoin (BTC) price drops 4.52% in 7 days

As of August 7, 2025 at 13:30 WIB, the price of Bitcoin (BTC) was recorded at Rp1,865,675,420, a decline of around 4.52% in the past week.

The chart shows a fairly consistent downward trend since the beginning of the period, from a high of around Rp1,953,953,266 to a low of around Rp1,851,019,052. After the initial decline, the price movement seems to be flat with some fluctuations up and down in a narrow range.

In general, weekly movements reflect market adjustments, with a tendency to consolidate at current price levels. These price changes can be influenced by a variety of factors, including global market dynamics, investor sentiment, as well as developments in the cryptocurrency ecosystem as a whole.

Read also: Standard Chartered Supports Ethereum Treasury Companies Over Spot ETFs, Why?

Bitcoin fails to break resistance, downside risks increase

Bitcoin (BTC) is currently trading at around US$113,476 or equivalent to Rp1,852,259,044, failing to break through strong resistance at the US$115,000 level. The Parabolic SAR technical indicator shows a downward signal, with the position of the indicator dots above the price candlestick – indicating that the bearish trend is still dominant.

If the selling pressure continues, analysts predict BTC could test the next support at US$111,187 (around Rp1,813,879,653), which is also a monthly low. Failure to defend the US$114,500-116,000 zone also increases the risk of further decline in the near future.

Read also: MetaMask and Stripe Prepare to Launch mmUSD Stablecoin, What’s the Project Like?

Economic Data Weakens, Dollar Strengthens, Crypto Takes a Hit

Reporting from Coin Central, the crypto market weakness was exacerbated by the release of weaker-than-expected ISM Non-Manufacturing PMI data from the United States. This data raises fears of potential stagflation – a condition when inflation is high and economic growth is stagnant.

On the other hand, the Fed’s decision to keep interest rates high strengthened the US dollar exchange rate, making investors more cautious of risky assets like crypto. This combination of macroeconomic factors led to capital outflows from speculative assets and reduced liquidity in the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coin Central. Why is Crypto Down Today? Here’s What Happened. Accessed August 7, 2025

- Featured Image: Generated by Ai

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.