5 Bitcoin Hashrate Facts Set a New Record in August: Miner Optimism vs Market Reality

Jakarta, Pintu News – While the price of Bitcoin (BTC) remains under pressure, the world’s largest cryptocurrency network has set a new record in hashrate metrics. The latest data shows that the average 7-day hashrate reached an all-time high, signaling optimism among miners even though market conditions have not fully recovered.

1. What is hashrate and why is it important?

Hashrate is a measure of the total computing power miners use to process transactions and secure the Bitcoin network. Although miners work individually, this metric is an important indicator of their level of participation and trust in the network.

If the hashrate rises, it means that new miners are joining or existing miners are increasing their capacity. Conversely, a decrease in hashrate indicates a reduction in participation, which is usually triggered by declining profitability.

Read More: A Year of DCA Cardano (ADA): From Rp12 Million to Rp15.67 Million, Here’s the Journey

2. Hashrate Surges Amid Sluggish BTC Price

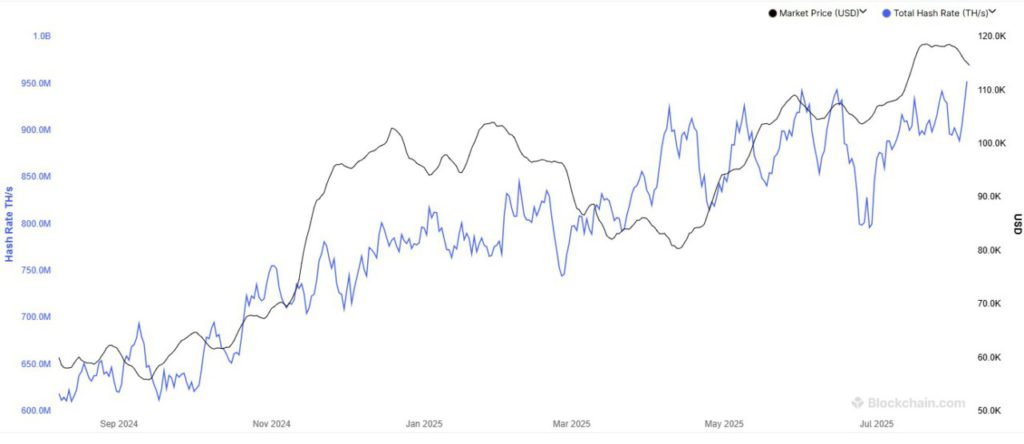

According to Blockchain.com data, Bitcoin’s hashrate had dropped to 889 EH/s on August 3, 2025. This decline coincided with the fall in the price of BTC to around $112,000 or the equivalent of Rp1.82 billion. This is natural because miners’ income is highly dependent on the price of Bitcoin.

However, just a few days later, the hashrate jumped sharply to reach a new record of 952.5 EH/s, breaking the previous record of 943.6 EH/s recorded in June 2025. This surge occurred even though the price of BTC has yet to fully recover, currently hovering around $116,300 or Rp1.89 billion.

3. Reasons Behind Miners’ Optimism

An increase in hashrate amidst a stagnant price could be an indication that miners are preparing themselves for a potential price increase in the future. Keep in mind, mining capacity expansion requires a large investment, so this move is often based on confidence in Bitcoin’s long-term prospects.

Some crypto analysts think that this is a signal that miners view the current period as an opportunity to strengthen positions before the market turns bullish again. Still, only time will tell if this strategy pays off.

4. Impact to Bitcoin Difficulty

With the hashrate jumping, the “Difficulty” level of mining will also undergo an automatic adjustment. Difficulty is a parameter that regulates the difficulty of finding new blocks, so the transaction processing time remains stable at around 10 minutes.

CoinWarz data predicts that the next adjustment will raise Difficulty to a new level of 129.13 trillion hashes (TH), also an all-time record. This adjustment is expected to occur this coming Friday.

5. What Does This Mean for the Crypto Market?

For the cryptocurrency market, this new record hashrate shows that confidence in Bitcoin’s fundamentals remains strong, despite weak short-term price sentiment. The increasing network strength may reinforce BTC’s position as the safest digital asset in the crypto industry.

Investors still need to be cautious. An increase in hashrate is not always followed by a price increase in the near future. Macroeconomic factors, regulation, and global sentiment still play an important role in Bitcoin price movements.

Conclusion

Bitcoin’s new hashrate record is a reminder that the cryptocurrency ecosystem continues to thrive, even amidst price pressure. Miner optimism, improved network security, and Bitcoin’s long-term prospects remain attractive to the global crypto community. However, as always, investment decisions should be accompanied by in-depth research and sound risk management.

Also Read: A Year of DCA XRP: From Rp12 Million to Rp29.78 Million, Here’s the Journey

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Hannah Collymore / Bitcoinist. Bitcoin Price Down, But Hashrate Sets New All-Time High. Accessed August 8, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.