5 Interesting Facts from Satoshi Nakamoto’s 15-Year Prediction that is Now Proven True!

Jakarta, Pintu News – Bitcoin (BTC) is now not only recognized as the world’s largest crypto asset, but it is also living proof of the visionary predictions of its anonymous creator, Satoshi Nakamoto. Exactly 15 years ago, he predicted that the benefits of Bitcoin would far exceed the cost of the electricity used to mine it. Today, that prediction is proving true amidst the rapid development of the cryptocurrency industry.

1. Predictions Delivered When Bitcoin Price Was Only Rp1,141

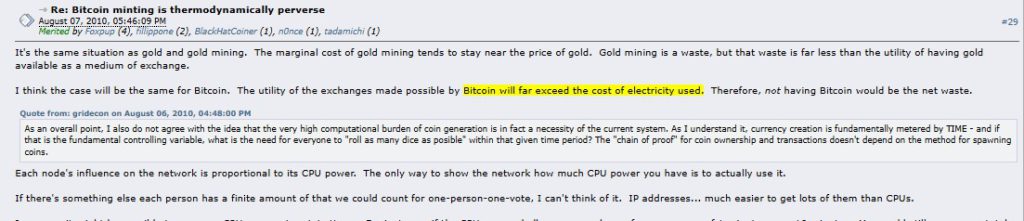

On August 7, 2010, Satoshi Nakamoto wrote on the BitcoinTalk forum that “the benefits of the exchanges enabled by Bitcoin will far exceed the cost of the electricity used. Not having Bitcoin would be a net loss.”

At that time, the price of Bitcoin was only around $0.07 or Rp1,141. Now, 15 years later, BTC has surpassed $116,000 or around Rp1.89 billion per coin.

This prediction is the foundation of the crypto community’s belief that technological innovation is not only judged by its operational costs, but by the long-term utility value it provides.

Read More: A Year of DCA Cardano (ADA): From Rp12 Million to Rp15.67 Million, Here’s the Journey

2. Market Capitalization Reaches IDR 37,490 Trillion

Since that prediction was made, Bitcoin has grown into a $2.3 trillion industry. Not only attracting retail investors, BTC is now attracting large institutions and even governments that are considering the establishment of a Strategic Bitcoin Reserve.

This journey shows that crypto adoption has expanded fromearly adopters to financial institutions and state entities.

3. Criticism about electricity consumption remains, but benefits outweigh costs

Electricity consumption in Bitcoin mining is still under global scrutiny and criticism. However, its utilities – from a middlemanless payment system to protection against inflation – are proving to provide greater economic value than energy costs.

For Satoshi, this is the crux of Bitcoin’s success: creating an efficient and censorship-resistant monetary system, despite the operational costs involved.

4. Positive Response to European Central Bank Policy

As of August 8, 2025, Bitcoin price rose to $116,000 (Rp1.89 billion) after the Bank of England cut interest rates by 25 basis points to 4.00%. This is the second cut this year, in line with the 2% inflation target. The positive impact was also felt in other crypto markets such as Ethereum (ETH) which rose to $3,800 (IDR61.9 million). Global monetary policy, especially from major central banks, continues to catalyze cryptocurrency price movements.

5. Challenges Remain: US Tariffs and Rate Cut Delay

Despite setting a new price record in 2025, Bitcoin continues to face pressure, including from the Trump administration’s tariffs on US imports and the Fed’s delayed interest rate cuts. These factors have prevented BTC from breaking back to its record high of $123,000 (IDR 2.00 billion).

Conclusion

Satoshi Nakamoto’s prediction 15 years ago is now proven: Bitcoin’s benefits as a decentralized financial system outweigh the cost of the electricity used to power it. Amidst global economic dynamics, BTC continues to demonstrate its strength as the premier digital asset and “digital gold” of the 21st century.

Also Read: A Year of DCA XRP: From Rp12 Million to Rp29.78 Million, Here’s the Journey

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Pooja Khardia / Coingape. Satoshi Nakamoto’s 15-Year-Old Prediction Just Proved Why Bitcoin Still Wins. Accessed August 8, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.