5 Reasons Why September Could Be the Plot Twist for Bitcoin’s Q4 Journey According to Analysts

Jakarta, Pintu News – Bitcoin (BTC) is entering what has historically been one of its strongest phases of the year. However, the ambitious target of Rp3.26 billion (USD 200,000) depends on how the crypto market reacts in September and early Q4 2025. Here are five key points to note.

1. Q4 is Bitcoin’s Golden Season

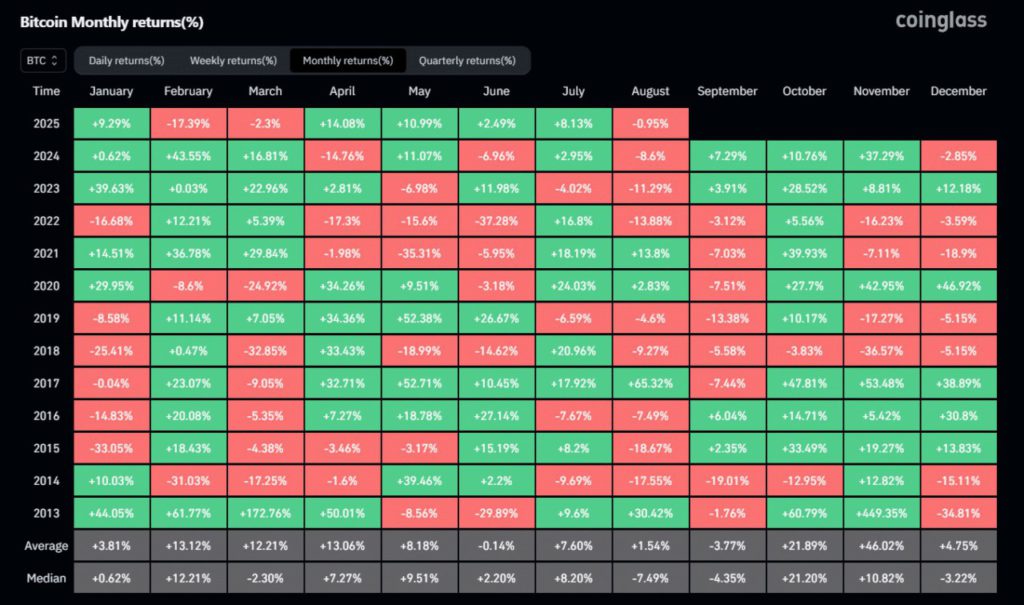

Historically, the fourth quarter (Q4) records an average yield of 85.4% for Bitcoin. Many major rallies in the past have occurred in this period, especially when the Federal Reserve (Fed) is easing monetary policy.

This easing usually boosts risky assets, including cryptocurrencies, due to increased liquidity and investor interest. This is the reason why Q4 is often the main momentum for BTC to set new records.

Read More: A Year of DCA Cardano (ADA): From Rp12 Million to Rp15.67 Million, Here’s the Journey

2. Potential Interest Rate Cut in September

The market expects the Fed to cut interest rates by 50 basis points in September, even though inflation is still quite high. If true, this will trigger a “risk-on mode” in global markets, including in digital assets.

With only about 45 days to go until the Fed’s decision, investors have already started anticipating policy changes that could give BTC a strong boost.

3. Challenge Level Rp2.03 Billion as Support

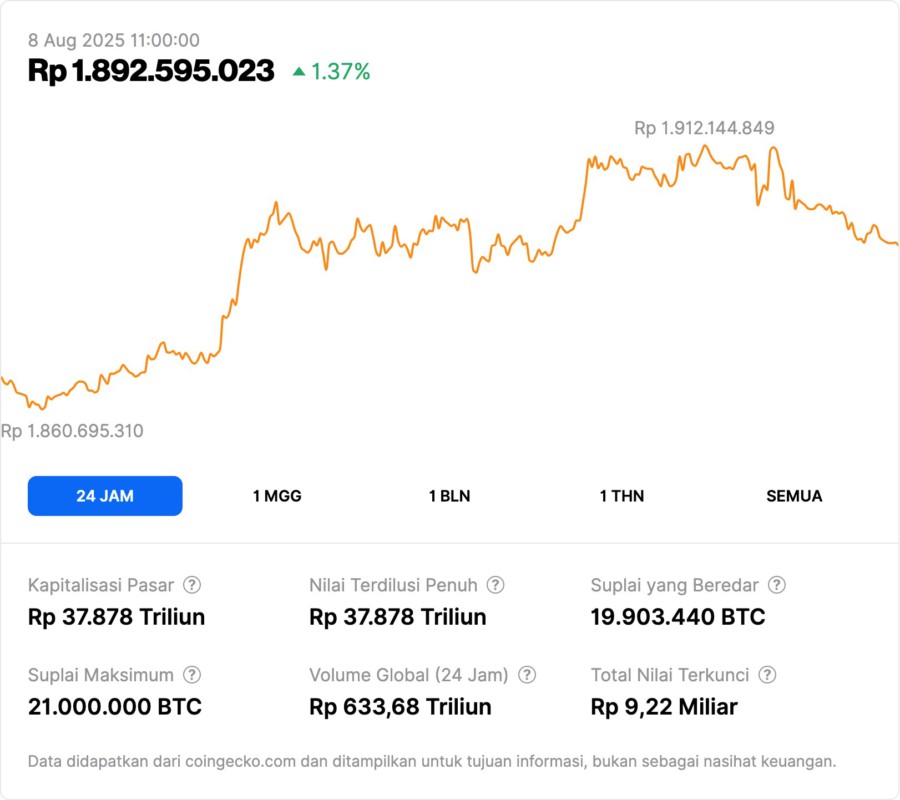

Technically, BTC is consolidating in the range of Rp1.79 billion-Rp1.87 billion (USD 110,000-USD 115,000). Bitcoin ETF inflows have recently returned to positive, with an additional IDR 1.46 trillion (USD 90 million) after a massive outflow.

However, to pave the way to a record price, BTC must break and maintain the Rp2.03 billion (USD 125,000) level as support. Without this achievement, Q4 momentum could be delayed.

4. October-November: Best Rally Period

Based on historical data, October and November recorded a combined average gain of +67.91%. This period is usually the start of a major rally that pushes BTC to new highs.

December tends to be a month of consolidation, where many investors secure profits, hence the more moderate gains compared to the previous two months.

5. Macro Factors that Strengthen Momentum

Besides interest rate cuts, other factors such as global liquidity, ETF inflows, and investor sentiment play a big role. New capital flows from monetary easing usually flow into the crypto market, strengthening the potential for a rally in Q4.

If all these factors align, September could be the turning point towards a big Bitcoin move later in the year.

Conclusion

September 2025 has a chance to be an important “plot twist” for Bitcoin’s journey in Q4. A combination of historical, technical, and macroeconomic factors will determine whether BTC is able to break the Rp2.03 billion level and pave the way towards the ambitious Rp3.26 billion target.

Also Read: A Year of DCA XRP: From Rp12 Million to Rp29.78 Million, Here’s the Journey

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Ritika Gupta, AMBCrypto. Bitcoin – Why September could be the plot twist in BTC’s Q4 story. Accessed August 8, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.