Pi Network Price Up 5% Today (August 8): Is Pi Coin Starting to Recover?

Jakarta, Pintu News – July has been a tough time for Pi Coin. However, the problems didn’t stop there. Over the past year, the value of the token has plummeted by more than 60%.

Most traders started to ignore it. However, in the first week of August, there was a noticeable change.

The PI has risen 4.6% from its all-time low, and for the first time since July 30, there were two short-term bullish moves signaling a possible change in market sentiment.

Then, how is Pi Network’s current price movement?

Pi Network Price Rises 5.6% in 24 Hours

On August 8, 2025, the price of Pi Network was recorded at $0.3663, having risen 5.6% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,283), then 1 Pi Network is IDR 5,964.

Read also: Dogecoin Jumps 8% on August 8 — Poised to Break $0.25 or Slip Back to $0.18?

Throughout the last 24-hour period, the price moved in the range of $0.3471 to $0.3693, showing a fairly steady uptrend.

Pi Network’smarket cap currently stands at around $2.86 billion, with afully diluted valuation of $4.40 billion. Trading volume in 24 hours was recorded at $96.56 million, signaling increased interest and transaction activity.

Signs of Life from the Bulls for the First Time in August

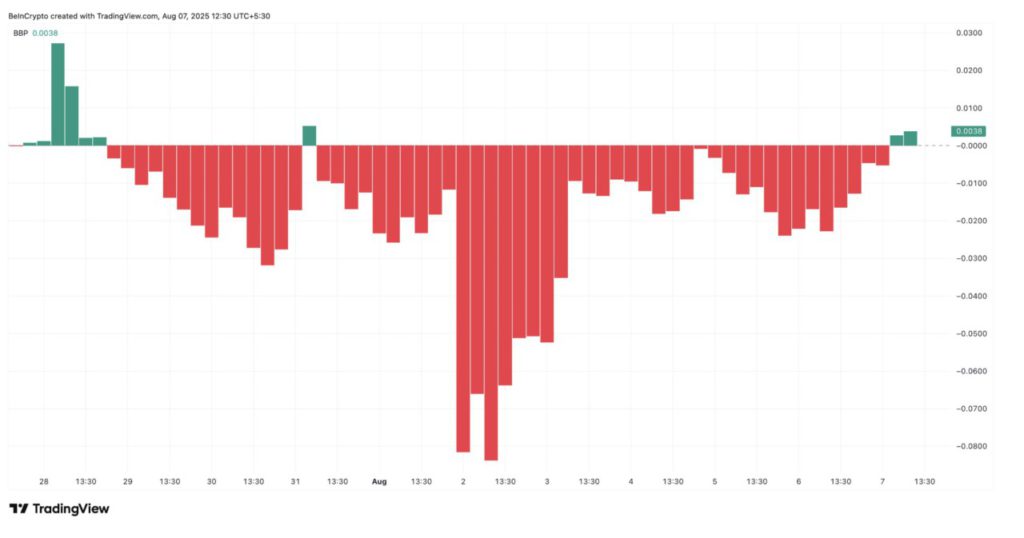

The first important signal appeared on the 4-hour bull-bear power chart, where a green bar appeared after more than 40 sessions. This is a significant thing. The last time bull strength was recorded on this chart was in July, and since then, the market has been completely dominated by sellers.

The appearance of the green bar shows that for the first time in weeks, buying pressure managed to beat selling pressure – albeit only momentarily.

The Bull-Bear Power Index measures the difference between the intraday high and low prices compared to the price moving average.

The appearance of a green bar signals that the bulls are trying to seize control of the market, which is often an early-albeit subtle-signal of an accumulation phase.

2-Hour Chart Reveals PI Coin Trend Change Through EMA Crossover

Although the 4-hour chart (August 7) shows early signs of buying pressure, the direction of the trend is still unclear. Therefore, the analysis moves to the 2-hour chart-to catch earlier trend changes and momentum building that may not be visible on larger timeframes.

On this lower timeframe, there was a crossover between the exponential moving average (EMA) periods 9 and 15, where the faster EMA 9 (red line) moved across the EMA 15 (orange line) from bottom to top. This indicates that buyers are starting to take control of the short-term price movement, overpowering the dominance of sellers for the first time in August.

The 9/15 EMA crossover is often used to identify early momentum shifts before they are seen on larger timeframes, making it a bullish signal worth watching.

Compared to the more commonly used 20/50 EMA, the 9/15 EMA crossover responds faster to small price changes, making it more effective for detecting momentum changes before they become apparent on longer timeframes.

However, as it is more sensitive to price fluctuations(noise), additional confirmation of the price and volume structure is required.

Read also: Ethereum Price Surges 6% to $3,900 Today (August 8) as Tom Lee Predicts a Rally Toward $16K!

PI Coin Price: Focus on Pennant Pattern and Key Breakout Levels

Still on the same 2-hour chart, the price of PI is currently pressuring the upper trendline of the bullish pennant pattern, with tight consolidation around the $0.35 level.

If there is a clean candle close above that level, it could trigger a short-term bounce, with an initial target near $0.36.

PI Coin’s daily price chart (7/8) confirms that these levels are key resistance zones. The $0.36 level coincides with the upper limit of the previous rejection area, followed by the next resistance at $0.39.

Meanwhile, the invalidation point for this pattern is around $0.32. If the price drops through this level, then the current pattern is considered a failure, and the price will most likely print a new low.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Coin Price Makes 2 Bullish Moves in August: Do Buyers Still Want a Slice of PI? Accessed on August 8, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.