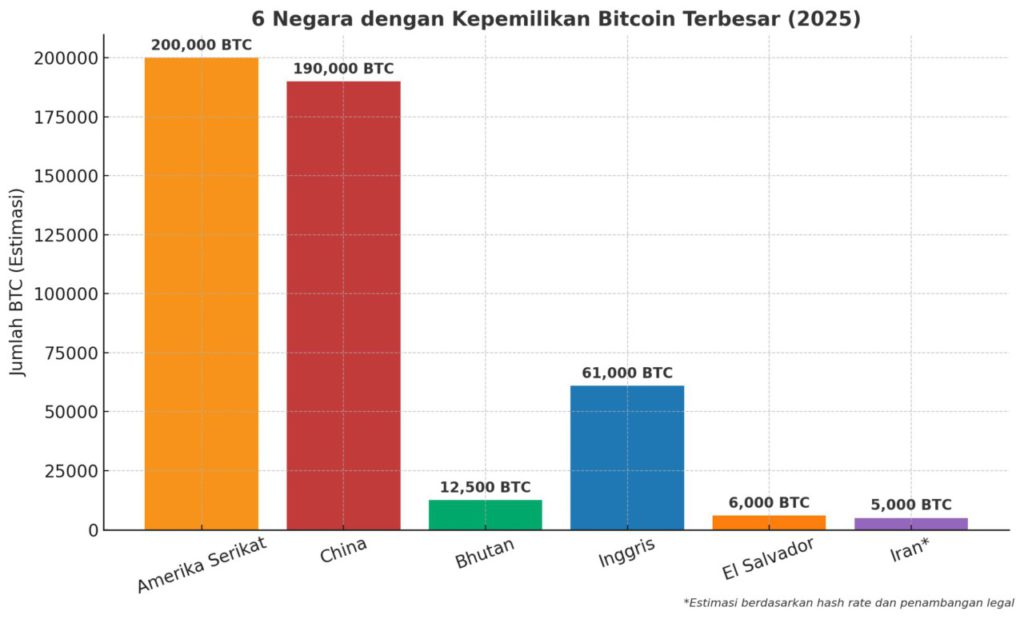

6 Countries that Hold the Most Bitcoin by 2025

Jakarta, Pintu News – Bitcoin (BTC) is now not only an asset owned by individuals or companies, but also part of the country’s financial strategy.

According to public blockchain data and official reports, around 463,000 BTC or 2.3% of the total Bitcoin supply was controlled by governments in various countries in 2025. This is equivalent to tens of billions of US dollars, making Bitcoin increasingly relevant in national asset policy.

Here are the 6 countries with the largest BTC holdings in the world according to Cointelegraph!

1. United States – ±200,000 BTC

The United States is the largest holder of Bitcoin in the world, totaling nearly 200,000 BTC. The majority of this BTC was obtained through seizures in major cases such as the Silk Road black market, ransomware operations, and other cybercrimes.

In March 2025, President Donald Trump signed an executive order to establish the Strategic Bitcoin Reserve, consolidating all confiscated BTC under federal control.

Unlike previous administrations that auctioned confiscated BTC, this policy signals a change in geopolitical outlook: Bitcoin is considered a strategic asset of the state, not just evidence.

2. China – ±190,000 BTC

China is in second place, with holdings of around 190,000 BTC. This BTC mostly comes from the huge seizure in the PlusToken fraud case in 2019, one of the largest fraud operations in crypto history.

Even though crypto trading and mining is banned domestically, China allegedly still holds a large portion of BTC in cold storage. The transparency of China’s BTC holdings is low, but analysts believe that the country remains one of the key players in Bitcoin geopolitics.

Also read: 4 Biggest Crypto Airdrops in August 2025

3. Bhutan – ±12,500 BTC

Bhutan shocked the world with its accumulation of around 12,000-13,000 BTC, equivalent to 30-40% of the country’s GDP. These holdings were acquired not through confiscation, but rather Bitcoin mining using renewable energy from hydropower plants.

Since 2019, the state investment institution Druk Holding & Investments (DHI) manages these mining operations as part of a long-term economic strategy. Bhutan’s approach is unique in that it is environmentally friendly, centralized, and one of the pillars of the national economy.

4. United Kingdom – ±61,000 BTC

The UK is holding around 61,000 BTC seized from a major money laundering case in 2021 related to a Chinese fraud network. This BTC is currently managed by the Metropolitan Police and the Crown Prosecution Service (CPS).

Unlike the previous practice of selling confiscated assets, the CPS is considering keeping this BTC as the country’s strategic reserve. Although no final decision has been made, this ownership already puts the UK in the elite ranks of the world’s Bitcoin holders.

Read also: Ethereum Flies 64% in 3 Months, Unseats Bitcoin Thanks to Institutional Fund Invasion

5. El Salvador – ±6,000 BTC

El Salvador became the first country to make Bitcoin a legal currency in 2021. The government under President Nayib Bukele regularly bought BTC, even implementing a “1 Bitcoin per day” program. By early 2025, the country’s BTC holdings reached more than 6,000 BTC.

Although in early 2025 Bitcoin’s legal tender status was revoked in favor of a $1.4 billion IMF loan, BTC purchases continued and the government still views it as a long-term asset.

6. Iran – Estimated Thousands of BTC

Iran is utilizing legal Bitcoin mining to replenish the country’s reserves. Since 2019, all legal miners have been required to sell mined BTC to the Central Bank of Iran. This strategy allows Iran to convert cheap electricity into BTC reserves without revealing the country’s wallet address.

While the exact amount is not published, estimates suggest Iran controlled 4-7% of the global hash rate at its peak, which could be equivalent to thousands of BTC in the country’s reserves.

Infographic 6 Countries with the Largest Bitcoin Holdings in 2025

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Which countries secretly own the most Bitcoin – beyond the US and China. Accessed August 10, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.