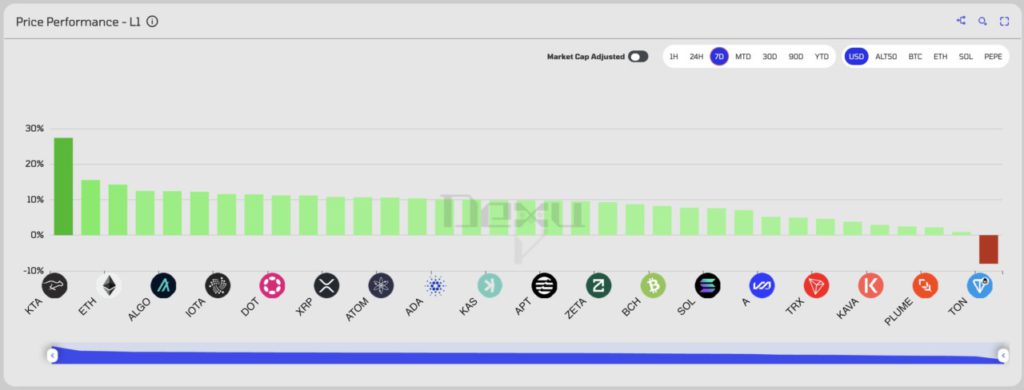

Top 5 Layer-1 Projects Based on Price Performance According to Dexu AI

Jakarta, Pintu News – The crypto market continues to heat up with intense competition among Layer-1 projects. According to the latest analysis from Dexu AI, five Layer-1 projects recorded the best price performance in the recent period, outperforming many of their competitors.

This impressive performance was driven by a combination of technological innovation, ecosystem adoption, and positive investor sentiment that pushed their prices up significantly.

This article will discuss who made the list and the factors that influenced their price spikes!

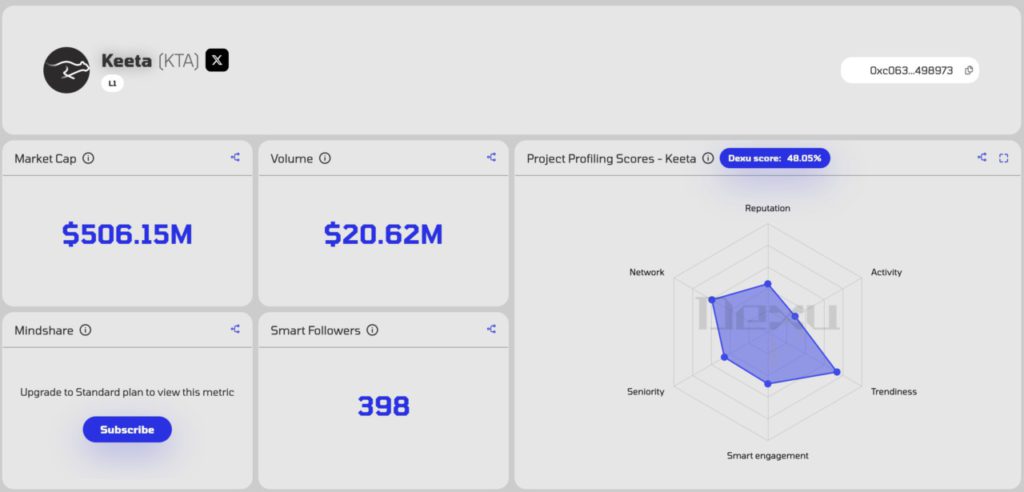

1. Keeta (KTA)

In the past seven days, the price of Keeta (KTA) surged 26.75% to reach $1.24, with a market capitalization of approximately $506 million. This surge was supported by a 24-hour trading volume of $20.62 million which was up 8.25% compared to the previous day.

Community sentiment is positive, with 81% of investors showing a bullish view on the KTA. The price chart shows a consistent uptrend since early August, with some minor corrections before printing another local high on August 8.

Data from Dexu AI shows Keeta’s project profiling score of 48.05%, with the greatest strengths in “Trendiness” and “Network”. Although the reputation and seniority scores are still moderate, interest in KTA is increasing, as reflected by the 398 “smart followers” monitoring its movement. This price movement indicates a strong market sentiment and potential continuation of the positive trend in the short term.

2. Ethereum (ETH)

In the past seven days, the price of Ethereum (ETH) rose 14.54% to break $4,023.44, supported by a market capitalization of $485.58 billion and a daily trading volume of $43.3 billion.

The chart shows a consistent upward trend since early August, with significant gains on August 8-9. Market sentiment tends to be positive, with 82% of the 1.5 million voters showing a bullish view on ETH.

Data from Dexu AI gives Ethereum a profiling score of 82.79%, with dominant strengths in the aspects of reputation, seniority, and smart engagement.

Currently, around 29% of the total ETH supply is staked, strengthening its network fundamentals. The combined factors of high demand, large staking interest, and strong community trust are the main drivers of this upward trend.

Read also: Ethereum Flies 64% in 3 Months, Unseats Bitcoin Thanks to Institutional Fund Invasion

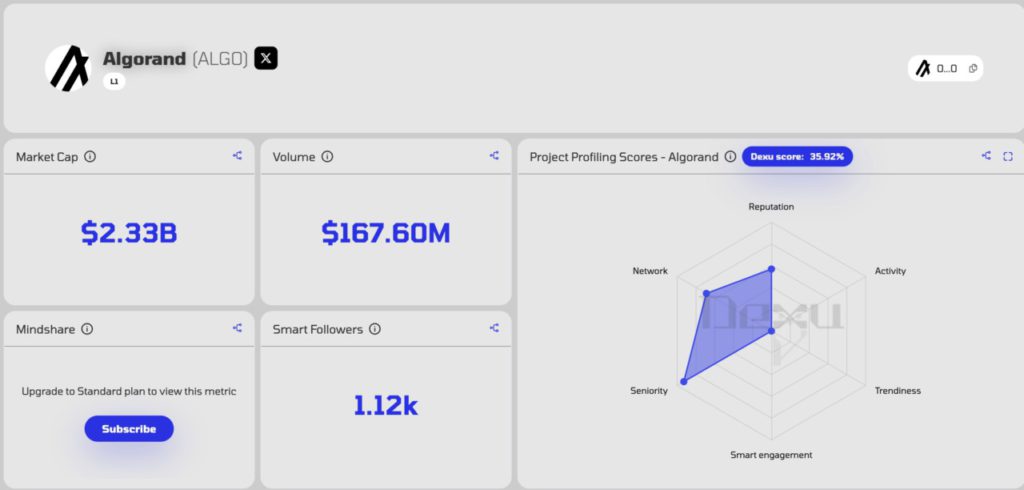

3. Algorand (ALGO)

Algorand (ALGO) price increased 12.45% in the last 7 days, trading at $0.2669 with a market capitalization of $2.32 billion. The 24-hour trading volume was recorded at $171.07 million, although it was down 7.07% from the previous day.

The price chart shows an upward trend since August 7 after a period of consolidation, with weekly highs hovering around $0.27. Community sentiment is trending positive, with 86% of investors showing a bullish view.

Based on Dexu data, Algorand has a project score of 35.92% with key strengths in seniority and network, while activity, smart engagement, and trends are still relatively low.

The number of smart followers reached 1.12K, signaling a community of informed investors although not yet as large as other major blockchain projects.

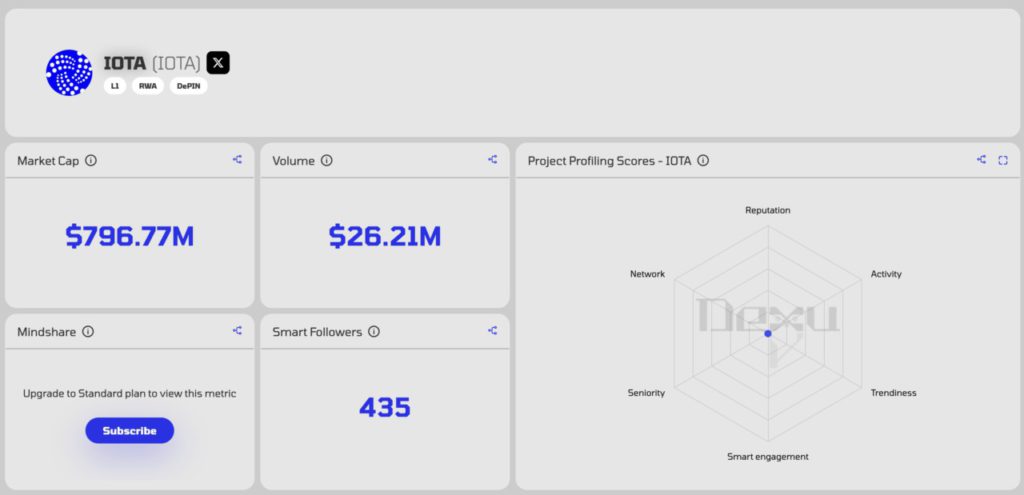

4. Iota (IOTA)

The price of IOTA (IOTA) has increased 11.55% in the last seven days, trading around $0.2010. The market capitalization was recorded at $794.91 million with a daily trading volume of $23.75 million, although it fell 20.45% in the last 24 hours.

Price movements have shown a consistent uptrend since early August, with some minor corrections before rallying back ahead of August 9. Community sentiment is also trending positive with 83% of votes bullish, supported by ecosystem developments such as the big launch of NFTs for cricket fans in Pakistan.

In terms of Dexu AI analysis, IOTA has a market capitalization of $796.77 million and a volume of $26.21 million, but the project profiling score is relatively low with minimal distribution of metrics in all aspects such as reputation, activity, and engagement.

The number of smart followers is only 435, indicating limited involvement from experienced investors. Nonetheless, the positive price trend in the past week suggests there is potential for renewed interest, especially if volumes can increase consistently.

Also read: Robert Kiyosaki Predicts Bitcoin (BTC) to Fall to $90,000 in August, Here’s His Analysis!

5. Polkadot (DOT)

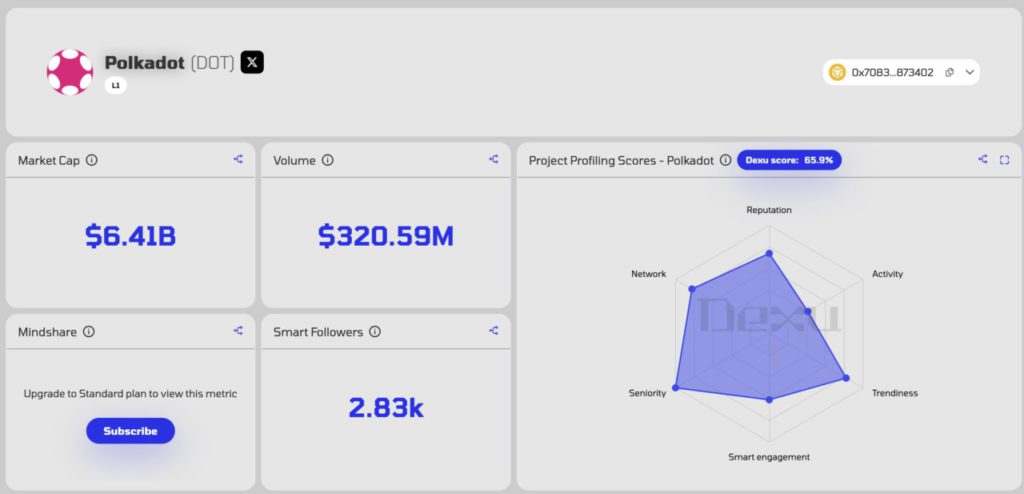

The price of Polkadot (DOT) rallied 11.3% in the past seven days, trading around $3.99. The candlestick chart shows a consistent uptrend since early August, with a significant rebound from the support area around $3.50 and positive momentum bringing the price close to the $4.00 level.

Daily trading volume was recorded at $320.59 million, while market capitalization reached $6.41 billion. Community sentiment remained positive, with 85% of investors showing a bullish view.

In terms of Dexu analysis, Polkadot scores 65.9% with notable strengths in reputation, network, seniority, and market trends. Its community activity and engagement is at a medium level, reflecting strong ecosystem support although there is room for improvement.

The combination of a strengthening price trend, large volumes, and solid network metrics puts DOT in a strategic position to continue its potential short-term rally towards targets above $4.50.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Dexu AI

- Featured Image: Generated by Ai

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.