Bitcoin Surges, These 3 Altcoins are in the Spotlight!

Jakarta, Pintu News – A surge in crypto prices may be just around the corner, following signals from the Federal Reserve that it plans to cut interest rates in September, as well as President Donald Trump’s signing of an executive order that could potentially bring billions of dollars into the industry.

Media reports suggest that Christopher Waller may be announced as the next Chairman of the Federal Reserve. Waller is known as one of the most vocal Fed officials pushing for interest rate cuts.

Trump has also nominated Stephen Miran, who shares similar views, to the board.

Bitcoin surge could trigger crypto bull run

As discussed earlier, the price of Bitcoin (BTC) has the potential to rise due to Donald Trump’s decision to impose tariffs on gold.

Read also: 3 Memecoins Getting Attention in August 2025, What’s the Reason?

In addition, BTC is also forming a bullish flag pattern that indicates a potential new record high price.

This movement is likely to trigger a bull run in the crypto market, which will have a positive impact on a number of leading altcoins. Some altcoins worth considering include: Chainlink (LINK), Ripple (XRP), and Pepe (PEPE). Check out the chart analysis!

Chainlink (LINK)

Chainlink is one of the best altcoins to consider right now and is well positioned to benefit from the next bull run.

As the leading oracle provider in the crypto industry, Chainlink is instrumental in helping major parties connect off-chain data into the blockchain.

Technically, LINK’s price is also showing strength. A double-bottom pattern formed at $11, with a neckline at $18. Market indications suggest that LINK has entered the third wave in the Elliott Wave pattern – which is usually the longest and strongest wave.

This wave could potentially take LINK’s price towards $25.65, in line with the 23.6% Fibonacci retracement level. This price target is also consistent with the projected measurement of the double-bottom pattern, which is calculated from the height of the pattern to the neckline.

Pepe (PEPE)

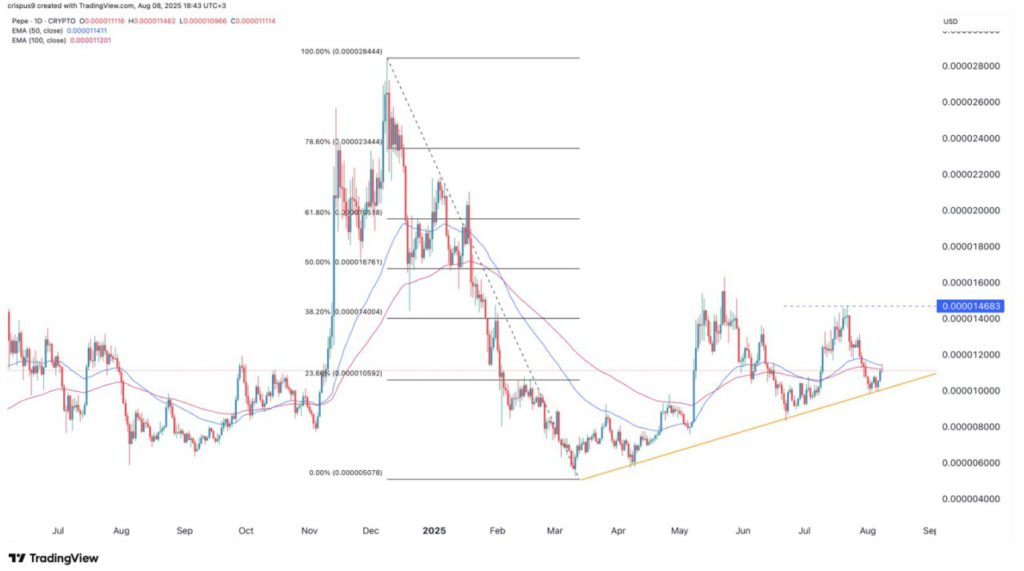

Pepe, the second-largest meme coin on the Ethereum (ETH) network, is one of the crypto assets to watch ahead of the start of the bull run. The main driver is the recent spike in Ethereum’s price, which usually boosts the momentum of tokens in its ecosystem.

Currently, Pepe has broken the 23.6% Fibonacci retracement level at $0.00001060 and is working to reclaim a position above the 50-day moving average. In addition, Pepe’s price is still holding above therising trendline support, signaling the strength of the bullish trend.

Read also: Ripple Acquires Rail for $200 Million to Strengthen Stablecoin Payment Dominance!

As long as the price stays above that trend line, the outlook remains positive. The initial target is at $0.00001468, which is this month’s high. If that level is broken, further upside could potentially push the price towards $0.000020.

Ripple (XRP)

XRP is becoming one of the key altcoins worth considering ahead of the next crypto bull run.

There are a number of catalysts in its favor, including the potential approval of an ETF, the rising market capitalization of Ripple’s USD stablecoin (RLUSD), as well as XRP’s opportunity to disrupt the dominance of international payment network SWIFT.

On the technical front, the price of XRP is also showing strength. A cup-and-handle pattern has formed, with an upper bound at $3.40 and a low at $1.6137. Based on analysis, this pattern indicates a potential upside to $5.20.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Crypto bull run could be near: best altcoins to buy today. Accessed on August 9, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.