Antam Gold Price Chart August 11, 2025: Gold Price Drop and Its Relationship with Crypto

Jakarta, Pintu News – Gold prices on Monday, August 11, 2025, experienced a slight decrease of Rp6,000 per gram for both types of products – both corporate BRANKAS gold and physical gold. While this change may seem small, it is interesting to note that it comes amidst global commodity price volatility and increasingly complex cryptocurrency market dynamics. From price differentials to trends over the past six months, here is an informative summary that will help you understand the current situation.

1. Difference between BRANKAS Gold and Physical Gold Price

BRANKAS corporate gold buying price is currently at IDR 1,885,600 per gram, down from IDR 1,891,600 per gram in the previous update. BRANKAS is a digital gold storage service that allows owners to secure assets without having to physically hold them. This price difference is usually influenced by management fees, physical premiums, and liquidity factors.

Meanwhile, the buying price of physical gold was recorded at IDR 1,945,000 per gram, also down IDR 6,000 from its previous position at IDR 1,951,000. Physical gold tends to be more expensive as it involves production, distribution and storage processes that require additional costs. This is one of the reasons investors who focus on cost efficiency prefer BRANKAS gold over physical gold.

2. Gold Price Trend for the Last 6 Months

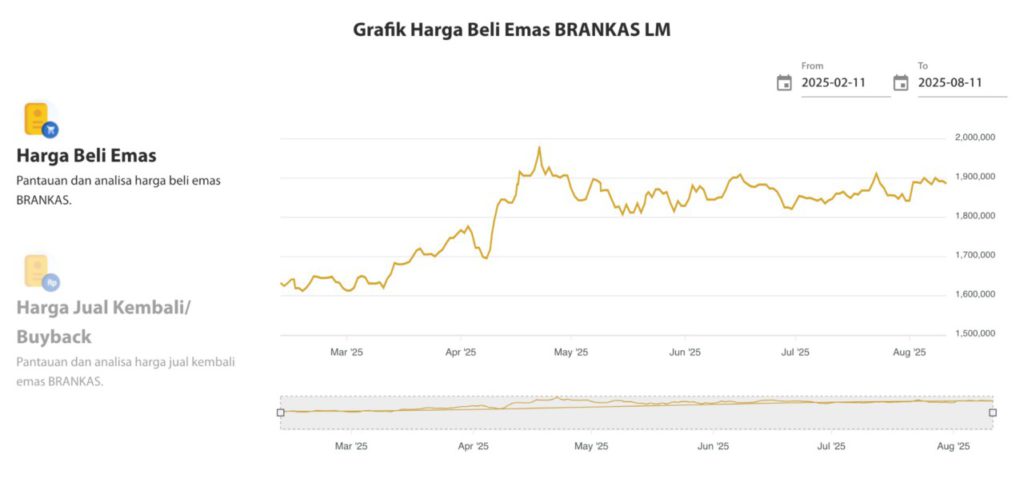

Based on the movement chart from February to August 2025, BRANKAS gold prices experienced a significant spike in April, touching around IDR 1,950,000 per gram before experiencing a correction. This movement was largely triggered by global uncertainties, including the monetary policy of the United States central bank and turmoil in crypto markets such as Bitcoin (BTC) and Ethereum (ETH).

From June to early August, prices tended to stabilize in the range of Rp1,880,000-Rp1,920,000. On the one hand, this stability provides peace of mind for conservative investors, but on the other hand, it also makes some market participants look for alternative assets such as cryptocurrencies with higher volatility.

3. Impact of Exchange Rate and World Gold Price

The current international gold price is around USD 2,370 per troy ounce or equivalent to IDR 38,486,430 at an exchange rate of IDR 16,239 per USD. The increase or decrease in world gold prices directly affects the domestic market as gold is traded in dollar denominations. Fluctuations in the rupiah exchange rate against the US dollar are an important factor that investors often watch out for.

In addition, gold price movements are also closely related to the dynamics of the crypto market. When crypto assets such as Ripple (XRP) or Litecoin (LTC) experience price pressure, some investors move their funds into gold as a form of hedging. Conversely, when the crypto market rallies, the outflow of funds from gold can depress its price.

4. Comparison with Crypto Assets

While gold is known as a safe haven, crypto developments have added a new dimension to investment diversification strategies. Cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and meme coins such as Pepe Coin (PEPE) offer the potential for high returns, but with equally high risks.

For some investors, gold and crypto are not mutually exclusive options, but rather complementary. Gold provides long-term stability, while crypto offers speculative opportunities that can generate significant gains in a short period of time. By understanding the movements of both, investors can manage their portfolios in a more balanced manner.

Conclusion

A gold price drop of IDR6,000 on August 11, 2025 may seem small, but it is still important to note in the context of global trends. By looking at the differences between physical and vault gold, understanding the trends of the past six months, and relating them to exchange rates and crypto markets, investors can make more informed decisions. Amidst global economic uncertainty, a diversification strategy between gold and cryptocurrency can be a smart move to preserve asset value.

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- LM vault. Antam Gold Price Chart August 11. Accessed August 11, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.