Bitcoin’s Legendary Golden Cross Returns — Is BTC Poised to Break Its All-Time High?

Jakarta, Pintu News – The Bitcoin (BTC) market is getting attention again as it is experiencing a number of important technical indicators and macro events.

Optimism increased after President Donald Trump nominated pro-Bitcoin economist Stephen Miran to the Federal Reserve Board of Governors.

The resurgence of historical trends, including the formation of a golden cross, as well as policy changes are also increasing the focus on Bitcoin’s medium-term prospects, according to Coingape’s report.

Analysts Look to Golden Cross Repetition for Bitcoin Price Surge

According to Merlijn The Trader, a market analyst, Bitcoin has just formed a golden cross on the weekly chart – a pattern he calls a “signal that never misses.”

Read also: Bitcoin Surges to $121,000 Level Today (August 11): Where is BTC Headed Next?

He highlighted that previous golden crosses in 2016, 2017, and 2020 were accompanied by rallies of 139%, 2200%, and 1190% respectively. According to him, the same pattern formed again in 2025 with similar structure and momentum.

The consistency of history makes it predictable that this signal could again be the main fuel for price increases. Therefore, the long-term projection of Bitcoin price is becoming increasingly optimistic as this pattern reappears.

On the daily chart, Bitcoin is trading above an uptrend line that has so far held since April. The price has just bounced off the $112K range and is currently around $116K, with $117.5K as the closest resistance around the 0.236 Fibonacci level.

If it manages to break this zone, the next targets are at $121K and $123.8K which represent Fibonacci extensions of 0.382 and 0.5 respectively. The RSI index is at 53, indicating neutral momentum and not yet in the overbought area.

However, failure to maintain a position above the trend line could trigger a correction back to the $112K level. Thus, the direction of Bitcoin’s further movement largely depends on the bulls ‘ ability to stay above this key structure.

Is the Bitcoin Rally Over or is there Still a Surge?

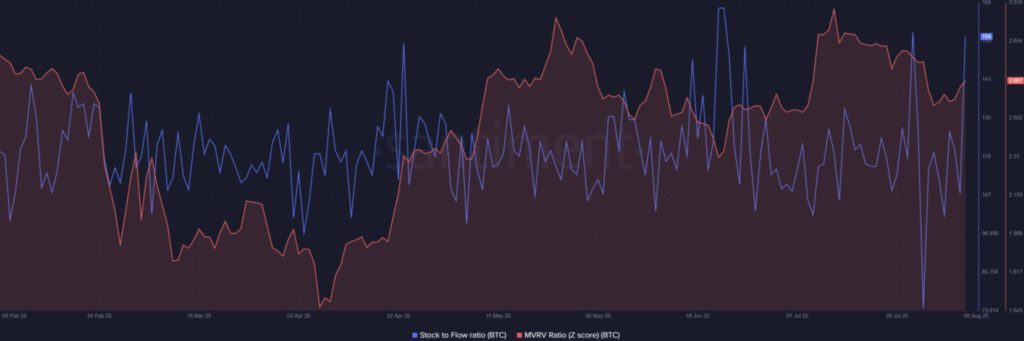

On-chain metrics also reinforce the bullish narrative, with the Stock-to-Flow (S2F) ratio reaching a new record of 154. This number indicates that Bitcoin is getting scarcer, which generally signals a strong demand cycle.

At the same time, the MVRV Z-score is at 2,667, which is not yetoverheated, so there is still room for growth without triggering maximum market risk. Such conditions are usually seen in the early stages of an expansion phase.

As such, the on-chain fundamentals support a positive long-term outlook. Together with macro and technical indicators, Bitcoin’s current position indicates that there is a chance for the next big rally.

Read also: 2 Crypto AIs to Watch Out For After ChatGPT OpenAI Launches GPT-5, Why?

In conclusion, with various bullish signals emerging, Bitcoin looks set for a potential new breakout. Golden crosses, macro policy changes, and solid on-chain patterns are additional layers of support.

However, maintaining key levels on the trendline remains crucial to confirm the continuation of the rise. If this condition persists, Bitcoin price has the potential to move significantly in the coming months.

Trump’s Fed member nominations boost prospects for pro-crypto policies

Furthermore, the nomination of Stephen Miran – a Bitcoin supporter – as a member of the Federal Reserve Board of Governors gave a boost to the pro-crypto sentiment.

Miran is known to support interest rate cuts as well as the use of digital assets, in line with investors’ hopes for a more crypto-friendly policy environment.

In the past, looser monetary conditions have proven favorable for Bitcoin and other risky assets, especially at the start of bull cycles. This nomination adds strength to the existing bullish structure, providing additional macro support to Bitcoin’s direction of movement.

As such, policy changes could potentially be atailwind in Q4, which traders see as a solid complement to technical momentum.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Analyst Predicts Bitcoin Price Surge as Historical Bullish Signal Returns – Can BTC Hit a New All-Time High? Accessed on August 11, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.