Antam Gold Price Chart August 12, 2025: Gold Drops, This Impacts Investments and Crypto

Jakarta, Pintu News – Gold prices experienced another decline on August 12, 2025, for both the corporate vault and physical gold categories. This decline is highlighted because gold prices are often compared to other assets such as crypto and cryptocurrencies in investment portfolios.

The latest data shows that the BRANKAS corporate gold buying price stands at IDR 1,864,600 per gram, while the physical gold buying price stands at IDR 1,924,000 per gram, both down by IDR 21,000 compared to the previous price.

Latest Gold Price Changes

The purchase price of corporate BRANKAS gold, which is currently at IDR 1,864,600 per gram, has been corrected from the previous price of IDR 1,885,600. Meanwhile, the physical gold price is now IDR 1,924,000 per gram, down from IDR 1,945,000. This decline of IDR 21,000 reflects external factors that affect the global gold market, such as changes in interest rates and the movement of the US dollar, which is now equivalent to around IDR 16,300 per USD.

When converted, the price of physical gold is equivalent to approximately USD 118.10 per gram, while corporate vault gold is equivalent to approximately USD 114.40 per gram. Although seemingly small, this decrease is still relevant for investors who utilize gold as a hedge against inflation and crypto market turmoil.

Also Read: Top 3 DePIN Tokens August 2025: These Altcoins Show Positive Performance!

Gold Price Trends in the Last 6 Months

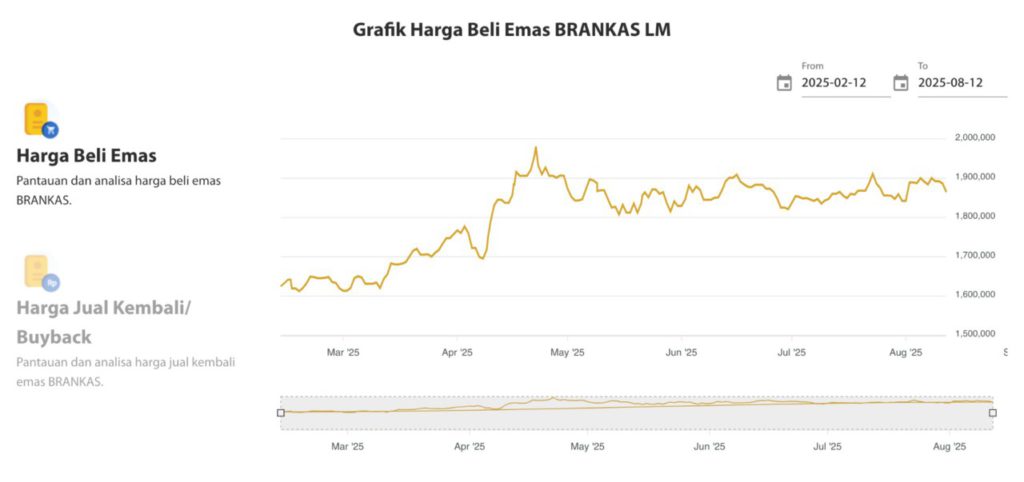

Based on the BRANKAS LM gold purchase price chart from February 12, 2025 to August 12, 2025, gold prices experienced a sharp spike in April to early May. The increase was then followed by more stable fluctuations in the range of IDR 1,850,000 – IDR 1,950,000. This movement indicates that the gold market is still quite responsive to global economic dynamics.

The price fluctuations seen on the chart show potential volatility similar to the movements of cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH), albeit on a different scale. For investors, understanding historical trends like this is important for determining market entry and exit strategies.

Gold and Cryptocurrency Relationship

Gold and cryptocurrencies are often seen as two assets that can complement each other in investment diversification. Gold has a reputation as a safe haven asset, while cryptos such as Ripple (XRP) or Pepe Coin (PEPE) are known for their high growth potential but high risk. The current fluctuations in gold prices may be an indicator for some investors to consider portfolio re-allocation.

Some analysts also see an indirect correlation between gold and Bitcoin (BTC) prices. When crypto comes under pressure, some investors move to gold, and vice versa. This phenomenon makes the two instruments influence each other’s perception of alternative assets.

Factors Affecting the Current Gold Price

Several factors influence global gold prices, including central bank interest rate policies, the US dollar exchange rate, and geopolitical tensions. When the dollar strengthens, gold prices tend to fall as it becomes more expensive for non-dollar buyers. With the current exchange rate at IDR 16,300 per USD, even small movements in the exchange rate can have a significant impact on domestic gold prices.

In addition, the dynamic development of the crypto market has also influenced investors’ interest in gold. Price spikes in certain cryptocurrencies can make some investors shift funds from gold to these digital assets.

The gold price drop on August 12, 2025 is a reminder that no asset is completely risk-free, including gold and cryptocurrencies. Investors need to continue to monitor market developments and consider appropriate diversification strategies to keep portfolios healthy amid global economic uncertainty.

Also Read: Top 3 Token Unlock August 2025: Redacted, Dappad, and GameGPT in the Spotlight

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- LM vaults. BRANKAS Gold Price August 12, 2025. Accessed August 12, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.