Alpaca Finance (ALPACA) Price Initial Release, Highest, Year-to-Date

Jakarta, Pintu News – Alpaca Finance (ALPACA) was first released in February 2021 at a price range of USD 1.00 (~Rp 16,300). The project was born as a leveraged yield farming platform running on Binance Smart Chain (BSC). In the initial period, investor interest was quite high thanks to the booming yield farming trend in DeFi.

In its early weeks of trading, ALPACA recorded high volatility due to speculation and FOMO. This prompted prices to spike sharply before the market began to adjust.

All-Time High Price (ATH)

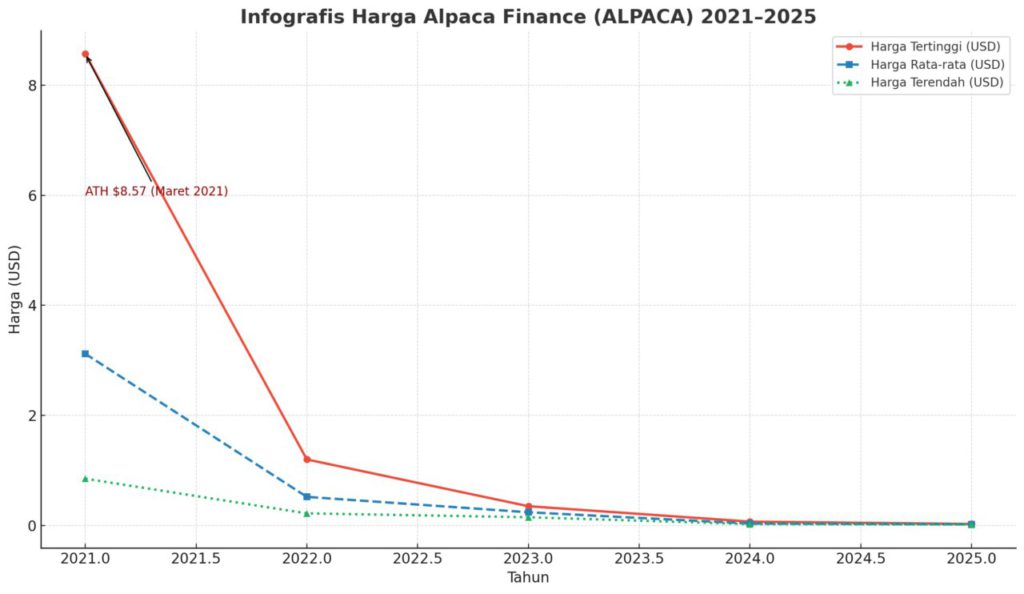

ALPACA’s all-time high price occurred in March 2021 at USD 8.57 (IDR 139,111). This spike was triggered by a wave of yield farming adoption and rampant liquidity in BSC at the time. However, the high price did not last long as a major correction hit the global crypto market.

Since that ATH peak, ALPACA’s price has entered a gradual downward trend, following the bearish crypto market cycle of 2022-2023.

Year-to-Year Price Development

| Year | Average Price (USD) | Highest Price (USD) | Lowest Price (USD) |

|---|---|---|---|

| 2021 | 3.12 (~$50,856) | 8.57 (~$139,111) | 0.85 (~Rp 13,855) |

| 2022 | 0.52 (~$8,476) | 1.20 (~$19,560) | 0.22 (~Rp 3,586) |

| 2023 | 0.24 (~$3,912) | 0.35 (US$5,705) | 0.15 (~$2,445) |

| 2024 | 0.035 (~$571) | 0.07 (~Rp 1,141) | 0.025 (~$408) |

| 2025* | 0.021 (~$342) | 0.027 (~$440) | 0.018 (~$293) |

Factors Affecting ALPACA Price Movement

Some of the factors that affect the price of ALPACA include:

- Fluctuations in total value locked (TVL) in the Alpaca Finance ecosystem.

- Overall DeFi and yield farming market trends.

- Price movements of BNB and other altcoins on BSC.

- Investor sentiment towards the risk of DeFi projects.

Historical Events that Affect the Price of Alpaca

1. Launch of Alpaca Finance (February 2021)

ALPACA’s release coincided with the DeFi hype on BSC, prompting an initial price spike to ATH $8.57 (IDR139,091). Many new users were attracted by the offer of high yields and low transaction fees compared to Ethereum (ETH).

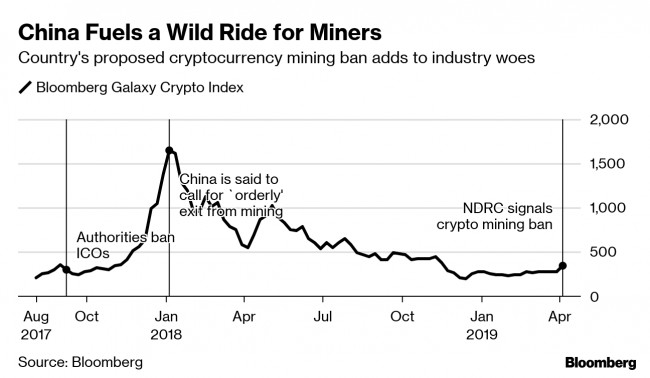

2. Global Crypto Market Pressure (May 2021)

The crypto market downturn triggered by the Bitcoin (BTC) mining ban in China brought down ALPACA’s price drastically from its peak. This negative sentiment caused the market capitalization to shrink significantly.

3. Declining Farming Yields and DeFi Competition (2022)

The emergence of new DeFi protocols on various chains, such as Avalanche (AVAX) and Fantom (FTM), made Alpaca’s TVL (total value locked) drop. The price of ALPACA stabilized at around $0.5 before finally going back down.

4. Multi-Chain Integration and New Features (2023) 5.

Alpaca is trying to make a comeback with cross-chain integration and features like auto-compounding. Despite a brief boost, the price only rose briefly to $0.35.

5. Long Bear Market (2024-2025)

The sluggish state of the crypto market, coupled with declining interest in leveraged yield farming, has kept ALPACA’s price depressed below $0.03. Despite this, the core community remains actively developing the protocol.

Recent Trends in Alpaca Finance

As of August 2025, ALPACA’s price was around USD 0.020 (~Rp 326), down about 99.7% from its highest price. The daily trading volume was recorded at around USD 616K, indicating that despite declining investor interest, ALPACA is still actively traded in the market.

ALPACA’s price journey shows how a DeFi token can soar high early on but also be vulnerable to sharp declines due to market cycles. For investors, it is important to understand the risks, industry trends, and the role of global sentiment in influencing prices.

Also Read: Top 3 Token Unlock August 2025: Redacted, Dappad, and GameGPT in the Spotlight

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinMarketCap. Alpaca Finance Price History. Accessed August 12, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.