Pi Network Price Rises 4% Today: Is Pi Coin Set to Recover from Its All-Time Low?

Jakarta, Pintu News – Pi Coin is facing a prolonged downward trend, pushing the altcoin close to its all-time low (ATL).

Despite investors’ efforts to change the direction of this movement, unfavorable market conditions have allowed the downward trend to continue. This situation creates uncertainty about the future direction of Pi Coin’s price.

Then, how is Pi Network’s current price movement?

Pi Network Price Rises 4.7% in 24 Hours

On August 13, 2025, the price of Pi Network was recorded at $0.3953, having risen 4.7% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,121), then 1 Pi Network is IDR 6,372.

In the last 24-hour period, the PI price moved in a range between $0.3756 to $0.3963, indicating relatively restrained fluctuations.

Read also: ETH Breaks $4,600, 5 Coin Memes Join the High Jump Today!

With a market capitalization of around $3.09 billion and a 24-hour trading volume of $89.13 million, Pi Network looks attractive to investors looking at its long-term potential.

The current circulating supply stands at around 7.83 billion PI, while the total available supply stands at more than 12 billion PI.

Pi Coin Investors Remain Optimistic

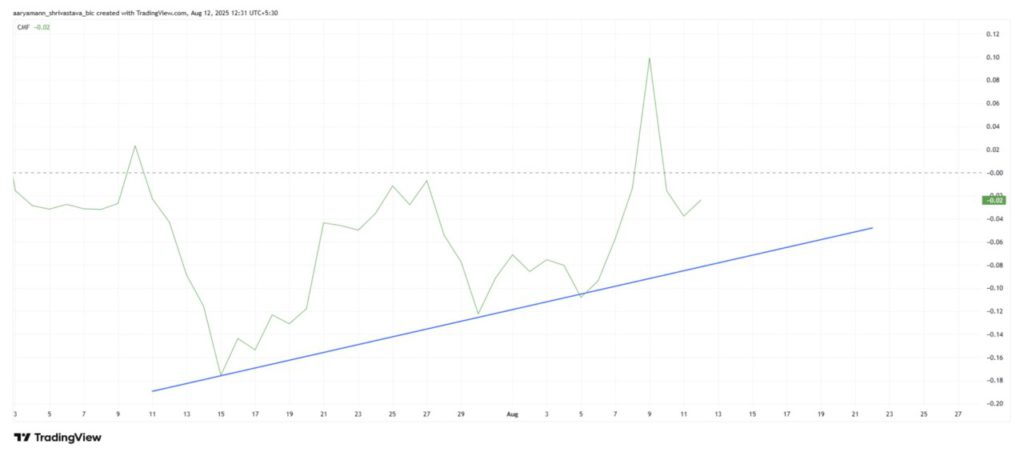

The Relative Strength Index (RSI) for Pi Coin has been giving bearish signals over the past few weeks.

Despite briefly breaking above the neutral level, the RSI has consistently failed to hold above it. This pattern was seen again this week, reinforcing the view that Pi Coin is still under bearish pressure.

In addition, the general market sentiment towards Pi Coin remains pessimistic. Despite occasional bullish attempts, repeated failures to sustain an upward movement suggest that this altcoin may find it difficult to break out of the downward trend.

However, the Chaikin Money Flow (CMF) indicator showed a positive increase, signaling an inflow of capital into Pi Coin. This indicates increased investor interest, although the level of commitment is still fluctuating.

This combination of diverse technical signals made capital inflows an important factor that prevented Pi Coin from falling to an all-time low (ATL).

If this capital flow continues to persist, it could provide support to keep Pi Coin’s price above its recent low.

As such, sharper selling pressure can be avoided, helping to stabilize the price of this altcoin in the short term.

Read also: These 3 Cryptos Are Closing In on All-Time Highs and Taking Center Stage

Pi Coin Price Attempts to Recover

On August 12, Pi Coin briefly traded at $0.383 after failing to break important resistance at $0.440. The failure triggered a 12% decline in the last three days, reinforcing a downward trend that has lasted for three months.

The inability to cross key resistance levels leaves Pi Coin vulnerable to potential further losses.

Pi Coin’s price is now only 16% away from its all-time low of $0.322. Based on mixed technical sentiment, the likelihood that the price will reach this level in the near future is fairly low. There is a chance that this altcoin will try to bounce off the current support at $0.362.

However, if general market conditions deteriorate or investor sentiment becomes more negative, further declines could be possible. This could potentially see Pi Coin break support and fall to $0.322, which would also invalidate the current bullish-neutral outlook.

In that scenario, Pi Coin could print a new ATL, pushing the price even lower and deepening the downward trend.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Can Rising Inflows Trigger Pi Coin Price Breakout From 3-Month Downtrend? Accessed on August 13, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.