XRP Whale Purchases 900 Million Tokens: Is a Bullish Surge on the Horizon?

Jakarta, Pintu News – Whale XRP (XRP) has recently been accumulating in large numbers. According to an on-chain analysis by analyst Ali Martinez, over 900 million XRP has been purchased by wallets holding between 100 million to 1 billion XRP in the past 2 days.

This large accumulation occurred while the price of XRP remained stable at $3.14, recovering thanks to increased investor confidence.

XRP Sees Potential Bullish Spike After Breaking Key Resistance

Read also: ETH Surpasses $4K: Is the Biggest Crypto Bull Run on the Horizon? Here’s Miles Deutscher’s Analysis!

This aggressive buying process may indicate confidence from large investors during a period of consolidation. Maxi, a crypto analyst, highlighted that XRP is retesting the upside of the bull flag structure.

The trend line that was previously moving between the $3.20 and $3.25 range has just been broken in the recent price rise. If buyers manage to maintain this position, Maxi believes that XRP could reach $4.50.

Resistance levels are very important for cryptocurrency movements. When the price crosses the resistance at $3.33, XRP will head towards its next target around the $3.50 area. The key level to watch on the support side is at $3.15.

If XRP manages to break this breakout level, it will confirm the continuation of the bullish trend. The price trend may accelerate if this support level holds in the next few days.

However, another analyst, The Cryptomist, mentioned a breakout above the long-term descending resistance line, which previously capped the token’s price in the range of $2.60 to $2.70.

Following this breakout, Ripple surged all the way to the $3.80 peak before retracement and moving above the $3.00 level.

This transformation of resistance into support is considered a bullish indication. As long as Ripple remains above the $3.00 price range, it is likely to test the $3.80 price range again before preparing for bigger gains.

Ripple’s Trading Volume Skyrockets 62.93% Amid Stable Market Conditions

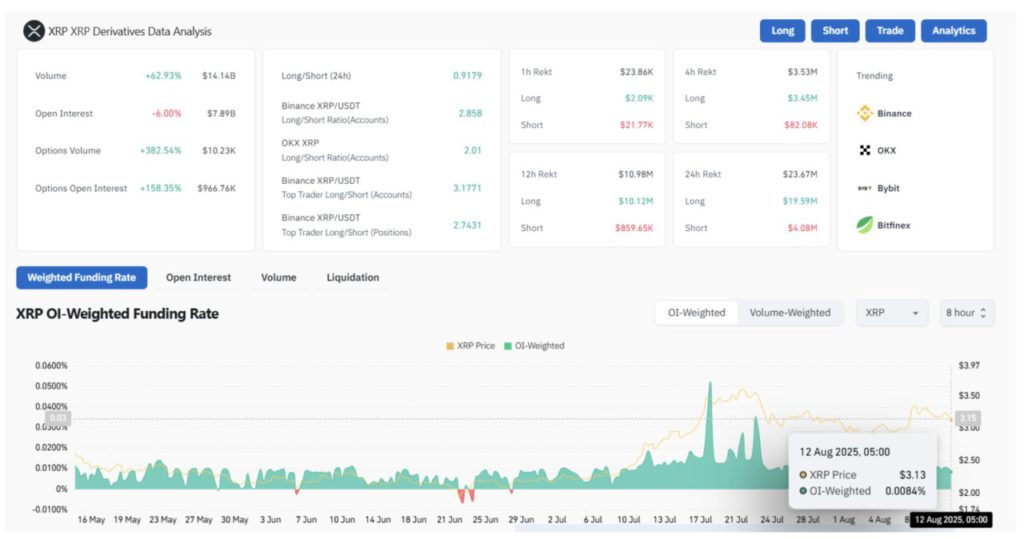

According to data from CoinGlass (August 8), trading volume increased by 62.93%, reaching a total of $14.14 billion.

Read also: Canary Capital CEO Forecasts Ripple (XRP) ETF to Outperform Ethereum (ETH) ETF, Why?

Meanwhile, open interest (OI) decreased by 6% to $7.89 billion. The OI-weighted financing rate was 0.0084%, indicating stable market conditions.

This cryptocurrency is showing positive performance with strong trading volumes and solid support levels. Investors will be monitoring Ripple to determine if this bullish trend is likely to continue and if it can break the existing resistance points.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Tron Weekly. XRP Whales Scoop Up $900M, Is Bullish Surge Coming? Accessed on August 13, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.