4 Publicly Listed Companies that Own Large Amounts of Solana (SOL)

Jakarta, Pintu News – Several public companies are now starting to accumulate large amounts of cryptocurrencies, most notably Solana (SOL).

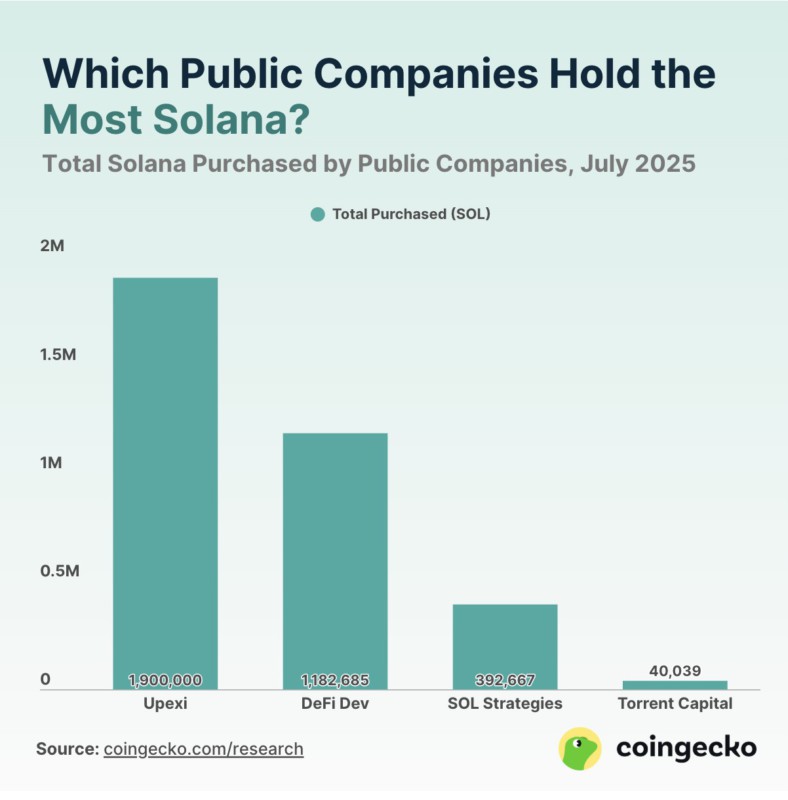

Based on the study conducted by Coingecko, Upexi, Inc, DeFi Developments Corp, SOL Strategies, and Torrent Capital were highlighted for having significant SOL positions in their portfolios.

The total holdings of these four companies amount to more than 3.5 million SOL, equivalent to around IDR 9.6 trillion. This aggressive move reflects the companies’ growing confidence in Solana’s long-term value in the crypto ecosystem.

Read the full details in this article!

Upexi: Largest Solana Holder

Upexi, Inc. has become the public company with the largest Solana holdings, totaling 1,900,000 SOL. These tokens were purchased at an average price of $168.63 per SOL, equivalent to Rp2.74 billion per token.

Currently, the total value of their holdings stands at $319.5 million or around IDR5.19 trillion, a slight decrease of IDR14.6 billion from the initial acquisition price. The aggressive purchase strategy that began in April 2025 demonstrates the company’s high confidence in SOL’s long-term potential.

The company placed its entire holding in stakes, which yielded around 8% until June 2025. In just four months, Upexi managed to build the largest Solana portfolio among public companies. They capitalized on crypto price momentum to gain a dominant position. This strategy also minimizes the risk of price fluctuations with rapid accumulation.

Also read: 4 Biggest Crypto Airdrops in August 2025

DeFi Developments Corp: Capitalizing on Market Momentum

DeFi Developments Corp (DeFi Dev.) holds 1,182,685 SOLs with an average acquisition cost of $137.07 per token or approximately Rp2.23 billion per SOL.

Currently, the value of their holdings stands at $198.9 million or IDR3.23 trillion, experiencing unrealized gains of around $36.8 million or IDR598.3 billion. The company continues to add to its SOL portfolio, with the latest purchase of 181,303 SOL worth $28.2 million (IDR 458.4 billion) in July 2025.

With this strategy, DeFi Dev. shows an edge in capitalizing on crypto price fluctuations. The company has shown no plans to sell, instead focusing on expanding SOL holdings.

SOL Strategies: Dollar-Cost Averaging Approach

SOL Strategies, a Toronto-based company, started buying SOL since mid-2024 and built up a holding of 392,667 SOL. The average purchase price was $158.12 per SOL or about Rp2.57 billion per token.

Currently, the total value of their holdings stands at $66 million or Rp1.07 trillion, with unrealized gains of $3.9 million or Rp63.4 billion. The company uses a dollar-cost averaging strategy, buying gradually to reduce the risk of crypto market volatility.

This systematic approach differs from other companies that buy large amounts at once. SOL Strategies records every transaction and combines reward staking in the portfolio.

This strategy shows a focus on long-term growth, not just price speculation. This cautious approach benefits companies in maintaining the stability of their crypto investments.

Also read: 3 Memecoins Getting Attention in August 2025, What’s the Reason?

Torrent Capital: Small Players with Precise Timing

Torrent Capital holds the smallest position with 40,039 SOL, bought at an average price of $161.84 per SOL or about Rp2.63 billion per token. The current value of the holdings is $6.7 million or IDR108.9 billion, with a profit of around $0.2 million or IDR3.3 billion.

Although the amount was smaller, the timing of purchases made before Solana’s major rally provided a strategic advantage. The company showed that even small positions can be profitable if the market timing is right.

With a small portfolio, Torrent Capital still capitalizes on Solana’s growth opportunities. This strategy shows flexibility in cryptocurrency investment management. The company is more cautious, buying little by little to reduce risk. This approach also makes it easier for them to adjust their strategy if the market experiences rapid changes.

Conclusion

These four public companies show that the accumulation of cryptocurrencies, particularly Solana, is now a serious investment strategy. Upexi and DeFi Dev occupy dominant positions, while SOL Strategies and Torrent Capital show more cautious buying methods.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinGecko. Top Public Companies Holding Solana. Accessed August 14, 2025

- Featured Image: Generatec by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.