5 Public Companies that Own Large Amounts of Bitcoin (BTC)

Jakarta, Pintu News – Bitcoin (BTC) is now not just the property of individual investors or financial institutions. A number of large public companies have made this cryptocurrency part of their financial and investment strategies.

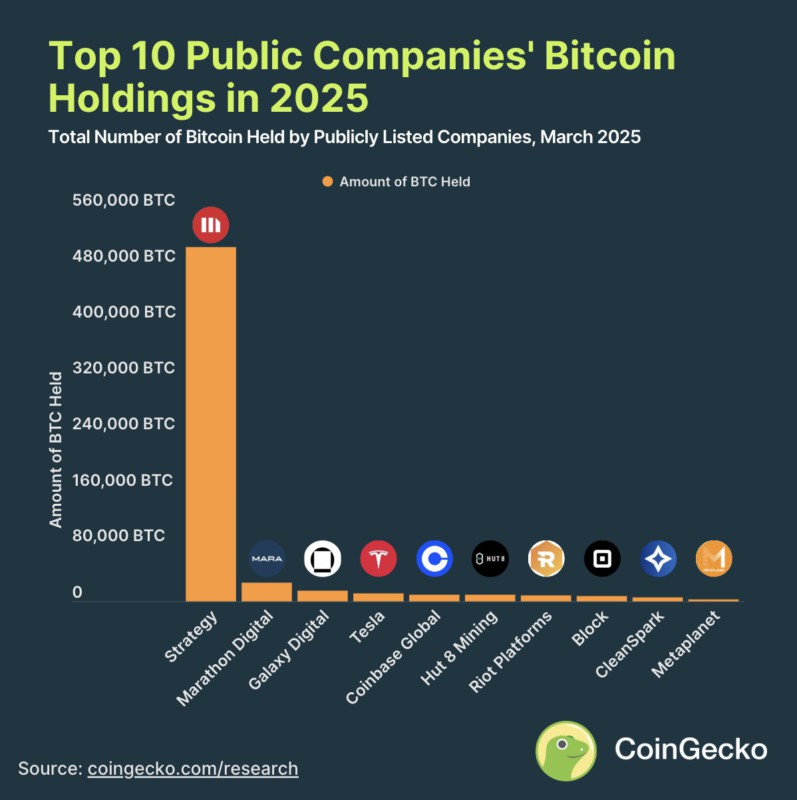

Here are the five public companies with the most Bitcoin holdings in the world, complete with their acquisition strategies and crypto asset values according to a study conducted by Coingecko as of March 2025.

1. Strategy, Inc. (506.137 BTC)

Strategy, Inc. formerly known as MicroStrategy, is the public company with the most Bitcoin holdings in the world. As of March 2025, they controlled 506,137 BTC worth over Rp714 trillion, or about 2.5% of the total BTC supply in circulation.

CEO Michael Saylor led an aggressive BTC accumulation strategy since 2020, funded through debt issuance and share sales. This strategy made Bitcoin the main asset on their balance sheet, and only once did they sell BTC – a total of 704 coins in December 2022 for tax reasons.

2. Marathon Digital Holdings (26,842 BTC)

The American crypto mining company takes second place with a total holding of 26,842 BTC. At the current BTC price, the total value of their crypto assets is equivalent to around IDR434 trillion.

Also read: MicroStrategy’s Bitcoin Purchase Timeline: From 2020 to 2025

Because it comes from mining activities, their BTC acquisition costs are much lower than market purchases. Marathon has consistently expanded its operations to increase production and add to their crypto holdings every year.

3. Galaxy Digital Holdings (15,449 BTC)

Galaxy Digital is a crypto-based investment and asset management company founded by Michael Novogratz. As of early 2025, they owned 15,449 BTC with an equivalent value of Rp249 trillion.

Unlike mining companies, Galaxy buys Bitcoin as part of a digital asset diversification strategy. Their holdings reflect a strong belief in the future of cryptocurrency, not only as a speculative asset, but also as a long-term hedging tool.

4. Tesla Inc. (11,509 BTC)

Tesla shocked the world in 2021 when it announced a $1.5 billion BTC purchase. Although it later sold 75% of its holdings in 2022 for environmental and asset management reasons, Tesla still held 11,509 BTC.

Read also: Searches for ‘Altcoin’ and ‘Ethereum’ on Google Surge, What’s the Factor?

This remaining stake is now worth around Rp168 trillion. Although Elon Musk’s company is no longer adding to its position, it remains one of the largest BTC owners in the non-crypto sector.

5. Block Inc. (8.038 BTC)

Block Inc. – formerly known as Square – is a financial technology company owned by Jack Dorsey, who has also been very vocal about his support for Bitcoin. They own 8,038 BTC worth around Rp129 trillion.

Block’s investment in Bitcoin reflects their belief in crypto as the future of the global financial system. The company also has products that support BTC transactions, including the Cash App payment service.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingecko. Top Public Companies Holding Bitcoin. Accessed August 17, 2025.

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.