Bitcoin’s Dominance in the Crypto Market Falls: What Does It Mean for Altcoins and Investors? (8/15/25)

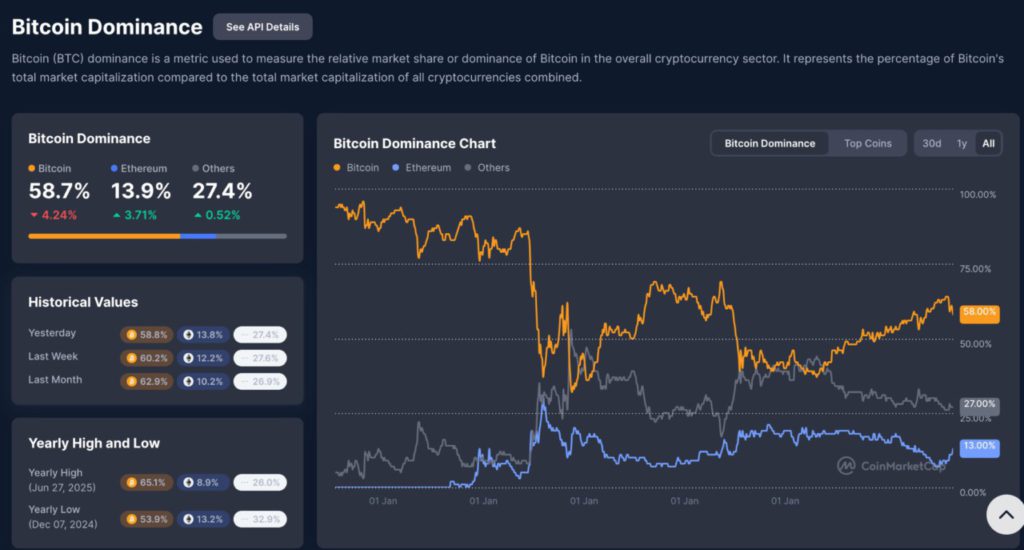

Jakarta, Pintu News – The cryptocurrency market has again shown a notable shift in the distribution of market capitalization between Bitcoin (BTC), Ethereum (ETH), and other altcoins. Based on CoinMarketCap’s Bitcoin Dominance Index, Bitcoin’s dominance percentage currently stands at 58.7%, down 4.24% compared to the previous period.

Meanwhile, Ethereum rose to 13.9% (up 3.71%) and other altcoins held 27.4% (up 0.52%). This change signals a flow of capital from Bitcoin towards altcoins, which is often an indication of increased investor interest in crypto projects other than BTC.

1. What is Bitcoin Dominance and Why is it Important?

Bitcoin Dominance is a metric used to measure Bitcoin’s market share relative to the total market capitalization of all cryptocurrencies. This figure is calculated by comparing Bitcoin’s market capitalization to the total value of all crypto assets in circulation.

This indicator is important because it helps market participants understand global sentiment. If Bitcoin’s dominance rises, it is common for the market to favor assets that are considered safer. Conversely, a decrease in dominance may indicate increased interest in altcoins.

Also Read: 10 Crypto Airdrop Telegram 2025: How to Claim Free Tokens from Telegram to DeFi

2. Recent Trends: BTC’s Declining Dominance

Currently, Bitcoin is at 58.7%, which marks a decline from last week’s position at 60.2% and a month ago at 62.9%. This decline is quite sharp when compared to the annual peak on June 27, 2025, when BTC briefly reached 65.1%.

In contrast, Ethereum saw its market share increase from 10.2% a month ago to 13.9% today. Other altcoins also increased from 26.9% to 27.4% in the same period.

3. Historical Data Comparison

The lowest point of Bitcoin’s dominance in the past year was recorded on December 7, 2024 at 53.9%, while other altcoins reached 32.9% in that period. This data shows that large fluctuations in market share can occur in a short period of time.

This historical movement is also reflected in long-term charts, where BTC’s dominance once approached 100% early in crypto history, then declined sharply with the rise of major altcoins such as Ethereum, Binance Coin (BNB), and Solana (SOL).

4. Factors Causing the Shift in Dominance

Some of the major factors driving Bitcoin’s decline in dominance include price spikes of certain altcoins, new project launches, and developments in blockchain technology. For example, the DeFi and NFT trends in the past managed to lift Ethereum and other altcoins.

In addition, macroeconomic factors such as regulatory statements, institutional adoption, and layer-2 innovations also influence capital flows in the cryptocurrency market. BTC’s stagnant price fluctuations also give altcoins room to grow faster.

5. What is the Impact on Investors?

For investors, Bitcoin’s decline in dominance could signal opportunities in the altcoin market. However, it also means increased risk, as altcoins are generally more volatile than BTC.

Using Bitcoin Dominance data can help determine asset allocation strategies. For example, BTC’s falling dominance can be a momentum to diversify into altcoins, but still with a careful risk calculation.

6. Future Prospects

If the downward trend of BTC dominance continues, altcoins could potentially gain more market share. This may prompt the birth of the Altcoin Season, when the majority of altcoins outperform Bitcoin in terms of price performance.

However, the volatility of the crypto market makes these projections worth watching carefully. Combining Bitcoin Dominance analysis with other indicators such as the CMC Altcoin Season Index can provide a more comprehensive picture.

Also Read: 7 Ethereum (ETH) Developments to Anticipate in 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinMarketCap. Bitcoin Dominance. Accessed August 15, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.