Bitcoin Pulls Back to $118K After New All-Time High — Is the Rally Just Getting Started?

Jakarta, Pintu News – As reported by AMB Crypto, since early August, Bitcoin’s (BTC) exchange netflow metric has shown a move towards a significant low, resembling the pattern that occurred ahead of major rallies in 2017 and 2021.

Historically, this kind of low often marks the beginning of the last, most explosive up phase of the previous bull market. On August 14, Bitcoin briefly set an all-time high of $124,457 before correcting to $118,901 at the time of writing (August 15).

Selling pressure from long-term holders is also seen to be easing. This indicates that the market may be entering a phase where supply constraints could strengthen the upward momentum in the coming weeks.

Bitcoin Price Drops 3.28% in 24 Hours

On August 15, 2025, Bitcoin was trading at $118,901 (approximately IDR 1,923,723,427), marking a 3.28% decline over the past 24 hours. During this timeframe, BTC dipped to a low of IDR 1,900,981,949 and climbed to a high of IDR 1,992,604,760.

At the time of writing, Bitcoin’s market capitalization is hovering around IDR 38,152 trillion, while 24-hour trading volume has increased by 4% to reach IDR 1,128 trillion.

Read also: Bitcoin Breaks New All-Time High of $124,000 – Where’s the Next Bull Target?

Does NVT Golden Cross Indicate a Market Turning Point?

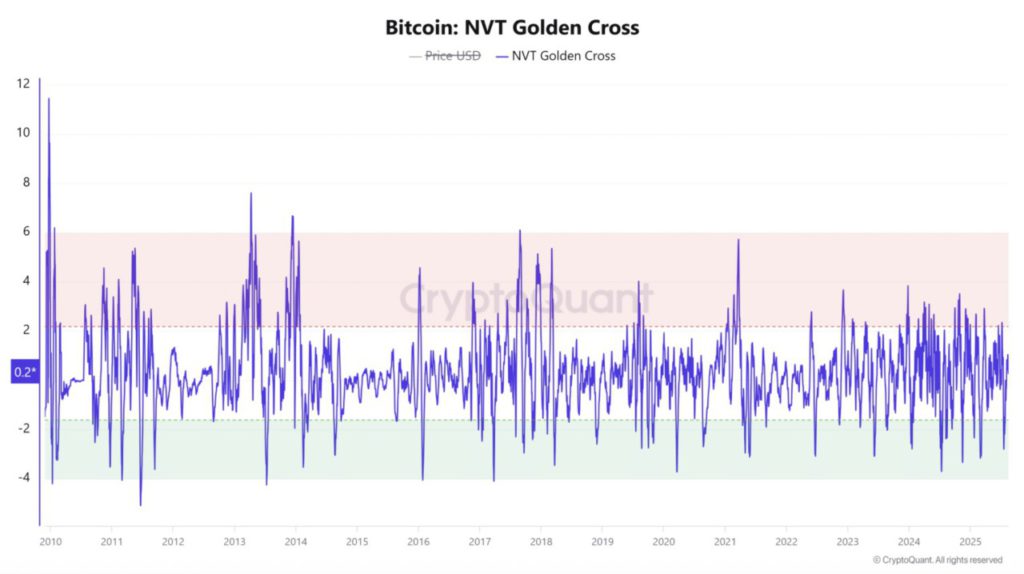

As of August 14, NVT Golden Cross was at 0.2709 after plummeting 53.92%, signaling a significant drop in valuation compared to transaction activity.

Historically, similar sharp declines have often coincided withmarket bottoms followed by strong rallies. This drop indicates a potential undervaluation of the Bitcoin transaction network relative to its market capitalization.

If this pattern reoccurs, Bitcoin could be well-positioned to enter a recovery phase.

Moreover, the indicator’s quick compression reinforces the possibility of a return of bullish activity, making it one of the important metrics worth watching by traders.

Will Positive Funding Rates Continue to Support Bullish Momentum?

The BTC OI-weighted funding rate currently stands at 0.0137%, reflecting a steady positive sentiment among traders with leveraged positions.

Continued positive funding indicates that buyers are willing to pay a premium to maintain long positions, which often helps maintain price stability in strong uptrends.

Under current conditions, this funding backdrop could potentially continue to support bullish momentum as long as it remains stable. However, if the funding rate jumps too high, it could be a sign ofovercrowded longs and trigger a correction.

For now, the indicator readings show a healthy bullish bias with no signs of excessive leverage that could trigger a sharp drop.

Liquidation and Derivatives Data Show Increased Market Activity

As of August 14, Bitcoin recorded a liquidation of $24.28 million in short positions compared to $17.16 million in long positions, signaling a forced exit from traders betting on a price drop.

Read also: Metaplanet Buys 518 Bitcoin Worth $61 Million, Its Total Holdings Now Touch 18,113 BTC!

At the same time, derivatives indicators showed significant gains. Trading volume surged 65.37% to $149.47 billion, while Open Interest (OI) rose 4.14% to $83.76 billion.

Activity in the options market also saw a huge surge, with options volume sharply increasing by 127.92% to $9.43 billion, and Options OI expanding by 5.19% to $57.15 billion.

This combined data indicates that both institutional and retail players are increasing their exposure, increasing market liquidity as well as potential volatility, especially since Bitcoin is now trading just below the All-Time High (ATH) level.

All in all, the combination of a bullish historical netflow pattern, a sharp decline in the NVT Golden Cross, a stable positive funding rate, and a surge in derivatives activity form a very optimistic outlook for Bitcoin.

All these factors collectively suggest that Bitcoin is potentially gearing up for its next big upside push, which might extend its parabolic phase.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin prices dip after ATH, but BTC’s rally isn’t over – Here’s why. Accessed on August 15, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.