Why Dogecoin (DOGE) Plunged Today August 15, 2025: Is It a Temporary Correction?

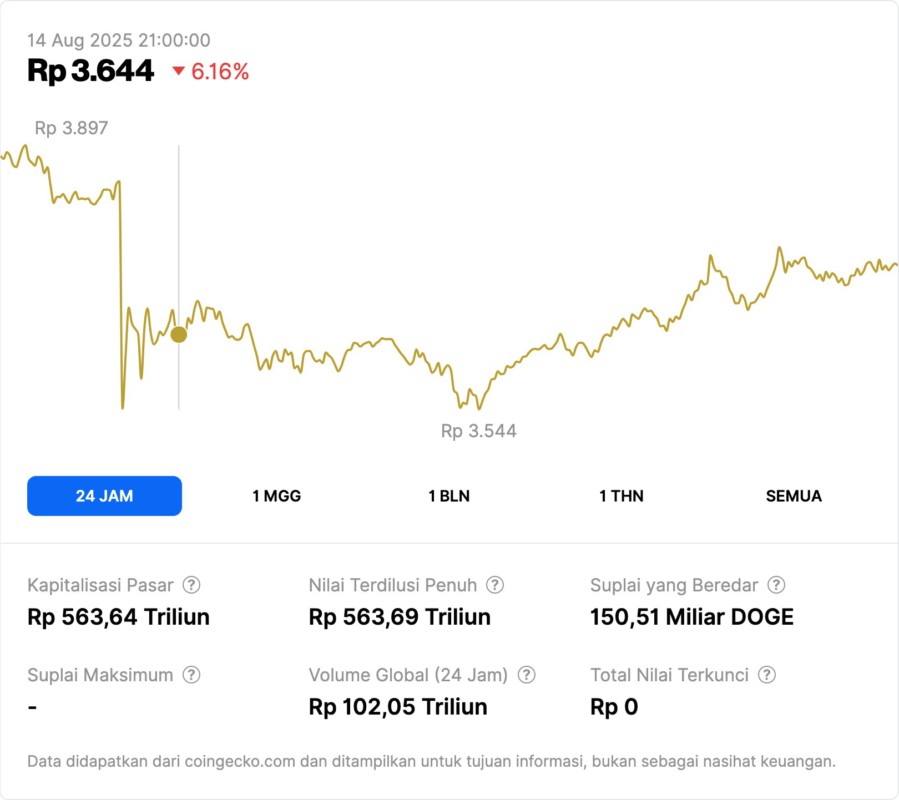

Jakarta, Pintu News – Dogecoin (DOGE) is experiencing a sharp decline on Thursday, August 14, 2025. The Dogecoin price has recorded a drop of around 8.4% in the last 24 hours, while the Bitcoin (BTC) and Ethereum (ETH) prices have also declined by 3.8% and 4% respectively.

The main cause of the Dogecoin price drop was the release of higher-than-expected PPI (Producer Price Index) inflation data for July. July’s PPI inflation was recorded at 3.7%, higher than economists’ estimates which predicted only 3%. This rise in inflation had a negative impact on the overall crypto market, including Dogecoin.

1. PPI Inflation Data and Its Impact on Crypto Market

After this high PPI inflation report was released, the crypto market immediately went into a sell-off. Investors were concerned that rising inflation could hinder the Federal Reserve ‘s move to cut interest rates in the near future. Previously, many had hoped that a rate cut would boost the price of cryptocurrencies, including Dogecoin.

However, with higher-than-expected PPI data, market sentiment became more cautious, leading to a drop in Dogecoin price. While lower interest rates are often a booster for cryptocurrencies, this inflation uncertainty made investors more wary.

Also Read: 10 Crypto Airdrop Telegram 2025: How to Claim Free Tokens from Telegram to DeFi

2. Dogecoin Correction Before Further Rise?

Based on the higher-than-expected inflation data, many believe that Dogecoin could experience further declines before resuming its rise. In recent months, the expectation of lower interest rates has prompted many investors to buy Dogecoin, which in turn has made the price of this meme coin rise.

However, if inflation remains high or increases, market appetite for speculative assets like Dogecoin could wane. Therefore, although bullish sentiment still exists, the crypto market could experience high volatility, and Dogecoin may have to experience further consolidation or decline before reaching higher prices.

3. Impact of Federal Reserve Policy on Dogecoin

Federal Reserve policy plays a key role in the price movements of Dogecoin and cryptocurrencies in general. Although most analysts still believe that the Federal Reserve will cut interest rates at its September 2025 meeting, higher inflation data provides greater uncertainty.

If inflation continues to rise, the Federal Reserve may choose to hold off on cutting interest rates or only make small reductions. This would make the market more cautious and could slow down the bullish rally that many analysts had predicted earlier. It also means that Dogecoin and other altcoins may have to face deeper price corrections before returning to an uptrend.

4. What Should Dogecoin Investors Look Out For?

While this price correction may seem significant, Dogecoin investors should be cautious in the face of high volatility. Strong support and resistance levels, as well as economic policy developments in the US, will greatly influence the direction of Dogecoin’s price movement going forward.

Investors should keep an eye on upcoming inflation data and policy decisions from the Federal Reserve, as these factors will largely determine whether Dogecoin will resume its rally or come to a temporary halt. In the meantime, wise risk management is essential to cope with the volatility.

Conclusion

Dogecoin ‘s significant price drop was caused by higher than expected PPI inflation data, adding to uncertainty regarding the Federal Reserve’s interest rate policy.

While this correction could push the Dogecoin price lower, there is still a chance for the price to rise again if interest rates are cut in the future. Investors are advised to stay tuned to global economic developments and upcoming interest rate policies.

Also Read: 7 Ethereum (ETH) Developments to Anticipate in 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Keith Noonan / The Motley Fool. Why Dogecoin Is Plummeting Today. Accessed August 15, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.