Chainlink Price Prediction: LINK Price Reaches 8-Month High – Is $27 the Next Target?

Jakarta, Pintu News – According to Coinpedia, as the crypto market prepares for the next potential major upswing, one crypto asset is quietly positioning itself at the center of a trillion-dollar shift, namely Chainlink (LINK).

Chainlink’s native token surged to hit an eight-month high, extending its weekly gain to 45%.

Despite its significant weekly gains, leading crypto analyst, Miles Deutscher, predicts more gains for LINK, citing its growing role in the adoption of blockchain technology by institutions.

Why has Chainlink (LINK) Price Increased?

The main reason behind Chainlink’s (LINK) recent price surge is the major deal it has just struck with Intercontinental Exchange (ICE) to bring forex and precious metals price data onto the blockchain. This move further strengthens Chainlink’s relationship with Wall Street and blockchain technology.

Read also: Ethena Crypto Price Update: Will ENA Break $1.61 or Plunge to $0.50?

Another big reason is the new “Chainlink Reserve” program, which will use revenue from services and partnerships to purchase LINK, thus maintaining strong demand for the token.

In addition, active buying by whales is also driving the price up. These trends show strong confidence in the token’s potential and further fuel the ongoing price rally.

Chainlink Emerges as the Premier Crypto for Institutions

In addition, crypto analyst Miles Deutscher also pointed out that the rise in tokenization of real-world assets (RWAs) was the main driving factor for Chainlink’s rapid growth.

In just two years, this market jumped from $1 billion to $13 billion, covering everything from tokenized bonds to blockchain-based real estate properties.

Currently, Chainlink secures around 84% of the total value on the Ethereum (ETH) oracle and $84.65 billion across DeFi, far outperforming its competitors.

Chainlink’s reach also extends beyond crypto, with major partners like SWIFT, JPMorgan, Euroclear, and Mastercard already on board.

Read also: Ethereum Slips to $4,600 on August 15 — Thomas Lee Still Sees a Path to $15K

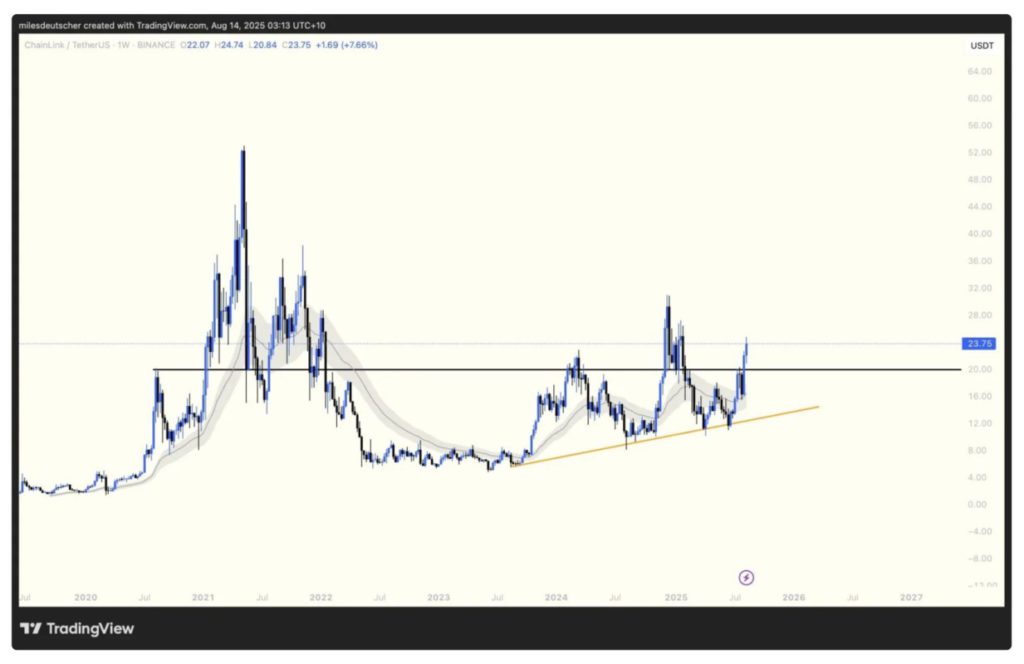

Chainlink Eyes $27 Level

On August 14, the LINK token was trading around the price of $23.80, experiencing a small decline in the past 24 hours. However, LINK is still holding strong above its 50-day and 200-day moving averages, signaling continued bullish momentum.

In the short term, $24.45 serves as the resistance level, while support is around $22.80. If LINK manages to break the resistance zone at $24.45, it could pave the way for another rally towards $27.

Meanwhile, LINK’s RSI index is currently at 52, which is fairly neutral, indicating there is still room for prices to continue rising.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Chainlink Price Breaks 8-Month High as Wall Street Backs Link – Here’s What’s Next. Accessed on August 15, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.